The Australian dollar suffered from the global sell-off in stocks and the accompanying risk-off sentiment. What’s next? A busy week includes inflation and retail sales among other figures. Here are the highlights of the week and an updated technical analysis for AUD/USD.

RBA officials did not rock the boat in the past week and left AUD/USD to rock by the moves in global markets. The attempts of the Chinese authorities to calm markets by announcing stimulus provided only a short-term relief. Stocks dropped all over the world and the Aussie, a risk currency dropped. US figures were mixed and the fall is more related to tariffs and the Fed’s policy than anything concrete.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

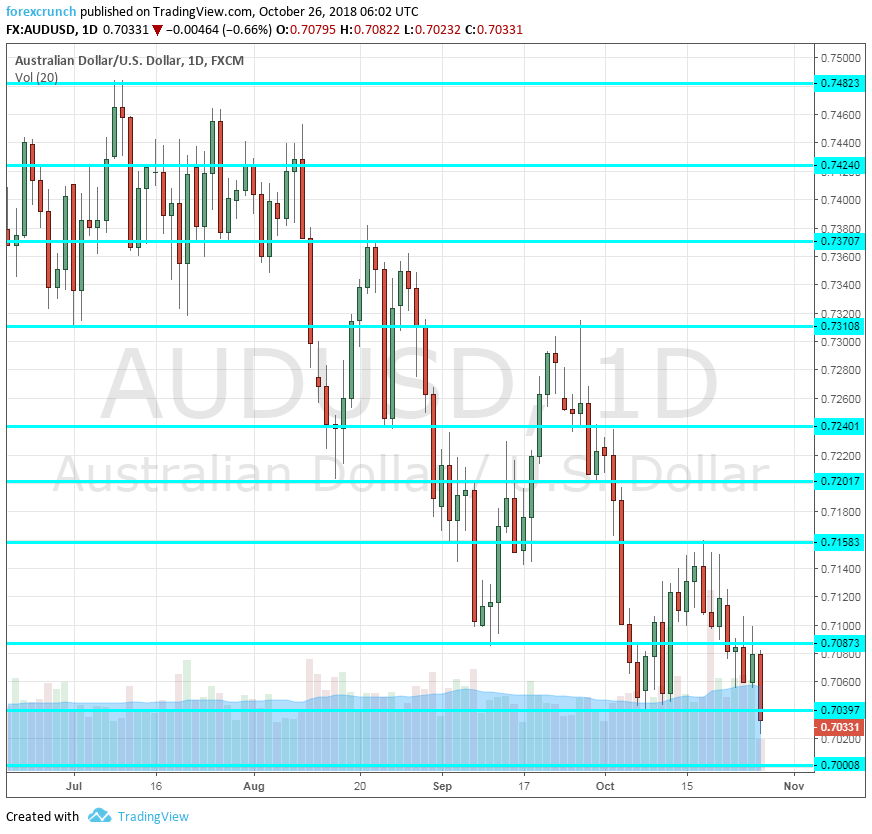

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Building Approvals: Tuesday, 00:30. The number of building consents changes in a volatile manner, but still provides useful information about the housing sector. Approvals fell by 9.4% in August and are projected to advance by 3.9% in September.

- CPI: Wednesday, 00:30. The land down under publishes its official inflation figures only once per quarter, making the impact greater than in other numbers. The Consumer Price Index rose by 0.4% q/q in Q2 while the Trimmed Mean CPI (known as core inflation in other countries) advanced by 0.5%. We may get higher. Headline inflation is forecast to rise by 0.5% and core CPI is predicted to move up by 0.4%. this time. Annual levels of inflation stood at 2.2% while Core CPI was at 1.9% in Q2.

- Private Sector Credit: Wednesday, 00:30. Enhanced credit to the private sector means more economic activity. Credit increased by 0.5% in August and a small rise of 0.4% is projected in September.

- AIG Manufacturing Index: Wednesday, 00:00. The Australian Industry Group’s PMI-like survey stood at 59 points in September, indicating robust growth in the sector. A weaker figure is likely now.

- Trade Balance: Thursday, 00:30. Australia enjoyed a trade surplus of 1.6 billion A$ in August and this surplus is now forecast to widen to 1.71 billion in September.

- Import Prices: Thursday, 00:30. Prices of imported goods feed into consumer prices. The quarterly figure leaped by 3.2% in Q2. We will now get the figures for Q3. The number does not have a very significant impact on markets after the CPI was already published. A more moderate increase of 1.1% is on the cards for Q3.

- Chinese Caixin Manufacturing PMI: Thursday, 1:45. This independent gauge of China’s manufacturing sector is of importance to Australia and its metal exports to the world’s second-largest economy. A perfectly balanced score of 50 points was seen in September. A minimal rise to 50.1 is on the cards for October. A drop to below 50 points implies contraction.

- Retail Sales: Friday, 00:30. Australians increased their spending by 0.3% in September, an OK figure. The same level is expected now. With the mining sector gradually moving out of the limelight, domestic consumption is set to have an increasing role in the economy.

- PPI: Friday, 00:30. The Producer Price Index (PPI) provides further information about the inflation situation. Like with import prices, the number comes out a bit late, having a limited impact.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD dipped below the 0.7040 level (mentioned last week) but pulled back up shortly afterwards. This is a false break at the moment.

Technical lines from top to bottom:

0.7480 capped the pair in mid-July and defends the round 0.75 level. 0.7420 capped the pair twice in mid-July. 0.7360 was a low point in mid-July.

0.7310 is the low of July 2018. 0.7240 was a swing low in late August and the pair attempted to reach it in mid-September.

The round number of 0.7200 was a temporary low. 0.7150 was a stepping stone on the way down in early September. 0.7040 was the low point in mid-October and the last defense before the round number of 0.70.

The round number of 0.70 is closely watched by many market participants. Close by, 0.6970 played a role back in January 2017. Below, the only noteworthy level is only 0.6825 that supported the pair in late 2016 and early 2017.

I remain bearish on AUD/USD

It is hard to see any significant relief for stock markets and the concerns about China’s economy will likely increase. The greenback could continue advancing and the risk A$ has more room to the downside.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!