- RBA Monetary Policy Meeting Minutes: Tuesday, 0:30. The minutes will provide details of the policy meeting earlier this month, when the RBA cut rates for the third time since June. A dovish message from the bank could weigh on the Aussie.

- MI Leading Index: Tuesday, 23:30. The Melbourne Index has struggled, having posted just one gain since April. Will we see better news from the September release?

- Chinese New Loans: Tuesday, 15th-16th. New bank loans improved to 1210 billion yuan ($170 million) in August. The indicator is expected to rise to 1350 billion yuan ($190 million) in September.

- Employment Data: Thursday, 0:30. The Australian labor market has been strong, as the economy has created 75,000 jobs in the past two months, and the September estimate stands at 15.3 thousand. The unemployment rate is projected to remain at 5.3%.

- Chinese GDP: Friday, 2:00. The Chinese economy continues to lose steam and slowed to 6.2% in the third quarter. A year ago, GDP posted a gain of 6.7%. The downward trend is expected to continue, with an estimate of 6.1%.

*All times are GMT

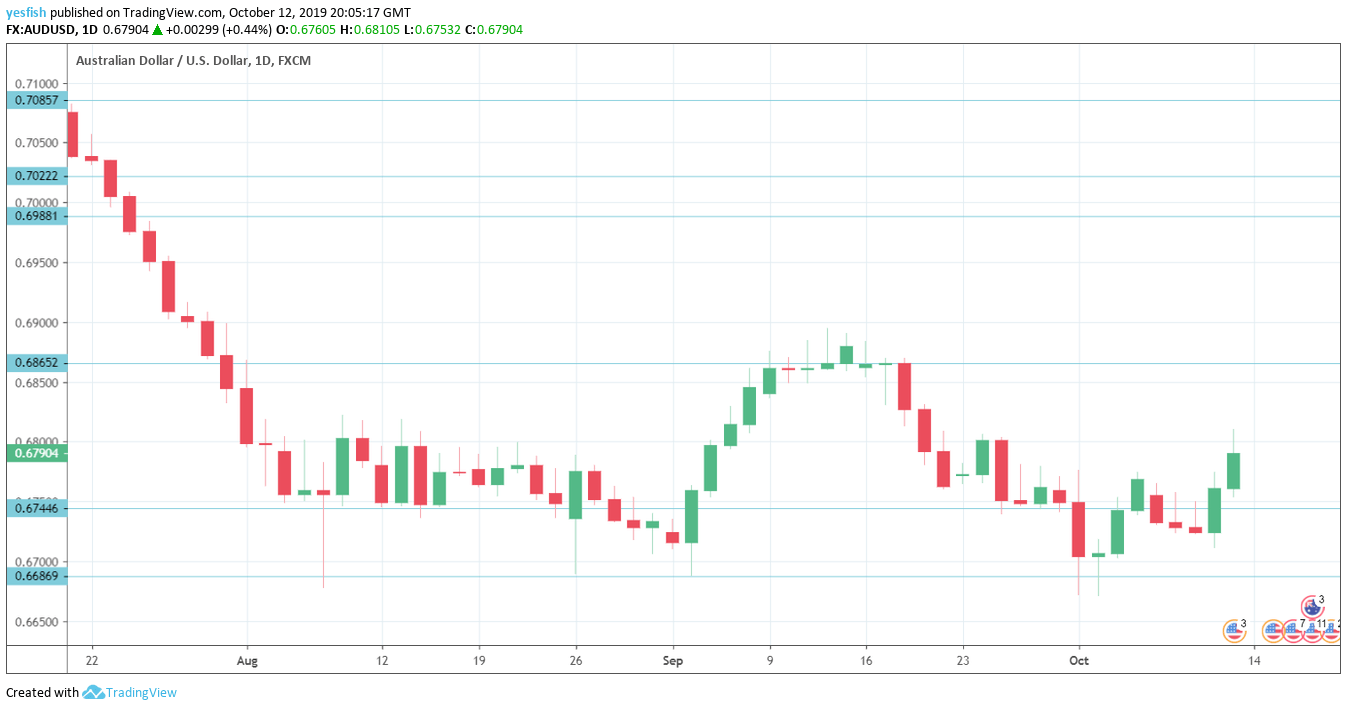

Technical lines from top to bottom:

We start with resistance at 0.7165. This line has held firm since early April.

0.7085 was a low point in September. 0.7022 is next.

0.6988 marked the low point in April.

0.6865 was active in mid-September and has some breathing room in resistance.

0.6825 (mentioned last week) is an immediate resistance line.

0.6744 was relevant throughout the week. It is providing support.

0.6686 was a cap back in January 2000.

0.6627 has held in support since March 2009. 0.6532 is next.

0.6456 is the final support level for now.

I am bearish on AUD/USD

The RBA has slashed interest rates, but the domestic economy has yet to respond to these moves. Weak global demand has taken a toll on the manufacturing and export sectors, and the Aussie will have difficulty attracting investors.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!