The Australian dollar retreated from the highs as global stock markets were on the back foot once again. Capital expenditure, Chinese PMI’s, and the G-20 meetings stand out. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Equity markets suffered another leg lower, and the Aussie, a risk currency, slipped with it. There are mixed signals about the US-Chinese talks ahead of the G-20 Summit. On one hand, the US released a document blaming China for unfair practices. On the other hand, the White House reportedly sidelined Peter Navarro, a Chinese critic.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

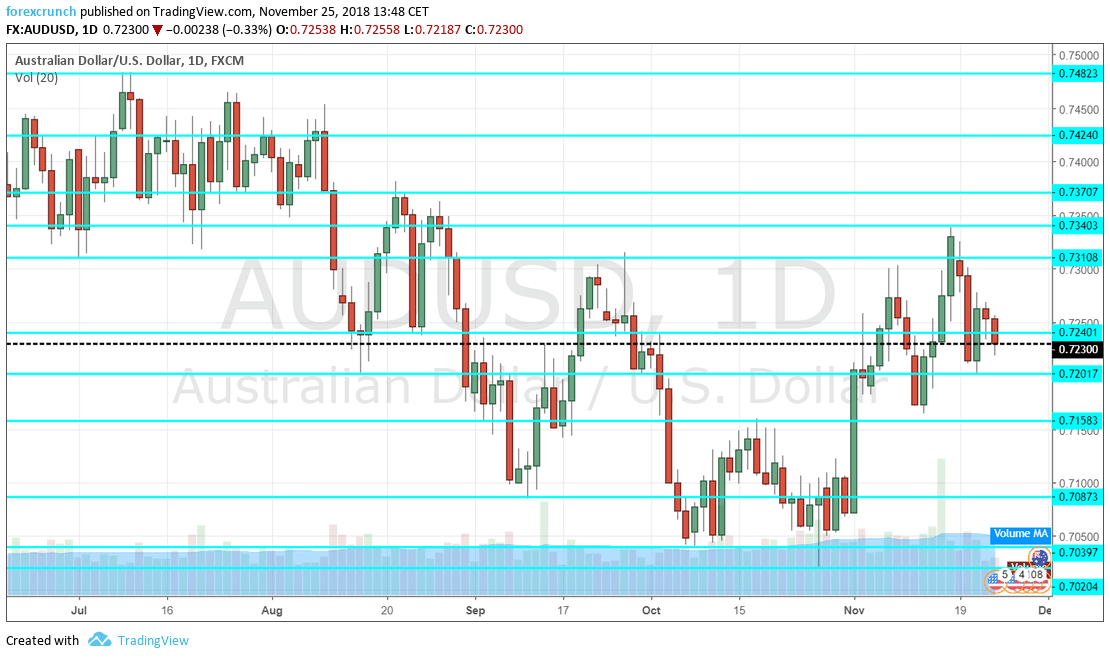

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Construction Work Done: Wednesday, 00:30. The quarterly report on the construction sector will provide some insights into the slowdown. The amount of work advanced by 1.6% in Q2 2018 and another moderate figure could be seen now: 0..9% is on the cards.

- Private Capital Expenditure: Thursday, 00:30. The all-important quarterly measure reflects investment and it is closely watched by the Reserve Bank of Australia. A big disappointment was recorded in Q2: a fall of 2.5% after five quarters of growth. We could see a small improvement now. 1.1% is expected.

- Private Sector Credit: Friday, 00:30. More credit to the private sector results in enhanced economic activity. An increase of 0.4% was seen in September. The number for October could be similar. +0.4% is forecast.

- Chinese Manufacturing PMI: Friday, 1:00. China’s official survey of businesses in the manufacturing sector fell to 50.2 points in October, barely above the 50-point threshold that separates expansion from contraction. A drop below 50 could be worrying for Australia’s No. 1 trading partner. The same score of 50.2 is on the cards.

- G-20 Summit: Friday, Saturday. Global leaders will descend on Buenos Aires over the weekend to discuss current affairs. The most important event is the bilateral meeting between US President Donald Trump and his Chinese counterpart Xi Jinping. The world’s two largest economies are still at loggerheads on trade, with the US set to raise the tariffs on some $200 billion worth of Chinese goods from 10% to 25% in January. At times, Trump sounded optimistic about reaching a deal, but negotiations have not gone too far.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD slipped fell off the 0.7310 level (mentioned last week) and found it hard to recover.

Technical lines from top to bottom:

0.7480 capped the pair in mid-July and defends the round 0.75 level. 0.7420 capped the pair twice in mid-July. 0.7360 was a low point in mid-July. 0.7340 was a swing high in November.

0.7310 is the low of July 2018. 0.7240 was a swing low in late August and the pair attempted to reach it in mid-September.

The round number of 0.7200 was a temporary low. 0.7150 was a stepping stone on the way down in early September. 0.7020 was the low point in late October and the last defense before the round number of 0.70.

The round number of 0.70 is closely watched by many market participants. Close by, 0.6970 played a role back in January 2017. Below, the only noteworthy level is only 0.6825 that supported the pair in late 2016 and early 2017.

I am neutral on AUD/USD

It is hard to assess whether China and the US will strike a deal or not. And while the RBA may wish to raise interest rates in the future, they may find it hard to do so amid a global slowdown.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!