- AUD/USD lost 20 pips this week, thanks to the rising US dollar.

- China’s dismal data and FOMC meeting minutes about tapering exacerbated the selling.

- The Aussie could not gain traction from the upbeat employment data.

- Jackson Hole is the key event next week that can turn the upside-down of the market.

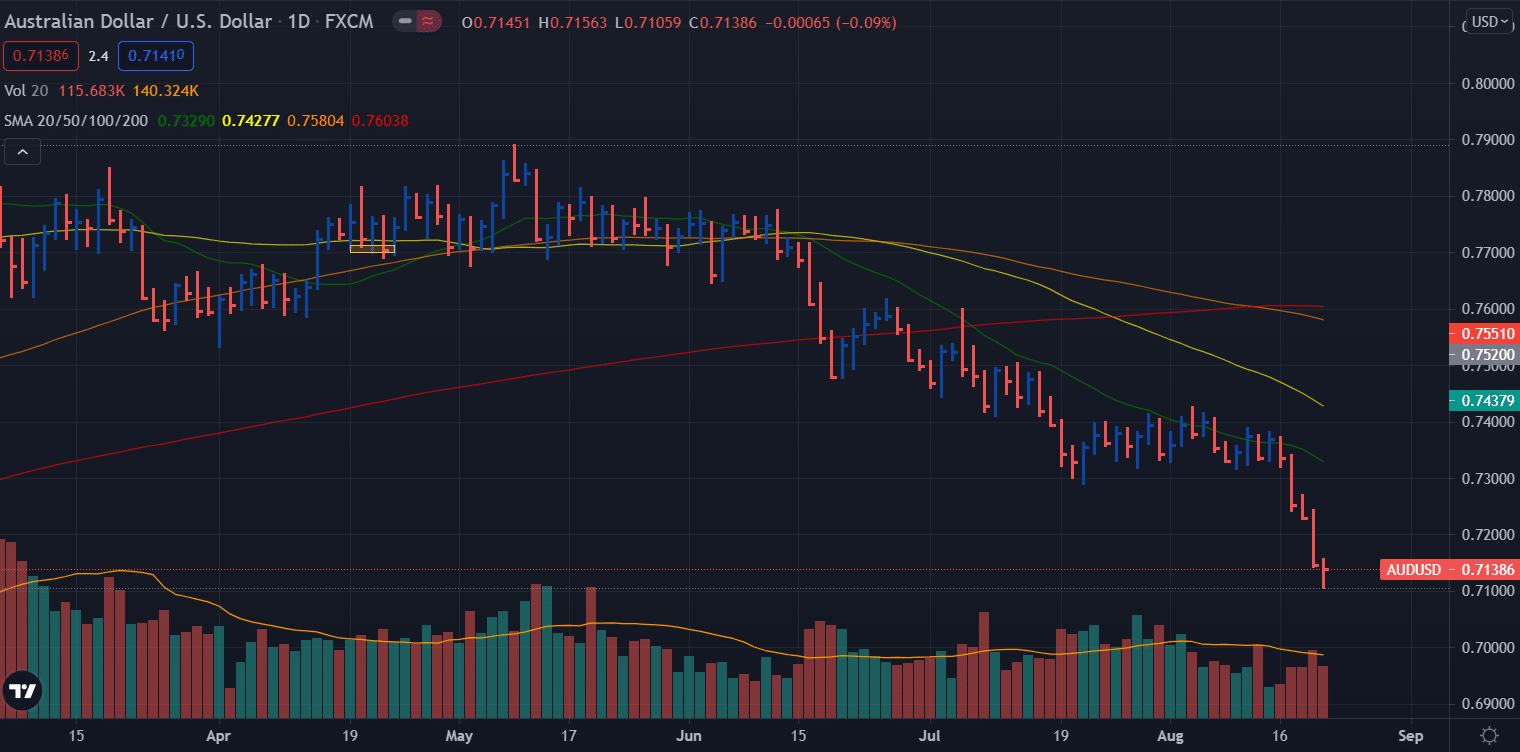

The AUD/USD weekly forecast is bearish as the US dollar is not pausing its rally to the multi-month highs and risk sentiment remains sour.

The AUD/USD fell to 0.7105, a new low since 2021, and bounced only slightly from the close of the week as investor confidence and demand for the commodity-pegged currency collapsed.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

On the economic front, China reported weaker-than-expected numbers for industrial production and retail sales in July. In addition, the financial markets were fearful of global growth and indications that the US Federal Reserve would cut asset purchases soon.

Federal Reserve revealed in its minutes that participants intensified their negotiations on the tapering. Several policymakers believe it’s best to wait until 2022 before cutting production capacity, but the market expects it to start in the last quarter. The unemployment rate is still the same, despite continuing divergent inflation forecasts.

Surprisingly, the unemployment numbers are mostly positive. During the week ended Aug 13, initial US jobless claims dropped to 348,000, while Australia added 2.2k new jobs, despite an expected loss of 46.2k. Nevertheless, Australia reported that its annual wage price index stood at 1.7% in the second quarter, a slight improvement over the previous 1.5% but below the 1.9% expected.

Key events in Australia from Aug 23-27

Next week, Markit will release its preliminary US and Commonwealth Bank PMIs for August. The US calendar for the week will include durable goods orders as well as retail sales in Australia.

Key events in the USA from Aug 23-27

Starting Thursday, the Jackson Hole Symposium will be the highlight of the week. Market participants follow the event to get updated information about economic policy from the event, which is attended by several central bank governors.

–Are you interested to learn more about forex signals? Check our detailed guide-

AUD/USD weekly technical forecast: 0.7100 looks vulnerable

The AUD/USD pair plummeted more than 200 pips this week and posted fresh YTD lows just below the mid-0.7100 mark. The volume data reveals a dismal scenario for the pair. The pair is too feeble to hold the recent lows. We can expect the 0.7100 to be tested and broken if the bearishness persists. On the upside, the 0.7200 mark will be the key resistance, and the pair is likely to stay below the level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.