- CB Leading Index: Tuesday, 14:30. The Conference Board Index is based on 7 economic indicators, but tends to have a muted impact since most of the data has been previously released. The index declined by 0.2% in July.

- Flash Manufacturing PMI: Wednesday, 22:00. The index slowed to 49.4 in September, falling below the 50-level and into contraction territory. We now await the October data.

- Flash Services PMI: Wednesday, 22:00. The services sector improved to 52.5 in September, indicative of slight expansion. This comes after a reading of 49.2 in the August release, which showed contraction in the services sector.

*All times are GMT

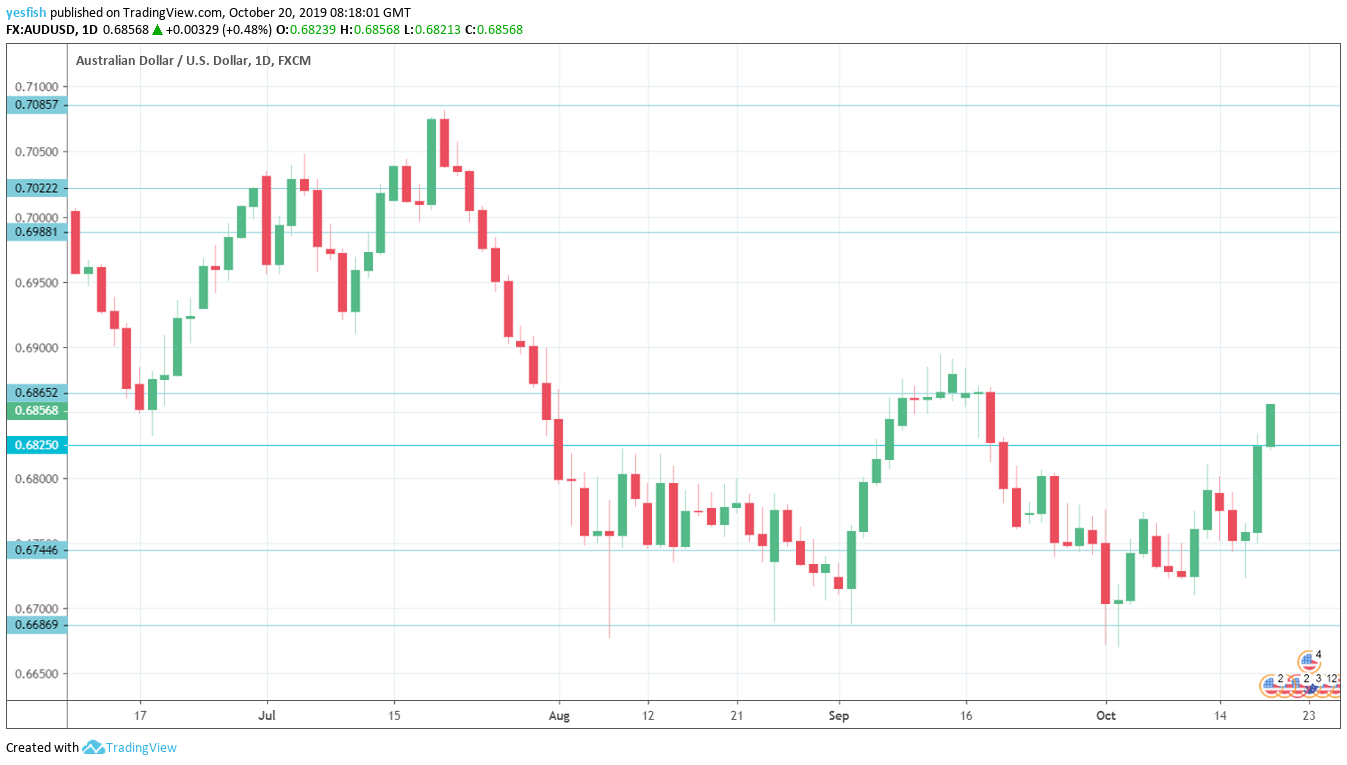

Technical lines from top to bottom:

We start with resistance at 0.7165. This line has held firm since early April.

0.7085 was a low point in September. 0.7022 is next.

0.6988 marked the low point in April.

0.6865 is under pressure in resistance following strong gains by AUD/USD last week.

0.6825 (mentioned last week) has switched to a support role. It is a weak line.

0.6744 has some breathing room in support.

0.6686 was a cap back in January 2000.

0.6627 has held in support since March 2009. 0.6532 is next.

0.6456 is the final support level for now.

I remain bearish on AUD/USD

The Aussie jumped on the bandwagon and took advantage of a weak U.S. dollar, but this could be a temporary improvement. The U.S-China trade war continues to hamper Australia’s export industry and the recent rate cuts by the RBA have made the Australian dollar less attractive to investors.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!