- NAB Business Confidence: Tuesday, 1:30. Business sentiment improved to 4 in July, up from 2 a month earlier. This points to stronger confidence in the Australian economy, which is key to increased business investment, hiring and spending. Will the upward trend continue in August?

- Westpac Consumer Sentiment: Wednesday, 0:30. Consumer confidence rebounded in August, with a gain of 3.6%. This follows two straight declines. We will now receive the September data.

- MI Inflation Expectations: Thursday, 1:00. Analysts use this indicator to track actual inflation levels. In July, the indicator rose 3.5%, its highest level in 4 months. Will we see another strong gain in August?

*All times are GMT

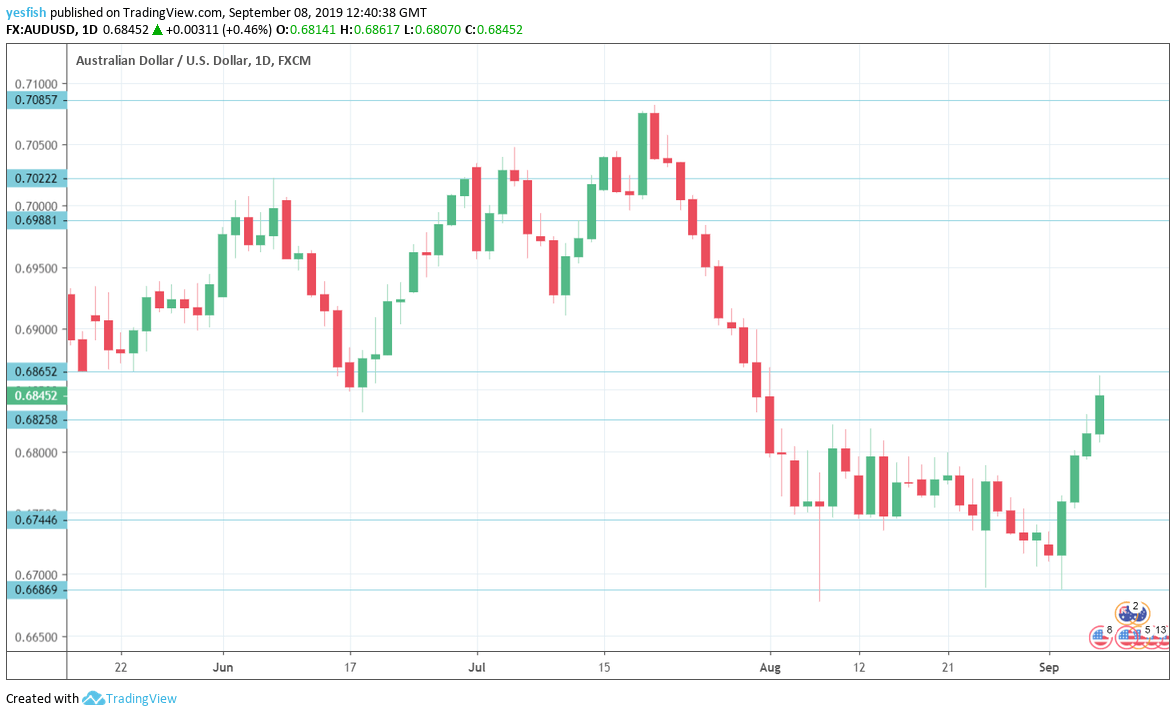

Technical lines from top to bottom:

We start with resistance at 0.7165. This line has held since early April.

0.7085 was a low point in September. 0.7022 is next.

0.6988 marked the low point in April.

0.6865 is next.

0.6825 (mentioned last week) has switched to a support role following sharp gains by AUD/USD. It is providing immediate support.

0.6744 is next.

0.6686 was a cap back in January 2000.

0.6627 has held in support since March 2009. 0.6532 is next.

0.6456 is the final support level for now.

I am neutral on AUD/USD

After several quiet weeks, the Aussie has rallied in impressive fashion. Will this upward trend continue or is it just a retracement before further losses? The U.S-China trade war continues to weigh on the Australian economy, but investors are hopeful that the sides will resume talks in October.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!