- Following the recession caused by the Coronavirus, Australia’s economy continues to recover.

- With its prudent stance, the US Federal Reserve can assist financial markets.

- Despite the gloomy sentiment, AUD/USD maintains its long-term positive stance.

The AUD/USD weekly forecast is bearish as the pair ended the week negative below key levels ahead of Fed’s rate decision. The AUD/USD pair ends the week slightly lower; the commodity-pegged currency hit a new high for 2022 at 0.7440 against the US counterpart. The Aussie has weathered the risk-off environment fairly well with gold flirting with its all-time high of $2,075.64 an ounce.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Russia-Ukraine conflict to guide the markets

As the situation in Ukraine continued to deteriorate daily, headlines related to the financial markets were again dominated by the Russian invasion. The prospect of a diplomatic solution has lingered all week, but there have only been talks with no further progress so far. During these two weeks of conflict, Russia continued attacking Ukrainian cities.

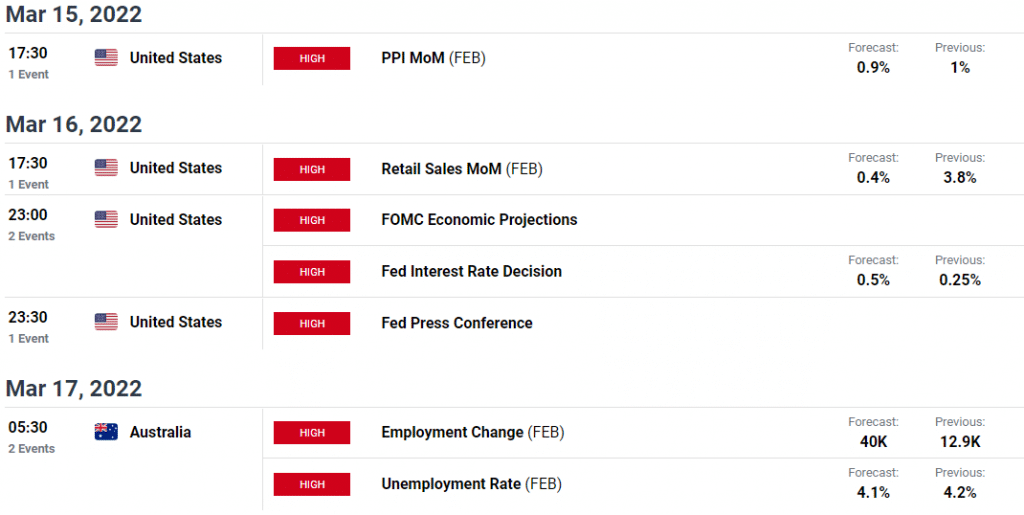

As the US Federal Reserve is expected to increase rates by 50 basis points next week, the market is pricing in a wait-and-see stance from the Reserve Bank of Australia. In February, consumer prices rose 7.9% year-over-year, reaching their highest level in four decades. It is still possible for the US Federal Reserve to raise rates by 25 basis points, which would inspire some optimism among equity traders and weigh on the US dollar.

Inflation continued to rise in Australia despite signs of economic improvement. Unexpectedly, consumer inflation expectations increased to 4.9% from 4.6% in February. Next week, the Reserve Bank of Australia (RBA) will release the minutes of its latest monetary policy meeting, while February employment data will also be released.

AUD/USD key data/events next week

As in the past, the focus will be on inflation and the central bank’s response to it, along with the latest retail sales data. Moreover, Australian employment data will be the key event to watch.

AUD/USD weekly technical forecast: Bearish reversal

The daily chart of AUD/USD shows an interesting scenario. The last week saw three widespread down bars closing back below the 200-DMA and the horizontal level at 0.7310. The bearish run may test 0.7200 ahead of plunging further towards 0.7100. The 20-DMA is lying around 0.7250, which will remain a pivot point for the pair.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

On the upside, 200-DMA will be the key hurdle ahead of swing highs at 0.7440. However, the upside path is loaded with hurdles, while the path of least resistance lies on the downside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money