The Australian dollar lost a significant support line against the US dollar and is trading at an 8 month low.

This comes as more signs indicators of weakness came from China and as Spain, Greece and Italy continue struggling. The next support line is quite far.

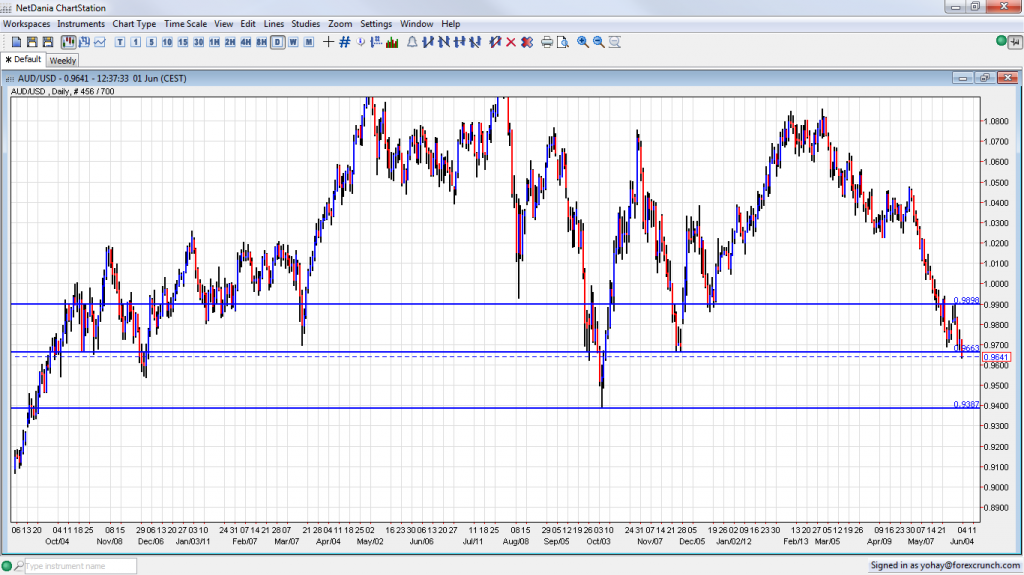

AUD/USD is now trading at 0.9636, below the critical support line of 0.9660. This was a trough back in December 2011 and also served as support back in November 2010.

After breaking this critical line, significant support can be found only at 0.9387, the swing low seen back in October 2011.

Pain in Spain

As a risk currency, the Aussie suffered from the escalation in the European debt crisis, as investors moved money to the safety of the US dollar and the Japanese yen, and away from high yielding currencies as the A$.

Spain is in the limelight: only the Spanish sovereign has access to markets, after banks and regions were shut out. The need to fund banks, such as in Bankia’s nationalization, is weighing on Spain. Talks about contingency plans and a bailout for the euro-zone’s fourth largest economy are looming, and Spain is usually seen as “too big to bail”. The plans don’t seem serious now.

Nevertheless, the Aussie managed to stage an impressive recovery enjoying a relative calm earlier in the week, and some mixed local data: falling building approvals were offset by strong capital expenditure. AUD/USD touched the 0.99 line.

Chinese Ease

This didn’t last long though: Australia’s main trade partner and the world’s No. 2 economy, China, has released a disappointing manufacturing PMI: it stands on only 50.4 points, just above the line separating growth from contraction, worse than 52 that was expected.

In addition to the official number, the highly respected HSBC Manufacturing PMI also disappointed with a downwards revision from 48.7 to 48.3 points.

Less Chinese demand weighs heavily on Australia and could ignite another rate cut to stimulate the economy.

For more on the Aussie, see the Aussie USD forecast.