- RBA minutes showed the need for more interest rates to control inflation.

- Australia’s unemployment rate dropped to 3.4%.

- Fed officials returned to their hawkish stance, pushing the dollar higher.

The weekly AUD/USD forecast is bearish as investors will likely continue digesting the negative Australian jobs report, and the dollar rally is set to continue.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Ups and downs of AUD/USD

According to the minutes from the Reserve Bank of Australia’s (RBA) August policy meeting, the Australian central bank continues to believe that further interest rate increases are necessary to prevent high inflation from becoming expected.

Australia’s unemployment rate fell to a 48-year low in July despite employment experiencing its first annual decline after a super-strong run, a mixed figure that may indicate some cooling in the hot labor market.

According to data released by the Australian Bureau of Statistics on Thursday, the unemployment rate decreased to 3.4%, while analysts expected it to remain at 3.5%. The lowest rate since August 1974 only highlighted the tight labor market.

On the US dollar side, in the July meeting minutes, which were made public on Wednesday, Fed officials stated that if inflation starts to decline, they will take a less aggressive position.

“The minutes were uniformly hawkish in our view,” Self added. “It’s clear among all the voting members that curing inflation is the No. 1 choice, and they will do whatever is necessary regarding raising rates to get there. We think they’re using the labor market as cover.”

Next week’s key events for AUD/USD

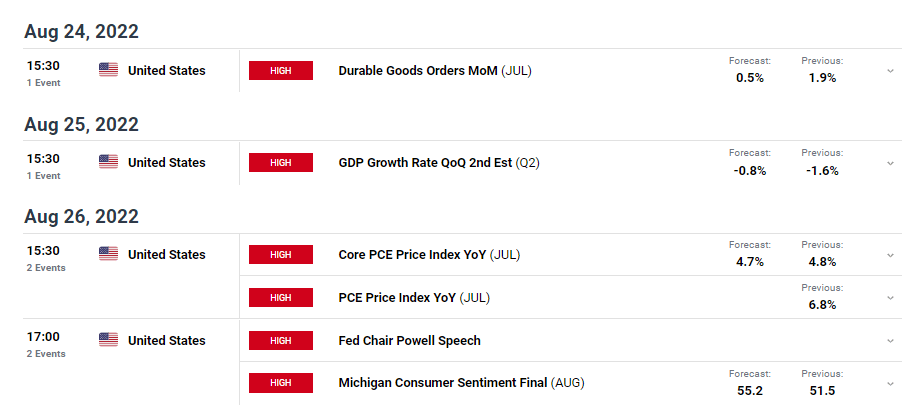

Investors will watch next week’s Fed Chair Powell’s speech to see what he has to say about monetary policy. US GDP is anticipated to decrease by 0.8% in Q2 from -1.6%. Orders for durable goods are predicted to fall from 1.9% to 0.5%.

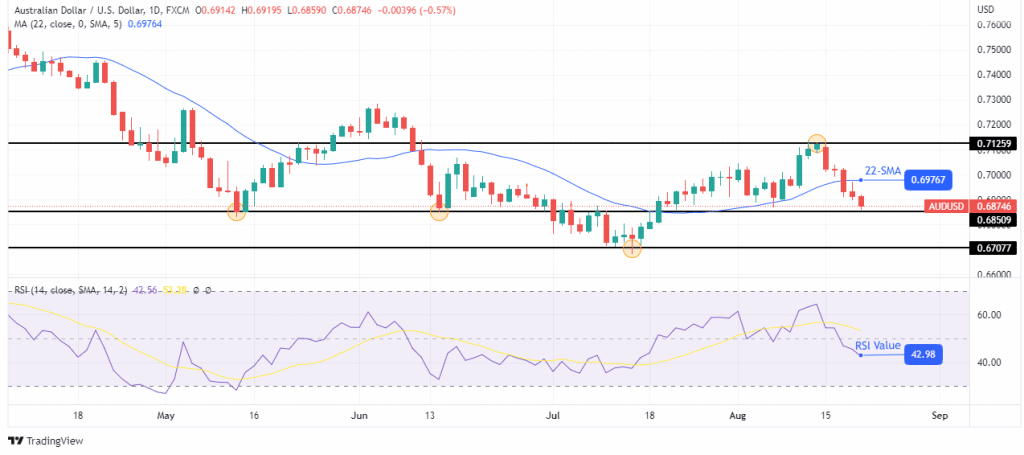

AUD/USD weekly technical forecast: Solid support at 0.6850

Looking at the daily chart, we see the price trading below the 30-SMA, a sign that bears are in control. The RSI is trading below 50, favoring bearish momentum.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

The price is trading close to a strong support level at 0.68509. In the coming week, the price will either break below this level and head for the next support level at 0.67077 or bounce and break above the 22-SMA.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.