- Australia’s government is planning to review the RBA.

- Markets have priced in a 75 bps rate hike from the Federal Reserve.

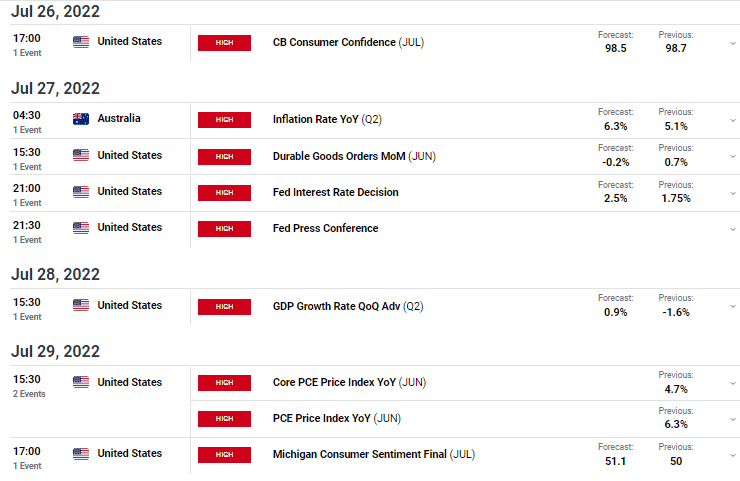

- Investors expect a slight drop in US consumer confidence.

The AUD/USD weekly forecast is bullish as investors wait to see if Australia’s inflation will push the RBA to be more aggressive.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Ups and downs of AUD/USD

The pair started the week on a bullish note after the Reserve Bank of Australia released its hawkish meeting minutes. The bullish trend was further supported by RBA Governor Philip Lowe’s speech, where he insisted on raising rates to curb inflation.

“For inflation to return to the 2%–3% target range, a more sustainable balance between demand and supply is needed. Higher interest rates will help achieve this,” Lowe said.

The central bank is also facing criticism over its inflation policy from the Australian government. The government is planning a review to look into the bank’s board structure, operations, and methods of communication with the public.

Next week’s key events for AUD/USD

Investors expect a significant rise in Australia’s inflation when data is released next week. Inflation in the country has been on the rise, surprising the Reserve Bank of Australia. The bank had forecasted rates to stay at 0.1% to 2024, only to raise rates in May as inflation exceeded expectations.

For this reason, the Reserve Bank of Australia is facing criticism from the government. However, the bank insists it will keep hiking rates until inflation is controlled. Investors also expect a rate hike from the Federal Reserve.

US consumer confidence is expected to drop as economic activity slows down. However, investors expect Q2 GDP to grow from -1.6% to 0.9%.

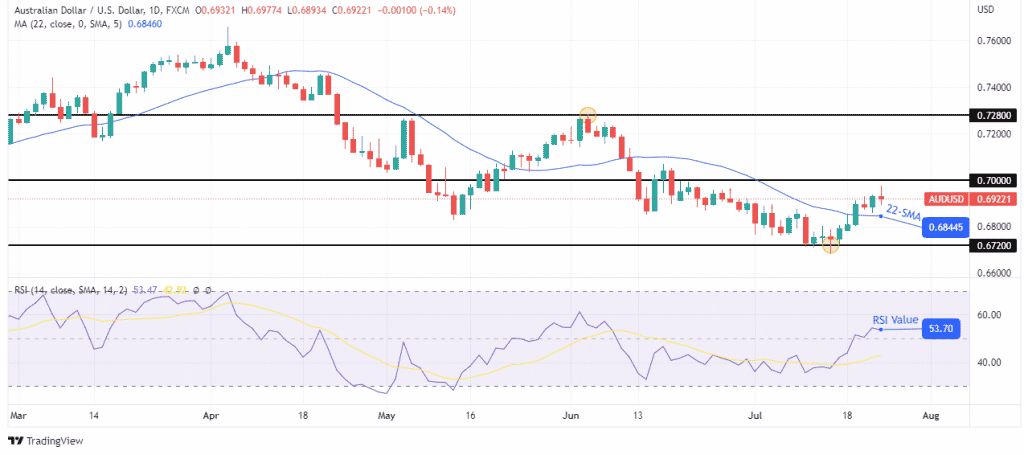

AUD/USD weekly technical forecast: A break above 0.7 will confirm the bullish trend

Looking at the 4-hour chart, we see the price trading above the 22-SMA, showing bulls are in charge. RSI also favors bullish momentum as it trades above 50. The pair’s downtrend stopped at the 0.67200 level before the price went on to break above the SMA.

–Are you interested to learn about forex robots? Check our detailed guide-

The price has come close to a critical psychological level at 0.7, which might pause or even stop the uptrend. There will be resistance at 0.7 and support at the 22-SMA. A break above 0.7 will confirm the bullish trend, while a break below the 22-SMA will resume the downtrend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.