The Australian dollar extended its dive on concerns about new US tariffs on China and amid amid mixed data. The jobs report stands out in the upcoming week. Will the pair challenge the round 0.70 level? Here are the highlights of the week and an updated technical analysis for AUD/USD.

While the US did not announce the immediate implementation of new tariffs on China, President Trump already said new ones are in the works. A slowdown in the Chinese economy and in global growth threatens the Australian economy. In the meantime, the data was mostly positive with GDP rising by 0.9% q/q and 3.4% y/y. On the other hand, retail sales disappointed by remaining flat in July. In the US, the NFP was quite upbeat with 0.9% q/q and 3.4% y/y.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

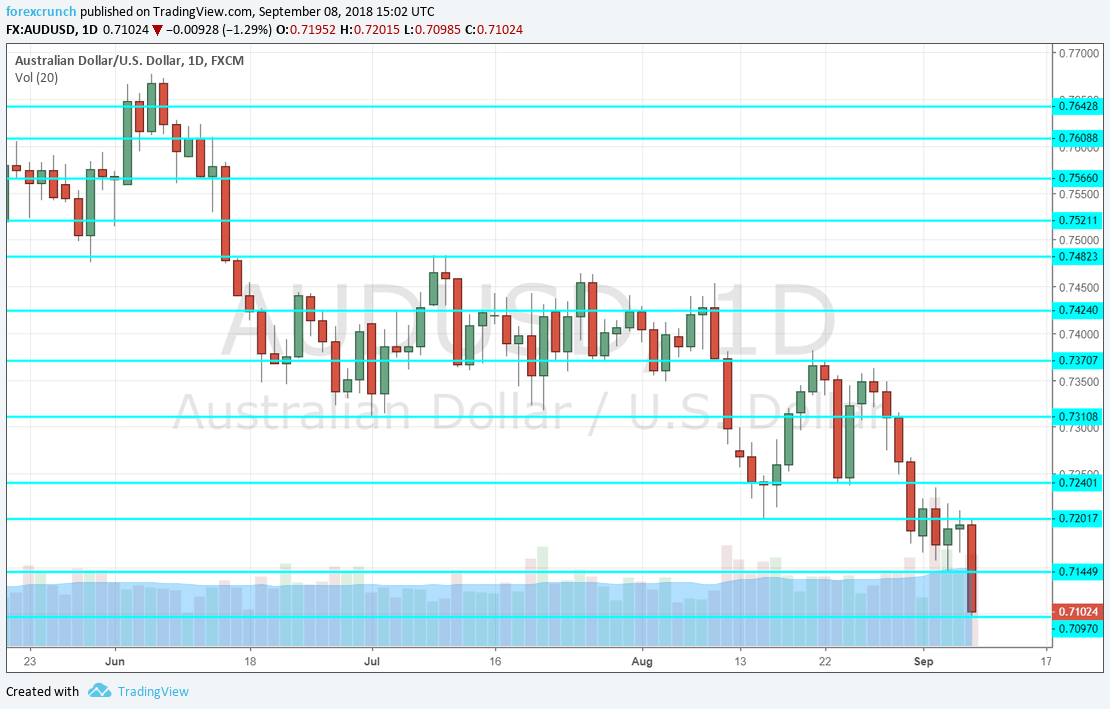

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Michele Bullock talks: Monday, 3:05. The RBA Assistant Governor will speak in Albury and may provide some hints about the next direction of the central bank. She will speak about risks to households and may focus on the housing sector.

- NAB Business Confidence: Tuesday, 1:30. Business sentiment has recently improved slightly according to this big bank, rising to 7 points in July. We will now get the figures for August.

- Westpac Consumer Sentiment: Wednesday, 00:30. The second significant report for a major bank focuses on the consumer. After two months of increases, consumer confidence dropped in August by 2.3%. We could see a bounce now.

- MI Inflation Expectations: Thursday, 1:00. The government publishes official inflation data only once per quarter, and this figure by the Melbourne Institute provides some insights into price developments. A level of 4% was seen in July and we may see a drop in August.

- Employment report: Thursday, 1:30. The Australian job market disappointed in July with a loss of 3,900 positions. The unemployment remained low at 5.3%. The report for August may see an uptick in jobs. The Aussie dollar suffered quite a bit of late and an upbeat labor market can help it recover. The number of positions is expected to rise by 18.4K and the jobless rate is not expected to move from 5.3%.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD fell sharply, losing the 0.72 level mentioned last week.

Technical lines from top to bottom:

0.7480 capped the pair in mid-July and defends the round 0.75 level. 0.7420 capped the pair twice in mid-July. 0.7360 was a low point in mid-July.

0.7310 is the low of July 2018. 0.7240 was a swing low in late August and serves as a support.

The round number of 0.7200 was a temporary low. 0.7150 was a stepping stone on the way down in early September. The round number of 0.71 was the close in the first week of September.

Below, we are back to levels last seen in January 2017: 0.7050 could provide some temporary defense against an assault on the round 0.70 level. Even lower, 0.6880 is the next level to watch.

I remain bearish on AUD/USD

The path of trade wars taken by Trump is unlikely to change, at least until the mid-term elections in November. Moreover, the Australian economy did well so far, but recent signs are not that great.

Our latest podcast is titled Brexit summer blues, trade troubles

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!