- Construction Work Done: Wednesday, 0:30. The construction sector continues to contract. as the indicator has rolled off four consecutive declines. Another decline is expected, with an estimate of -1.0%.

- Private Capital Expenditure: Thursday, 0:30. Business investment has sputtered, with the indicator posting four declines in the past five quarters. The forecast for Q3 stands at a flat 0.0%.

- Private Sector Credit: Friday, 0:30. Credit levels have posted gains of 0.2% for three straight months. The forecast for November is 0.3%.

- Chinese Manufacturing PMI: Saturday, 1:00. The U.S-China trade war has taken its toll on the Chinese manufacturing sector. The manufacturing PMI has failed to push above the 50-level, which separates contraction from expansion, since April. Another contraction is expected in November, with a forecast of 49.5 pts.

*All times are GMT

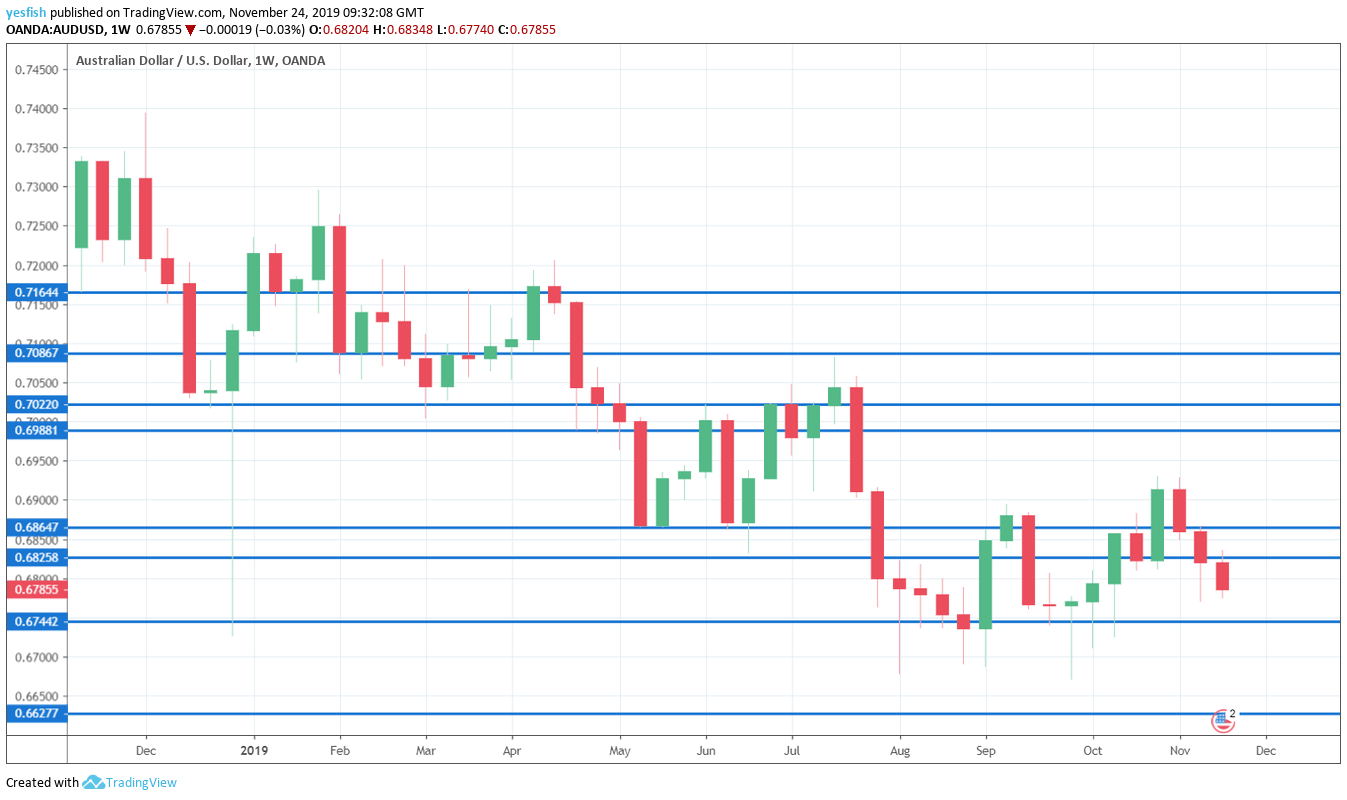

Technical lines from top to bottom:

0.7165 has held firm since early April.

0.7085 has held since July. This is followed by 0.7022.

0.6960 is protecting the symbolic 70 level.

0.6865 (mentioned last week) is next.

0.6744 is an immediate support level.

0.6686 was tested in early November.

0.6627 has held in support since March 2009. This is followed by 0.6532

0.6456 is the final support level for now.

.

I remain bearish on AUD/USD

Recent interest cuts have not yet trickled down and boosted the Australian economy, leaving consumers and the business sector apprehensive. A trade deal between the U.S. and China remains elusive, which is weighing on investor risk appetite.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!