AUD/USD reversed directions last week and recorded gains of 0.8%. The upcoming week has three events, including CPI. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

China’s GDP rebounded in Q3, with a gain of 4.9%. This was up from 3.2% in the second quarter. The consensus stood at 5.4%. The RBA signaled that it will cut rates at next week’s policy meeting. This would likely mean a trim from 0.25% to 0.10%. Retail sales continued to slump, with a reading of -1.5% in August. This marked a third straight decline, as consumers are holding tight on their purse strings.

In the US, jobless claims sparkled, falling to 787 thousand, down from 898 thousand beforehand. This was the lowest level since March, prior to the spread of Covid-19, which sent unemployment levels skyrocketing. Manufacturing PMI came in at 53.3, just shy of the estimate of 55.5 points. The Services PMI improved to 56.0, beating the estimate of 54.7 points. Both readings indicate expansion, above the 50-level which separates contraction from expansion.

.

- Inflation Report: Wednesday, 00:30. CPI in the second quarter showed a decline of 1.9%, the first decline since 2016. Trimmed CPI, which excludes the most volatile items in the headline release, also posted a rare decline, with a read of -0.1%. The headline figure is expected to bounce back in Q3, with a forecast of 1.5%. Trimmed CPI is projected to show a small gain of 0.3%.

- NAB Quarterly Business Confidence: Thursday, 00:30. The indicator has been in negative territory for the past four quarters, indicating ongoing pessimism in the business sector over economic conditions. In Q2, the indicator came in at -15 points. We now await the Q3 release.

- Private Sector Credit: Friday, 00:30. Credit levels remain weak, as the indicator has failed to post a gain since February. In July, the indicator came in at zero, up slightly from -0.1% beforehand. The August forecast stands at 0.1%.

.

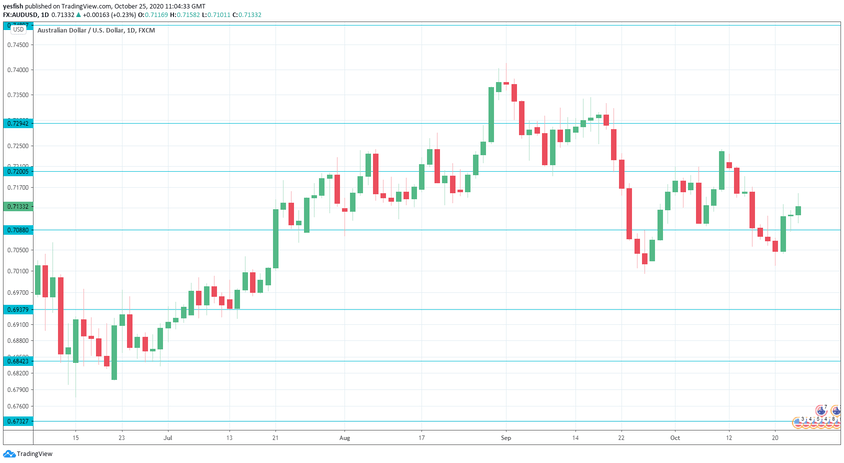

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7370.

0.7294 (mentioned last week) is the next resistance line.

The round number of 0.7200 has held in resistance since mid-October.

0.7087 is the first support level.

0.7008 is protecting the symbolic 0.7000 line.

0.6937 has provided support since mid-July.

0.6841 is an important monthly resistance line. It is the final support line for now.

I am bearish on AUD/USD

The RBA continues to signal that it will trim interest rates at the November meeting, which could weigh on the Australian dollar, as investors will look at other assets which offer a better rate of return.

Follow us on Sticher or iTunes

Further reading:

Safe trading!