- The release of several upbeat economic reports bolstered the dollar.

- Although inflation in Australia fell, it remains well above the RBA’s target.

- The Reserve Bank of Australia will likely lift its interest rate by 25 basis points.

The AUD/USD weekly forecast is slightly bullish as investors expect a rate hike at Tuesday’s RBA meeting.

Ups and downs of AUD/USD

Despite a stronger dollar, AUD/USD closed the week well above its lows amid expectations for an RBA rate hike next week. Notably, the release of several upbeat economic reports bolstered the dollar.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

The US economy demonstrated resilience as positive data on the housing market, consumer confidence, and durable goods orders emerged. Additionally, there was encouraging news on GDP and initial jobless claims in the US. These reports further solidified the expectations for additional rate hikes by the Fed.

Although inflation in Australia fell, it remains well above the RBA’s target, necessitating more rate hikes. Furthermore, Australia’s labor market remains hot, needing more policy tightening.

Next week’s key events for AUD/USD

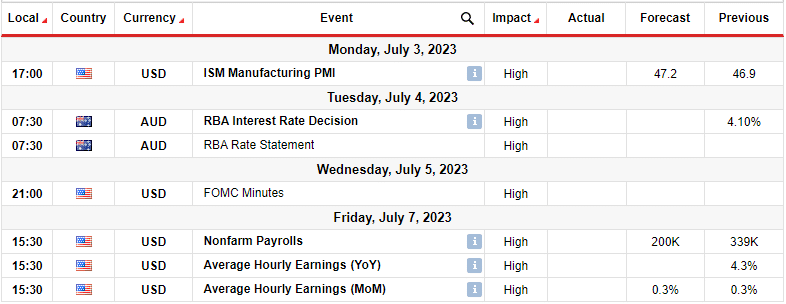

Next week will be big for AUD/USD as investors are awaiting the RBA policy meeting on Tuesday. There will also be important reports from the US, including the FOMC meeting minutes and the jobs report.

On Tuesday, the RBA will likely increase its interest rate by 25 basis points to 4.35% to control persistently high inflation.

On the other hand, the NFP report will influence the outlook for interest rates in the US. The report will show whether current high rates are working to lower demand in the labor market.

AUD/USD weekly technical forecast: Bulls take over at 0.6600 support.

AUD/USD fell last week before pausing at the 0.6600 support level. Aussie has been moving sideways for a long time. It has been chopping through the 22-SMA, showing neither bears nor bulls are willing to push the price far from the SMA.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

At the same time, the RSI has been crossing the pivotal 50-level, showing frequent shifts in sentiment. As such, the price bounced higher many times when it retested the 0.6600 support. Similarly, the 0.6800 has acted as strong resistance.

Currently, the price looks set to reverse at 0.6600 support. If bulls take over, the price will likely break above the 22-SMA and climb to retest 0.6800.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money