- On Friday, oil prices temporarily increased after the initial shock that Israel had attacked Iran.

- Economic data points to more upside potential for the USD/CAD pair.

- Markets expect the Bank of Canada to cut interest rates before the Fed.

With the Canadian dollar extending its rally from last week, the USD/CAD outlook remains bearish despite a dip in oil prices. On Friday, oil prices temporarily increased after an initial shock that Israel had attacked Iran, boosting the loonie. However, the move pulled back significantly after Iran downplayed the attack.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Although the USD/CAD pair has pulled back from recent peaks, economic data points to more upside potential. Therefore, the bullish trend could still be intact. Data last week revealed that Canada’s inflation eased more than expected. This put the Bank of Canada’s rate-cut outlook slightly at odds with the Federal Reserve’s.

Inflation in the US has remained stubborn, beating forecasts for the past few months. As a result, policymakers have shifted their stance and are ready to keep higher interest rates for longer. Consequently, markets expect the Bank of Canada to cut interest rates before the Fed. This outlook puts the Canadian dollar in a weaker position than the US dollar.

The only other thing that can strengthen the loonie is a rise in oil prices. However, at the moment, the tensions between Israel and Iran have gone down. With such calm, oil traders can focus on the demand side. Unfortunately, the outlook for demand, especially in China, remains poor and would weigh on oil prices.

USD/CAD key events today

Investors will watch developments in the Middle East war as neither the US nor Canada will release major reports today.

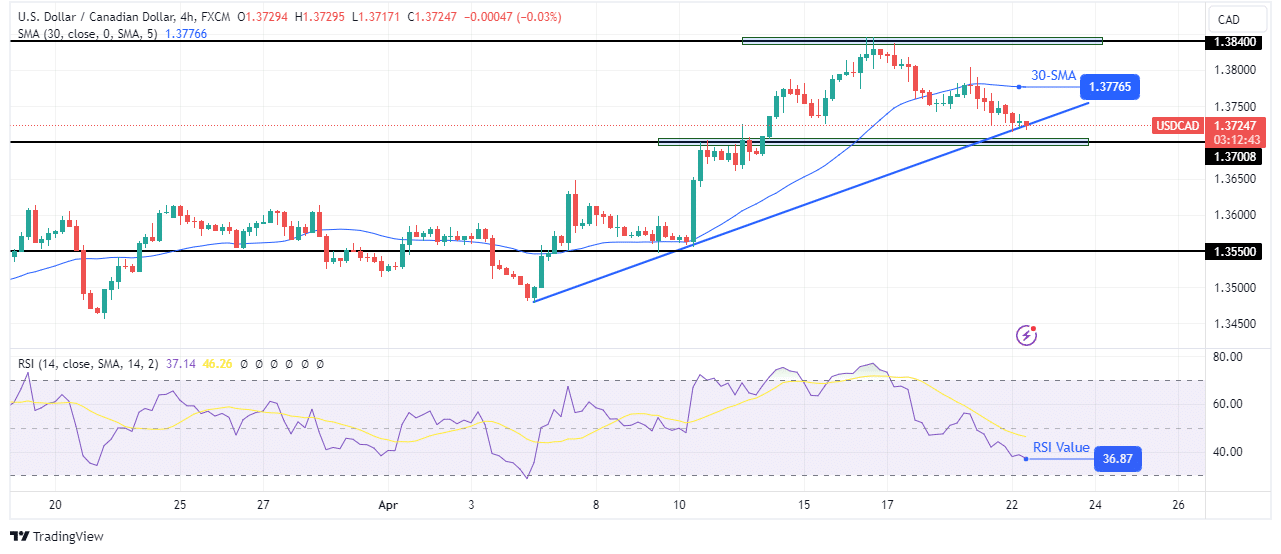

USD/CAD technical outlook: Price meets support at bullish trendline

On the technical side, the USD/CAD price has fallen below the 30-SMA to retest its bullish trendline. Previously, the price had traded in a steep bullish trend above the SMA that paused at the 1.3840 key level. Although sentiment has shifted to bearish, bears can only confirm a reversal if the price breaks below the trendline. Otherwise, it might act as support to push the price to new highs.

-Are you looking for automated trading? Check our detailed guide-

A break below the trendline and the 1.3700 key support level would allow the price to retest the 1.3550 key support level. On the other hand, if it acts as support, the price will likely break above the 1.3840 resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money