- MI Inflation Gauge: Monday, 1:00. This monthly release helps analysts track inflation on a monthly basis. The indicator dipped to zero in July, the third flat reading in the past four months.

- Chinese Manufacturing PMI: Monday, 1:00. The ongoing trade war with the U.S. has taken a heavy toll on the manufacturing sector, resulting in soft readings from the index. For the past four months, the index has been below the 50-level, which indicates contraction. The September release is projected at 49.6 points.

- Private Sector Credit: Monday, 1:30. Credit levels for consumers and individuals remain at low levels. The previous release came in at 0.2%, matching the estimate. The indicator is expected to tick up to 0.3% in August.

- Chinese Caixin Manufacturing PMI: Monday, 1:45. In July, this PMI had a stronger reading than the official Manufacturing PMI, with a reading of 50.4, indicating stagnation. Little change is expected in September, with an estimate of 50.2 points.

- AIG Manufacturing Index: Monday, 22:30. The index improved to 53.1 in August, indicative of expansion in manufacturing. The release marked a 4-month high. Will we see further expansion in the September release?

- Building Approvals: Tuesday, 1:30. This key construction gauge tends to show sharp swings. In July, the indicator recorded a sharp decline of 9.7%, well off the forecast of 0.0%. The markets are expecting a rebound in August, with an estimate of 2.1%.

- RBA Rate Decision: Tuesday, 4:30. All eyes are on the RBA, which is expected to cut rates from 1.00% to 0.75%. Although the rate cut has been priced in by the markets, the move could still push the Aussie downwards. Investors will also be monitoring the RBA rate statement.

- AIG Services Index: Wednesday, 22:30. The index is pointing to weak expansion in the services sector, with three readings above the 50-level in the past four months. The August release improved to 51.4, up sharply from 43.9 a month earlier. Will the upward momentum continue in September?

- Retail Sales: Friday, 13:30. This key indicator can have a strong effect on the movement of AUD/USD. The indicator disappointed in July, with a decline of 0.1%. Investors are expecting a strong rebound In August, with an estimate of 0.5%.

- RBA Financial Stability Review: Friday, 1:30. The central bank publishes a report on financial stability twice per year. Apart from the assessment on stability, the publication also provides economic figures and may hint about monetary policy.

*All times are GMT

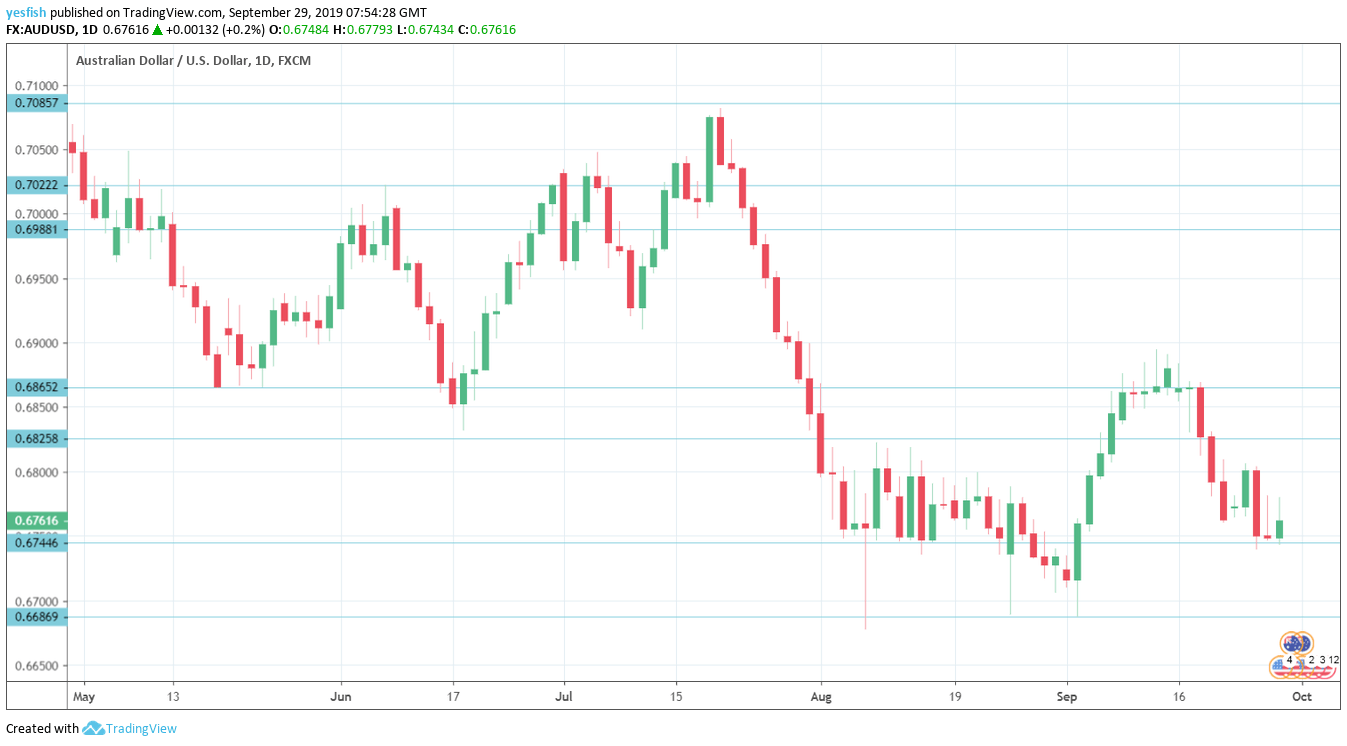

Technical lines from top to bottom:

We start with resistance at 0.7165. This line has held firm since early April.

0.7085 was a low point in September. 0.7022 is next.

0.6988 marked the low point in April.

0.6865 was active in mid-September and has some breathing room in resistance.

0.6825 (mentioned last week) is next.

0.6744 was tested in support during the week. It remains a weak line.

0.6686 was a cap back in January 2000.

0.6627 has held in support since March 2009. 0.6532 is next.

0.6456 is the final support level for now.

I am bearish on AUD/USD

The RBA slashed interest rates this past summer, and is expected to cut rates again this week. This dovish stance points to concern about the strength of the Australian economy, and the Aussie could lose some of its attractiveness to investors.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!