The Australian dollar enjoyed a post-Brexit recovery and managed to top the 0.75 level. While AUD/USD keeps holding on to this ground, the gains may have stopped for now.

Australian elections – count continues

The initial count in Australia’s elections held on Saturday showed a hung parliament, with neither of the main parties reaching an outright majority. After a long pause for the weekend, the count of the final vote continues.

AUD/USD did open the week with a small weekend gap to the downside on this uncertainty, but this was closed quite soon.

The land down under has seen quite a few PMs in a short span of years but this hasn’t affected the currency. Democracy is solid in Australia. But will a hung parliament make a difference?

Very balanced RBA

The Reserve Bank of Australia left the rates unchanged as widely expected. The statement was relatively balanced, like the currency movements. Glenn Stevens and co. did refer to the currency by saying that the rising AUD could complicate the economic re-balancing, but this does not sound very worried.

Regarding inflation, they see it as quite low and remaining as such for a while. However, growth continues and low rates are supporting domestic demand. They also seem mixed on jobs, not seeing a very specific direction.

Weak data

Apart from the words coming out from politicians and central bankers, we also received some data from Australia. The main data points were underwhelming: retail sales rose by only 0.2%, below 0.3% expected. In addition, the previous month’s data was revised down to 0.1%.

The trade balance deficit also deteriorated with 2.22 billion instead of 1.72 predicted. Also here, the previous figure was revised to the downside.

Elsewhere, the AIG Services Index slipped from 51.5 to 51.3. China’s services PMI did surprise to the upside with 52.7. This is good for Australia which still relies on the world’s second largest economy.

AUD/USD down from here?

With global uncertainty and political uncertainty joined by mediocre data and the momentum lost, we could see a slide from here.

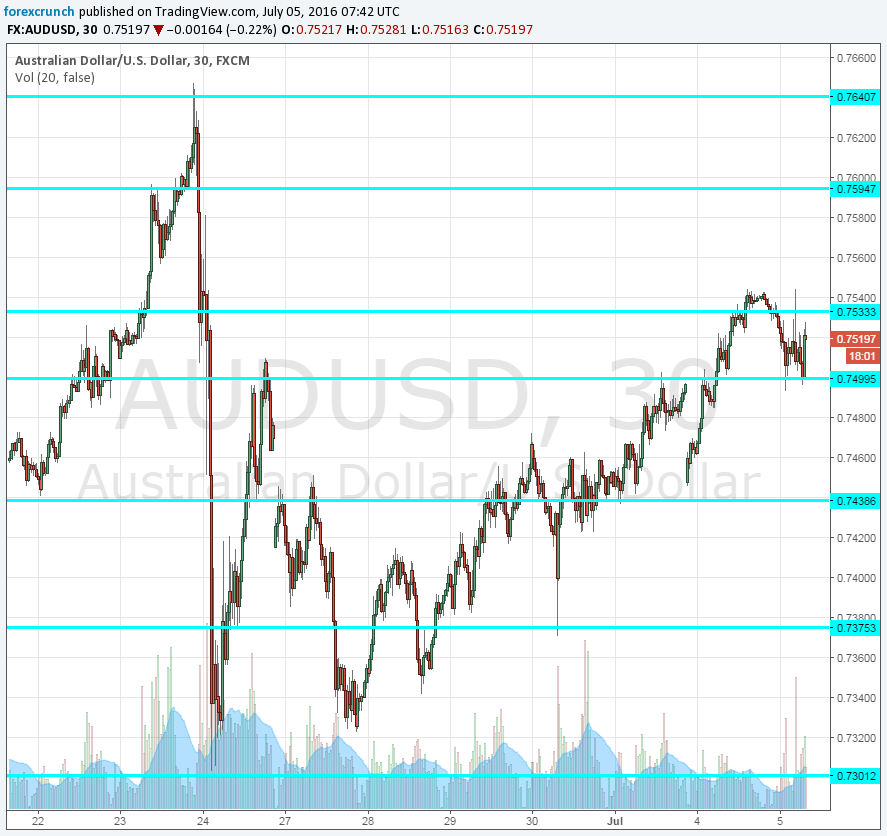

AUD/USD is currently trading at 0.7517, down from the highs of 0.7544 which was the highest the Brexit vote. 0.75 serves as support.

Further support if the pair begins sliding, the next line is 0.7440. Further below, we have 0.7375 and 0.73. On the topside, resistance is at 0.76 and 0.7640.

More: AUD, NZD: A Sell Vs Safe-Haven? Where To Target? – Credit Suisse

Here is how it looks on the chart: