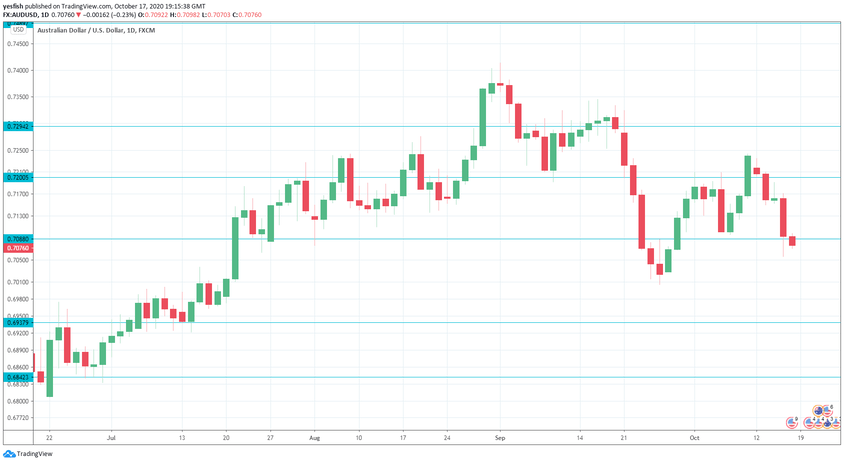

AUD/USD tumbled last week, as the pair dropped by 2.2%. This marked its worst week since mid-September. The upcoming week has four events, including the RBA minutes and Chinese GDP. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

In Australia, Westpac Consumer Sentiment impressed with a gain of 11.9% in October, after a gain of 18.0% a month earlier. On the inflation front, the Melbourne Institute Inflation Expectations report rose to 3.4% in September, up from 3.1%. Will inflation levels follow suit?

The Aussie lost ground after investors were treated to weak job numbers. The economy lost 29.5 thousand jobs in September, after three successive gains. As well, the unemployment rate edged up to 6.9%, up from 6.8%.

US consumer inflation slowed in September, as inflation levels remain at low levels. Both the headline and core readings dropped to 0.2%, down from 0.4% beforehand. The Philly Fed Manufacturing Index jumped to 32.3 in October, up from 15.0 points. This was the highest level since February. Unemployment claims climbed to 898 thousand, the highest level in seven weeks. Retail sales rebounded in September. The headline figure rose 1.9% and the core reading showed a gain of 1.5%.

- Chinese GDP: Monday, 2:00. China is projected to be the only major economy that will record growth this year. In the second quarter, GDP grew by 3.2% and the forecast for Q3 stands at 5.5%.

- RBA Monetary Policy Meeting Minutes: Tuesday, 00:30. The Reserve Bank of Australia left interest rates unchanged at its policy meeting earlier this month, but dropped a broad hint that it could trim rates before the end of the year. The meeting minutes will shed some light on the deliberations at the meeting.

- MI Leading Index: Tuesday, 23:30. The Melbourne Institute uses nine economic gauges for its composite measure. The indicator is expected to post a small gain of 0.1% for a second straight month in the upcoming reading.

- NAB Quarterly Business Confidence: Thursday, 00:30. The National Australia Bank is pointing to worsening conditions, as the Q2 reading fell to -15, down from -11 beforehand. Will we see an improvement in the Q3 release?

.

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7294 (mentioned last week).

The round number of 0.7200 is next.

0.7087 is an immediate resistance line.

0.7008 is the first support level. It is protecting the symbolic 0.7000 line.

0.6937 has provided support since mid-July.

0.6841 is an important monthly resistance line.

0.6732 is the final support line for now.

I am neutral on AUD/USD

The Australian dollar continues to show volatility and the currency took a tumble last week. The Chinese economy is showing growth, and a solid Chinese GDP could give a boost to the Aussie this week. At the same time, weak global demand for Australian goods continues to weigh on the currency.

Follow us on Sticher or iTunes

Further reading:

Safe trading!