The Australian dollar tumbled on as fear over trade gripped markets. Apart from the US-China trade relations, a rate decision and GDP will be closely watched. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The Aussie dollar fell below 0.72, the lowest levels since January 2017. Concerns about global trade dominated the scene. A week that began with hopes for NAFTA saw these hopes fade and things became much worse, especially for Australia, with the intent of the US to push through with whopping tariffs on China. Imposing tariffs on $200 of goods would be a severe escalation and Australia will be affected as well. The A$ also suffered from a significant drop in capital expenditure, 2.5%, in Q2.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

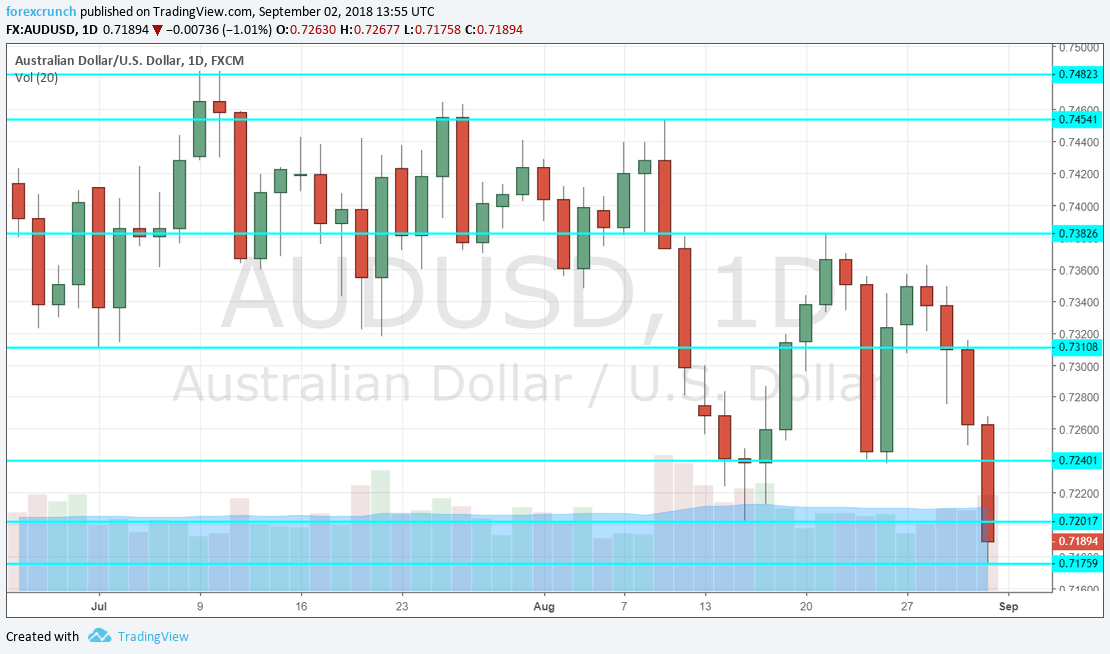

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Retail Sales: Monday, 1:30. Australian consumers have cautiously expanded their buying in June, by 0.4%. A slower growth rate of 0.3% is expected for July.

- Company Operating Profits: Monday, 1:30. Australian companies’ profits jumped by 5.9% in the first quarter of the year. A much slower increase of 1.4% is on the cards.

- Current Account: Tuesday, 1:30. Australia had a current account deficit of 10.5 billion back at the beginning of the year. A broader deficit of 11.1 billion is on the cards for Q2.

- Rate decision: Tuesday, 4:30. The Reserve Bank of Australia has not changed the interest rate in the past two years. This time will unlikely be different. Phillip Lowe and his colleagues are set to maintain the rate at 1.50%. The Australian economy is doing well, despite the risks to growth coming from trade. Housing in Sydney may be a worry and could be mentioned in the statement.

- Phillip Lowe speaks Tuesday, 9:30. The Governor of the RBA speaks in Perth and may shed some more light on the Bank’s policy. Comments about trade will be watched closely.

- Australian GDP: Wednesday, 1:30. The Australian economy enjoyed a solid growth rate of 1% in Q1 2018, the best since Q4 2016. Q2 will probably see upbeat figures as well: 0.8% q/q is expected. The impact of US tariffs on China was implemented only in Q3, and the preparations may have hastened economic activity beforehand.

- Trade Balance: Thursday, 1:30. Contrary to the broader current account surplus, Australia enjoys a trade surplus. This surplus is set to squeeze from 1.87 billion in June to 1.46 billion in July.

- New US tariffs on China: Thursday and potentially Friday. In the past two months, the US imposed tariffs on $50 billion worth of Chinese goods. China retaliated with the same scale of duties. A major escalation is on the cards now. September 6th is the deadline for public comments on new tariffs worth a whopping $200 of Chinese products. China imports far less than it exports to the US and is set to hit back with levies of $60 billion of American products but may also cause other disruptions to US companies operating in China. There is always a chance of a delay or a deal, but the Trump Administration seems keen to move forward with a move that would serve as a significant disruption to the global economy. A risk-off atmosphere resulting from the tariffs is due to boost the US dollar and the Japanese yen. A de-escalation will do the opposite.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD fell sharply, losing the 0.72 level mentioned last week.

Technical lines from top to bottom:

0.7560 is the next level to watch after it was the recovery level in early May. 0.7520 was a swing low in late May.

0.7480 capped the pair in mid-July and defends the round 0.75 level. 0.7420 capped the pair twice in mid-July. 0.7360 was a low point in mid-July.

0.7310 is the low of July 2018. 0.7240 was a swing low in late August and serves as a support.

The round number of 0.7200 is the 2018 low. 0.7175 was the low point in August. Further down, we are back to levels last seen in January 2017. These include the 0.7140 line and the round 0.70 level.

I am bearish on AUD/USD

The US insists on escalating the trade wars and this is not fully priced in. Australian data may be OK for now but the prospects of a weaker Chinese economy may force the RBA to cut rates eventually.

Our latest podcast is titled Brexit summer blues, trade troubles

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!