- With rising cases and lockdowns in Europe, COVID risk aversion is resurfacing.

- Fourth-quarter economic growth in the US was stronger than expected.

- In 2022, the Reserve Bank of Australia rules out raising interest rates.

The AUD/USD weekly forecast is broadly bearish as the rate hike bets have lost traction, while the technical scenario also provides no respite for the bulls.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The AUD/USD pair lost for the third consecutive week as the US dollar strengthened and traders resumed trading to counter COVID risk. As a result of escalating cases that cast doubt on the high vaccination rates in both countries, Austria has implemented partial isolation, while Germany is considering reverting to restrictions.

The Reserve Bank of Australia (RBA) does not anticipate a rate hike in 2022, whereas the US Federal Reserve is preparing for a rate hike. However, the Board of Directors will have to consider a rate hike next year if the economy and inflation differ from our baseline, RBA Governor Philip Lowe stated Tuesday.

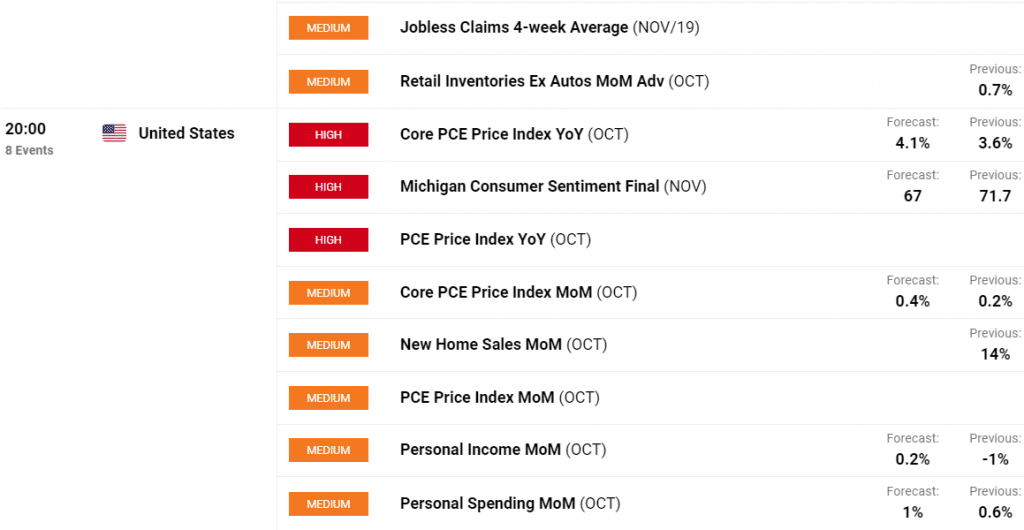

As a result of the excellent US retail sales report and the strongest consumer price index (CPI) since 1990, the Fed should be able to complete its $ 120 billion bond purchase program by June 2022. Thus, evidence of accelerated recovery may suffice for the Federal Reserve’s Open Market Committee (FOMC) meeting on December 15th.

