- On Friday, despite a generally favorable risk tone, the AUD/USD recovered traction upward.

- If CPI surprises the upside, the RBA might raise rates in May.

- The uncertainties surrounding Ukraine may deter bulls from putting new bets.

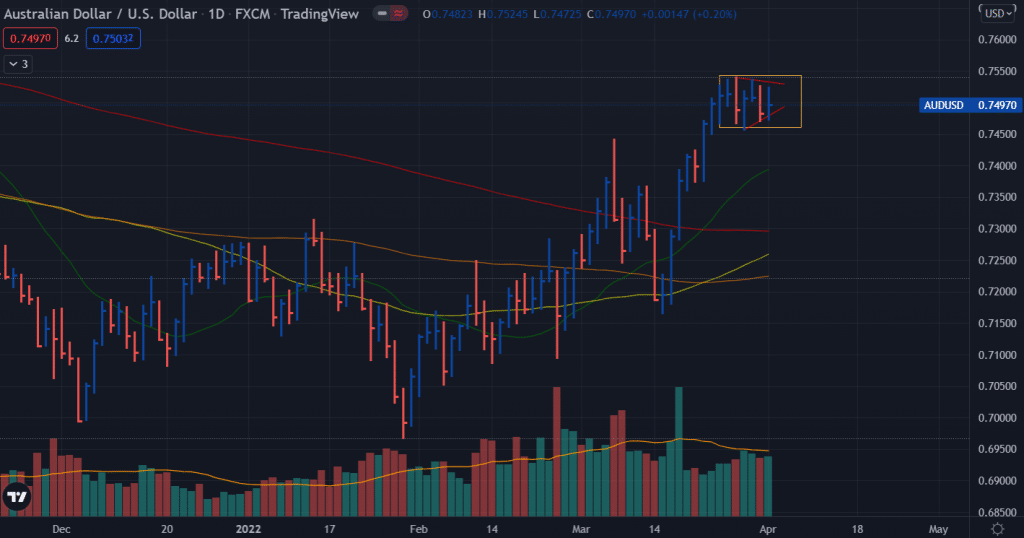

The weekly AUD/USD forecast is somewhat negative, as the USD bulls appear to be gaining ground. The AUD/USD only made a little gain during Friday’s North American session, finishing the week below 0.75.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Best among the rest

The AUD has been among the best performers since the start of the Russian-Ukrainian conflict. While several global currencies weakened in favor of the safe-haven greenback due to the Ukraine crisis, the Australian dollar (AUD) and other currencies thrived, providing the Reserve Bank of Australia (RBA) more flexibility in its approach.

The RBA has kept the cash rate at 0.1 percent since late 2020, but the country’s strong economic data suggests the central bank may tighten in the near future.

Greenback in green

DXY gained 0.22 percent on Friday, closing at 98.56. The 10-year benchmark note in the United States climbs three basis points to 2.360 percent, albeit it remains lower than the 2-year note, which is at 2.428 percent, reversing the curve for the second time this week.

The Russia-Ukraine saga continues

In a Facebook post on Saturday, Ukraine’s Deputy Defense Minister Hanna Malyar stated that the “whole Kyiv region is liberated from the invader.”

The port city of Mariupol, which the Russian siege has substantially damaged, would be included in the southeastern region of Ukraine. Over the previous week, Russian ground forces assaulting the north have been driven back from Kyiv, Ukraine’s capital.

AUD/USD Forecast: Week Ahead

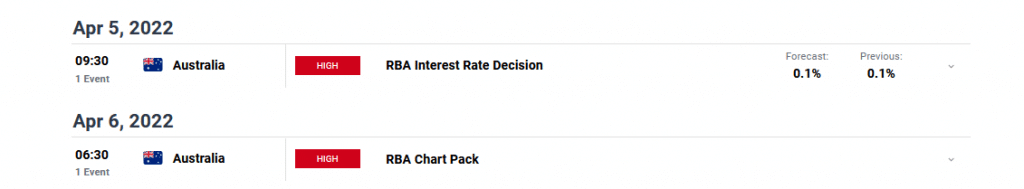

From down under, we have the all-important RBA’s decision on Tuesday, and on Wednesday, we have RBA’s chart pack.

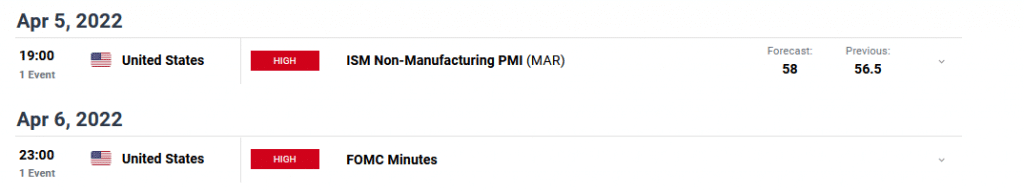

As we enter the first week of April, there will be some important releases from the United States. On Tuesday, the ISM Non-Manufacturing PMI will be released, followed by the FOMC Minutes on Wednesday.

The Russian-Ukrainian drama will continue to have a significant influence on the AUD/USD Weekly forecast and the RBA’s decision, and the US FOMC’s decision.

AUD/USD Technical Forecast: Travelling in a tight range

The AUD/USD pair has been drifting about the 0.7500-level for the past seven days but has been unable to maintain above it. The 20-day SMA appears to be rejecting the bulls.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

The daily high at 0.7478 would be the first support level for the AUD/USD. A sustained breach would disclose the daily high of March 7 at 0.7441, then 0.7400.

The initial level of resistance for the Australian dollar is around 0.7555. If the AUD/USD pair settles above this level, it can go to 0.7575, the next resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money