For a second straight week, AUD/USD showed little movement. The upcoming week has two events. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

The RBA minutes noted that Covid-19 had caused a severe downturn in the economy, but nevertheless the economy was showing signs of recovery. Employment numbers sparkled in August. The economy created 111.0 thousand jobs, defying the forecast of -40.0 thousand. As well, the unemployment rate fell to 6.8%, down sharply from 7.5%.

In the US, the highlight was the Federal Reserve policy meeting. As expected, the Fed kept interest rates close to zero. Of more interest to investors was the Fed message that it will not raise rates before 2023, under its new inflation target, which allows inflation to overshoot 2% without triggering a rate hike.

US retail sales slowed significantly in August. The headline reading dropped to 0.6%, down from 1.2%. Core retails sales came in at 0.7%, down sharply from 1.9%. This points to weakness in consumer spending, which is a key driver of economic growth.

- Manufacturing PMI: Tuesday, 23:00. Manufacturing has improved, as the PMI has posted two consecutive readings above the 50 level, which separates contraction from expansion. In August, the PMI rose to 53.9 up from 53.3 beforehand. We now await the September data.

- Services PMI: Tuesday, 23:00. The index slipped badly in July, falling from 58.5 to 48.1 points. Will the index push back into expansion territory in September?

.

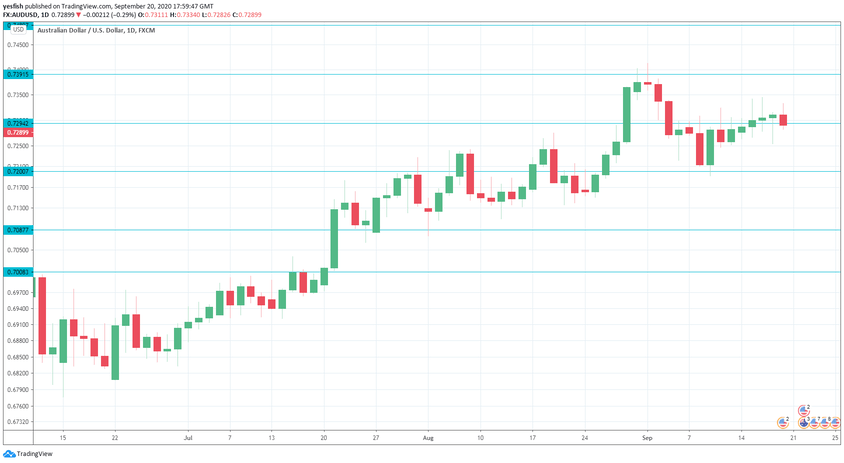

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7595.

0.7513 has held since June 2018.

0.7392 is next.

0.7294 (mentioned last week) remains an immediate resistance line.

The round number of 0.7200 is the first support level.

0.7087 is next.

0.7008, which is protecting the symbolic 0.7000 line is the final support level for now.

I am bullish on AUD/USD

Investors have been bullish on the Aussie, despite the Covid-19 pandemic and its status as a risk currency, With the US battling Covid and a fiscal stimulus package stuck in Congress, AUD/USD could post gains this week.

Follow us on Sticher or iTunes

Further reading:

Safe trading!