- The mixed macroeconomic figures in Australia reflect the country’s economic struggles.

- Further tapering by the US Federal Reserve is expected this month.

- AUD/USD is extremely oversold but is not set for a reversal.

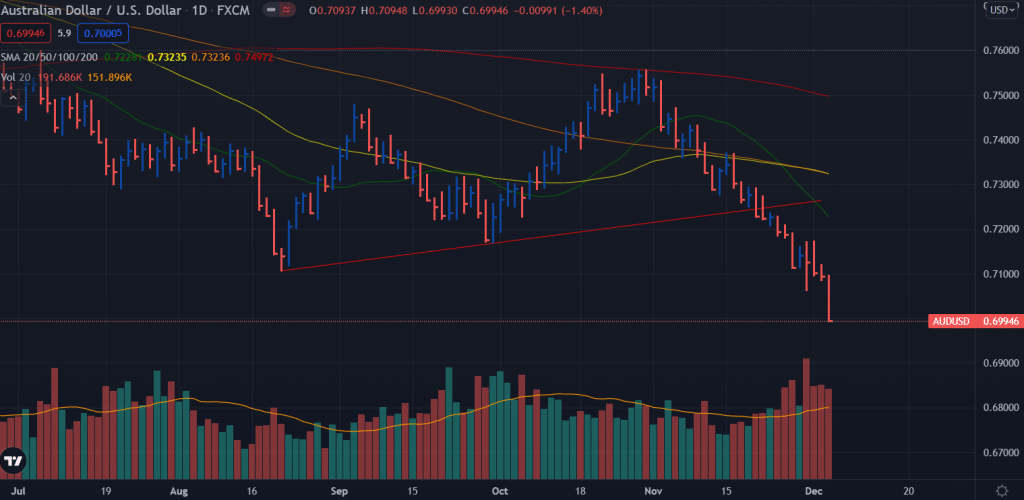

The AUD/USD weekly forecast is bearish as risk aversion prevails in the market amid growing Omicron fears and rising US dollar. The AUD/USD pair is in free fall, trading below 0.7000 as the week closes, its lowest level since November 2020. It is expected to end the week around 0.7000.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

In light of risk aversion and the possibility of further tightening in the US, the US dollar strengthened. Investing in the dollar is as popular nowadays as it was during the heyday of the oil tower. However, recent news about a new strain of Coronavirus, first discovered in South Africa on November 25th, has brought uncertainty to the forefront.

Jerome Powell, Chairman of the Federal Reserve, and Janet Yellen, Treasury Secretary, testified before a special Senate committee on the CARES bill on Wednesday. According to Powell, inflation has spread, and persisting inflation is an increasing concern. As a result, the Fed will consider accelerating emissions reductions to fight inflation at its December meeting. He said it is time to eliminate the word “temporarily” from its description of price pressures. President Yellen repeated his statement, adding that the new strain of the Omicron coronavirus could threaten the global economy.

After the Wall Street sell-off, the stock market rebounded slightly before the week ended. In addition, US Treasury bond yields remained weak, with the 10-year bond holding above 1.50%. The AUD/USD chart has followed the US stock market’s downward path but ignored their returns. With gold trading around $1,770 an ounce after repeated attempts to break the $1,800 mark, the weaker price has also put pressure on the Aussie.

Data on the US employment report was ignored by speculators. In November, there were only 210,000 new jobs in the country, much lower than the expected 550,000. Even so, the unemployment rate improved to 4.2%, better than the expected 4.5%, and economic activity rose to 61.8%. Meanwhile, the November ISM Manufacturing PMI was higher than expected at 61.1, and the Services PMI was higher than expected at 61.9.

The Australian data reflects both a country that is gradually removing restrictions and struggling economically. The number of building permits fell by 12.9% m/m in October, though gross domestic product grew in the third quarter decreased 1.9% q/q, which is 2.7% better than expected.

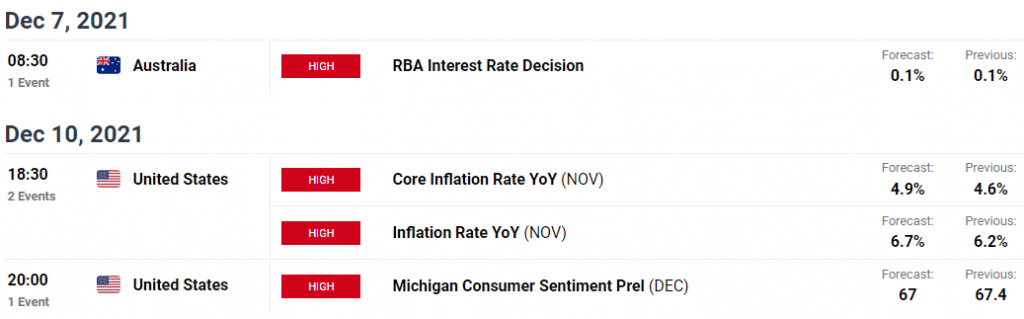

Key data/events for AUD/USD

TD Securities will release its November inflation report for Australia as part of the week’s events. Currently, there is no talk of a rate hike until 2024, as the Reserve Bank of Australia has already stated that higher inflation will not affect their monetary policy.

It is expected that the RBA will dispel any speculation sparked by Monday’s report on Tuesday.

The US will release its November CPI, which is predicted to be revised downward from 6.2% to 5.8% y/y.

–Are you interested to learn more about Australian forex brokers? Check our detailed guide-

AUD/USD weekly technical forecast: Buyers finding no respite

The AUD/USD week closes near the lows below the 0.7000 mark, providing no respite for the buyers. The price is well below the key SMA. The volume shows more clues for the downside. The pair may hit 0.6950 ahead of the 0.6900 handle. On the upside, a 0.7100 handle will be the key resistance to watch.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.