The Australian dollar has emerged from the abyss and manages to re-capture the 0.75 level thanks to positive data. While the Aussie still feels the RBA rate cut made only two days ago, it seems to have taken a path of recovery after the positive figures.

Australia enjoyed a gain of 0.4% in retail sales, better than 0.3% expected and coming on top of a small upwards revision from the previous figure. The same goes for trade balance: the outcome is a deficit of 2.16 billion, better than 2.95 expected and once again, coming on top of an upwards revision for the prior month. Also the New Home Sales release by HIA came out at a strong 8.9%. While this data point is volatile, a positive number adds to the mix.

The Australian dollar did not seem to be moved by the Chinese services PMI: Caixin’s number missed expectations with 51.8 points, below 52.6 expected. For Australia, the manufacturing figure is more important.

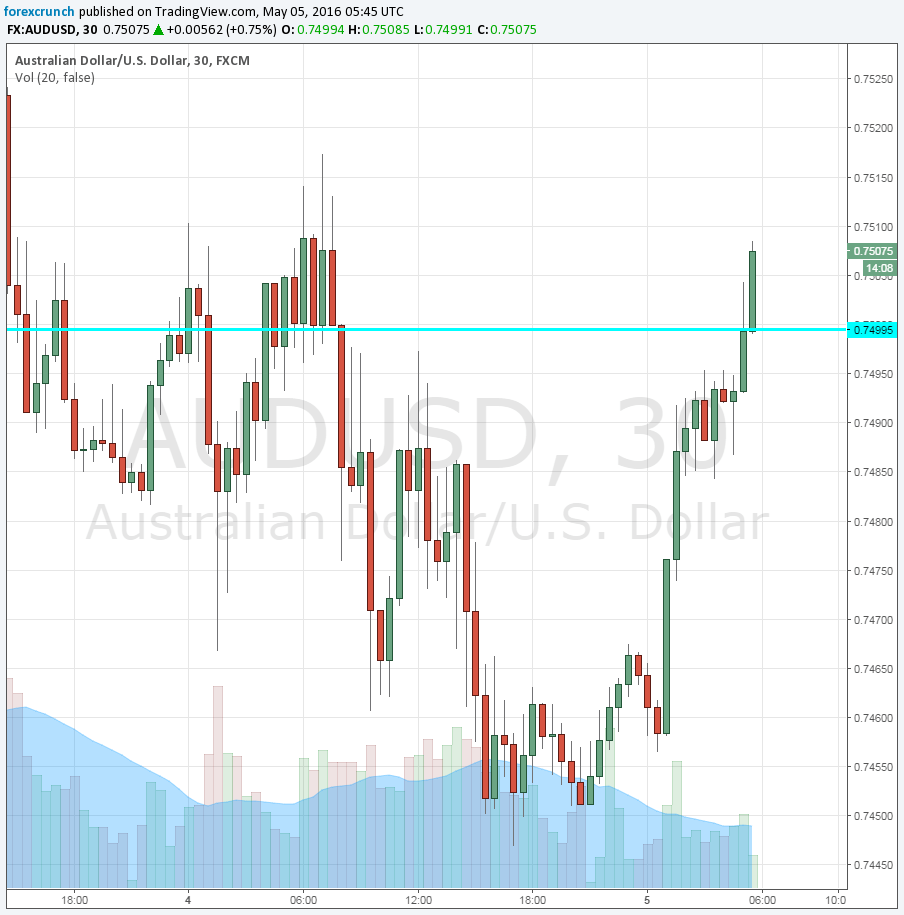

AUD/USD was settling at support around 0.7440, and with this positive data, it managed to jump to higher ground, reaching 0.7508. Further resistance awaits at 0.7533, followed by 0.76 and 0.7640.

Here is how it looks on the chart: