AUD/USD posted sharp losses last week, losing 150 points. The pair closed at 0.7482. This week’s key events include Retail Sales, Trade Balance and the Cash Rate. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, employment data was mixed. The Non-Farm Payrolls report disappointed with only 98K jobs gained, but wage growth was steady and unemployment claims dropped sharply. The Fed minutes were slightly hawkish, leaving room for additional hikes. In Australia, the RBA held rates at 1.50 percent.

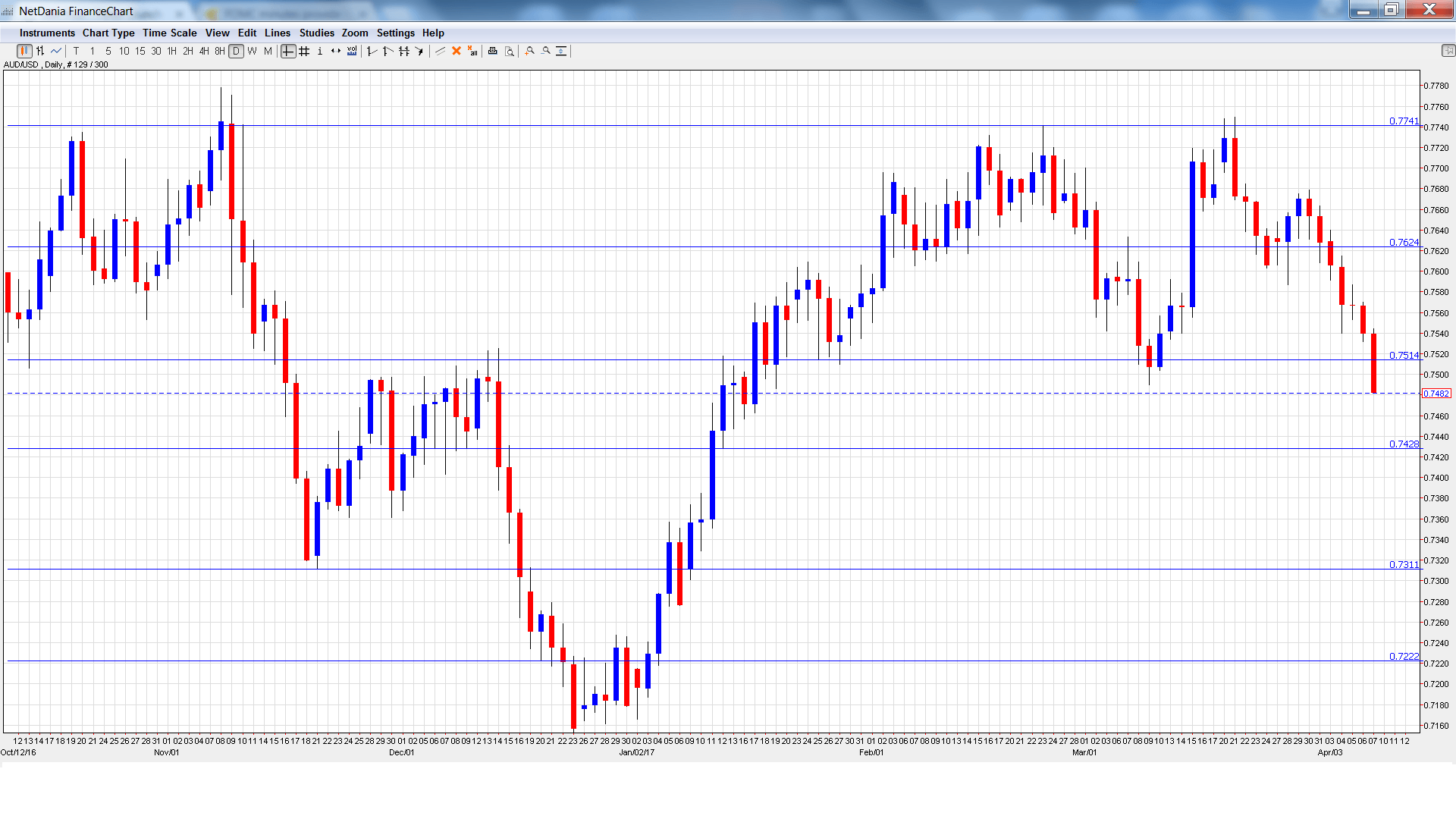

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Home Loans: Monday, 1:30. This indicator provides a snapshot of the strength of the housing sector. In January, the indicator edged up to 0.5%, crushing the estimate of -0.9%. The markets are forecasting a small gain of 0.1% in the February report.

- NAB Business Confidence: Tuesday, 1:30. Business confidence continues to improve, as the indicator came in at 7 points in February. However, this was down from 10 points a month earlier.

- Westpac Consumer Sentiment: Wednesday, 00:30. Consumer confidence is closely monitored, as it is linked to consumer spending, a key driver of economic growth. The indicator dropped to 0.1% in March, compared to a strong gain of 2.3% in February.

- MI Inflation Expectations: Thursday, 1:00. This indicator is used by analysts to predict actual inflation levels. The indicator has been weakening, and dropped to 4.0% in February.

- Employment Change: Thursday, 1:30. This is one of the most important indicators and should be considered a market-mover. In February, the indicator declined by 6.4 thousand, surprising the markets which had expected a gain of 16.3 thousand. The markets are expecting an excellent March report, with an estimate of 20.3 thousand. The unemployment rate jumped to 5.9% in February, with no change expected in March.

- RBA Financial Stability Review: Thursday, 1:30. The RBA releases this report twice a year. It provides an assessment of risks to financial stability, which could provides clues regarding future monetary policy.

- Chinese Trade Balance: Thursday, Tentative. China shocked with a trade deficit of $60 billion in February. The markets had expected a surplus of $173 billion. A small surplus of $73 billion is expected in the March report.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7632 and quickly touched a high of 0.7640. It was all downhill after that, as the pair dropped to a low of 0.7482, breaking through support at 0.7513 (discussed last week). The pair closed the week at 0.7482.

Live chart of AUD/USD:

We begin with resistance at 0.7938. This line has held since May 2015.

0.7835 was the high point in April 2016.

0.7741 was a cap in February.

0.7605 is the next resistance line.

0.7513 has switched to resistance following strong losses from AUD/USD. It is a weak line.

0.7429 is next.

0.7311 marked a low point in November.

0.7223 is the next support line.

0.7105 has held since March 2016. It is the final support level for now.

I am bearish on AUD/USD

The US economy remains strong and the Fed is likely to hike rates in June. Despite the unpredictability of Trump, sentiment continues to favor the US dollar.

Our latest podcast is titled Brexit Bad and “Clean Coal”

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.