It was a rather uneventful week for the Australian dollar, which ended the week almost unchanged. AUD/USD closed the week at 0.7673. The upcoming week has eight events, highlighted by Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In Australia, Retail Sales beat the estimate, while the RBA maintained interest rates at 2.25%, as expected. In the US, employment numbers were very positive last week. JOLTS Job Openings improved and the 4-week jobless claims was the lowest since 2000.

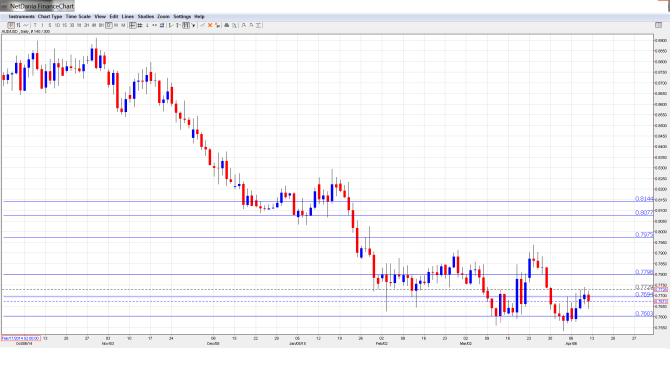

[do action=”autoupdate” tag=”AUD/USDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- Chinese Trade Balance: Monday, Tentative. The Australian dollar is sensitive to key Chinese releases such as Trade Balance, as China is Australia’s number one trading partner. The February reading showed a surplus of $60.6 billion, crushing the estimate of $7.8 billion. However, the markets are bracing for a sharply lower surplus in the March reading, with a forecast of $43.4 billion. Will the indicator repeat and beat the prediction?

- NAB Business Confidence: Tuesday, 2:30. The indicator slipped to 0 points in February, its worst showing since July 2013. If the indicator dips into negative territory in the March reading, this would indicate worsening conditions in the business sector, and the Aussie could lose ground.

- Westpac Consumer Sentiment: Wednesday, 1:30. Consumer Sentiment tends to show sharp volatility. The indicator reversed directions in March, posting a decline of 1.2%. Will the indicator rebound in April?

- Chinese GDP: Wednesday, 3:00. Chinese GDP has remained steady at 7.3% for the past two quarters, which was within expectations. The markets are anticipating weaker growth in Q1, with an estimate of 7.0%.

- Chinese Industrial Production: Wednesday, 3:00. This indicator dropped sharply to 6.9% in February, pointing to a slowdown in China’s manufacturing sector. This figure was well off the forecast of 7.7%. Little change is expected in the March report.

- MI Inflation Expectations: Thursday, 2:00. This indicator helps analysts track inflation levels. The indicator softened in February, posting a gain of 3.2%. This was down considerably from the previous reading of 4.0%. Will the indicator rebound with a stronger reading in the March report?

- Employment Change: Thursday, 2:30. Employment Change is one of the most important economic indicators and an unexpected reading can have an immediate impact on the direction of AUD/USD. The indicator rebounded in February with a gain of 15.6 thousand, very close to the forecast. The estimate for the March reading stands at 14.7 thousand. Another key employment release, Unemployment Claims, is expected to remain steady at 6.3%.

- New Motor Vehicles Sales: Thursday, 2:30. New Motor Vehicles Sales is an important gauge of consumer confidence and spending, as new cars and trucks are big-ticket items. The indicator rebounded in February with a strong gain of 2.9%.

* All times are GMT.

AUD/USD Technical Analysis

AUD/USD started the week at 0.7639 and dipped to a low of 0.7577, testing support at 0.7601 (discussed last week). The pair then reversed directions and climbed to a high of 0.7739. AUD/USD lost ground late in the week and closed at 0.7673.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We begin with resistance at 0.8150. This line has remained intact since late January.

0.8077 was an important resistance line in January.

0.7978 was an important cap back in January 2007.

0.7799 held firm as the pair showed some strength during the week before retracting.

0.7692 was tested in resistance and starts off the weak as a weak resistance line.

0.7601 was tested in support for second straight week. This line is providing immediate support.

0.7528 is the next support level.

0.7403 has held firm since May 2009. At that time, the Aussie was in the midst of a rally which saw it climb above the 0.94 line.

The final support line for now is 0.7283.

I remain bearish on AUD/USD.

The RBA has made no secret that it would like to see a lower AUD/USD exchange rate, and any change in interest rates will almost certainly be in a downward direction. US employment data rebounded nicely last week following the dismal NFP report. AUD/USD continues to trade at low levels, and the pair could move closer to the symbolic level of US 75 cents.

In this week’s podcast, we discuss: USDown or greenback comeback? And also touch other topics:

Subscribe to Market Movers on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZDUSD forecast.