- AUD/USD pared some losses by the end of week.

- NFP lent some support to the pair for the time being.

- RBA, Fed’s meeting minutes and US ISM survey are major risk events next week.

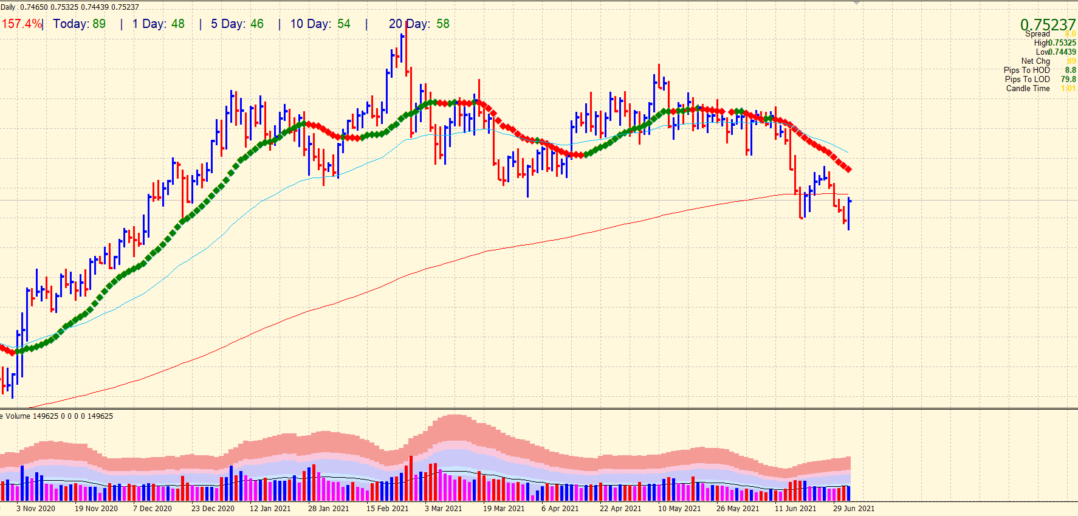

The Australian Dollar saw an entire week under the dominance of bears. The AUD/USD pair fell below the 0.7500 psychological mark and tested 21 December lows of 0.7445 area. The downtrend stemmed from Fed Chair Powel’s comments last week that triggered a rally in Greenback across the board. However, a nonfarm payroll report for the US came out and turned the upside-down of the market. Although the pair closed in red, it was able to catch some bids at the end of the session.

AUD/USD on NFP

The employers were able to add 850k new jobs in the US economy, which has been the strongest figure since August 2020. The momentum has clearly picked over the past two months.

Despite a sharp rise in payrolls, the unemployment rate rose to 5.9%. The rise emerged from household measures of employment that dropped to 18k. Thus, although the labor supply increased, the reduction in unemployment will take more time.

The AUD/USD pair picked up bids from 8-month lows amid little discouraging figures of unemployment. The upbeat jobs addition could not help the Greenback rally to continue. The pair has pared off some of the weekly losses.

What to watch next week?

The RBA meeting next week can also be decisive for the pair to find the directional bias. It should be noted here that on Monday, July 5, American trading floors will be closed. The States will continue to celebrate the public holiday (Independence Day). Literally the next day, during the Asian session on Tuesday, the RBA will announce its verdict on the prospects for monetary policy. For AUD/USD traders, this means that the pair may show increased volatility in the near future.

On the other hand, the US ISM survey and Fed meeting minutes are also important events next week that can provide fresh impetus to the market.

AUD/USD technical weekly forecast: Are bulls too dominating?

The bullish bar on the daily chart shows signs of bottom reversal with healthy volume. However, immediately, it is capped by 200-day SMA ahead of congestion of 20 and 50 DMAs.

Bulls need to clear the resistance of 0.7550 and sustain above the level to retain the bullish traction. Furthermore, local high and 20-day SMA at 0.7600 area can serve as another resistance level. However, we can see a mild corrective retracement of Friday’s bulls on Monday and Tuesday that can provide fresh buying opportunities.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.