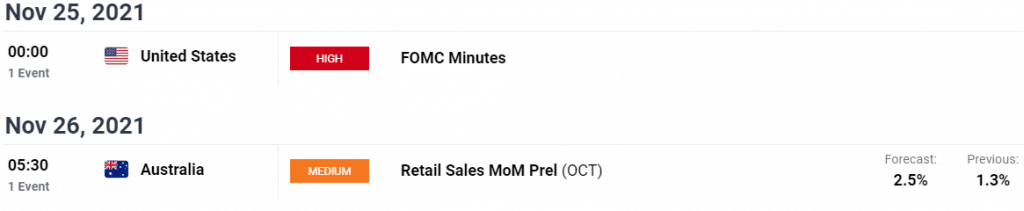

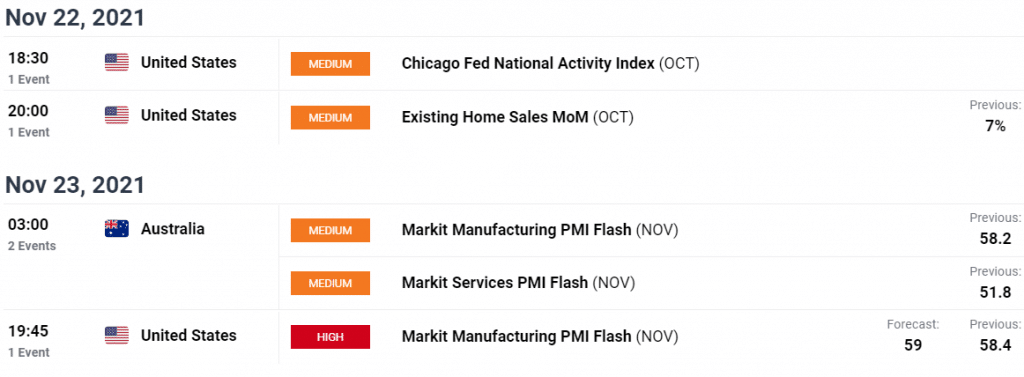

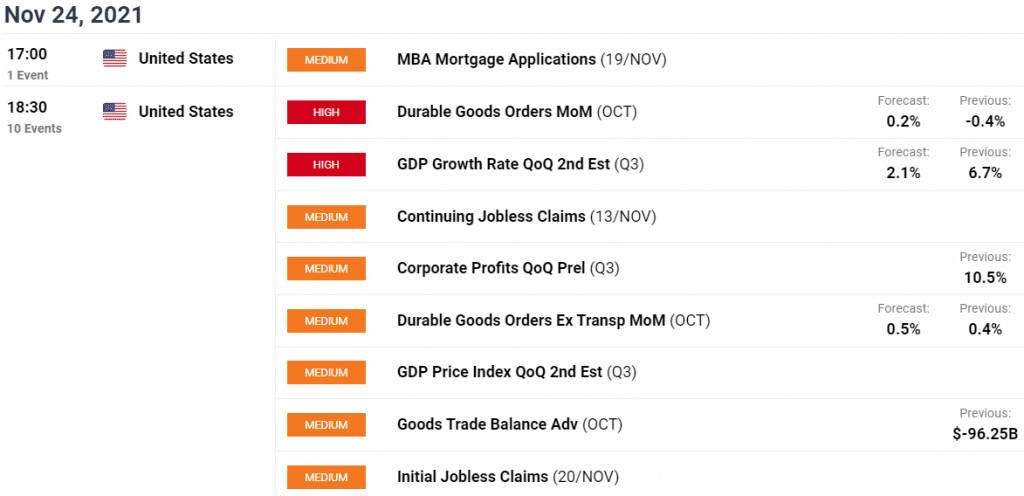

Key data/events for AUD/USD

Due to media reports, President Biden will name a new Fed chairman this weekend, the yield on the 10-year Treasury fell 6 basis points on Friday. Governor Lael Brainard is highly regarded in the media, while current leader Jerome Powell is considered the favorite. Since Treasury rates have fallen, it is generally considered to be more peaceful.

The release of Australian retail sales data for October on Friday will have no impact on the economy.

The Wednesday before Thanksgiving Thursday is a busy day for American information. October’s durable goods orders are expected to confirm October’s excellent sales figures. A modest GDP revision could be forthcoming in the third quarter. A stronger dollar will be sustained by better results.

–Are you interested to learn about forex bonuses? Check our detailed guide-

AUD/USD price technical forecast: Broken trendline to exacerbate selling

The daily chart of the AUD/USD pair indicates a very negative scenario as the price broke the ascending trendline and closed below it near the lows. The bears may test the previous swing lows at 0.7170 and 0.7107. However, the price is expected to post a minor up wave to test the broken trendline before continuing the downtrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.