AUD/USD posted sharp gains last week, as the pair gained 170 points. AUD/USD closed the week at 0.7670. This week has eight events on the calendar. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

It was a rough week for the US dollar. Janet Yellen sent the US dollar on its heels, seeing the glass half empty and certainly playing down rate hike expectations. The NFP beat expectations but this didn’t bolster the greenback. There were no major Australian releases last week.

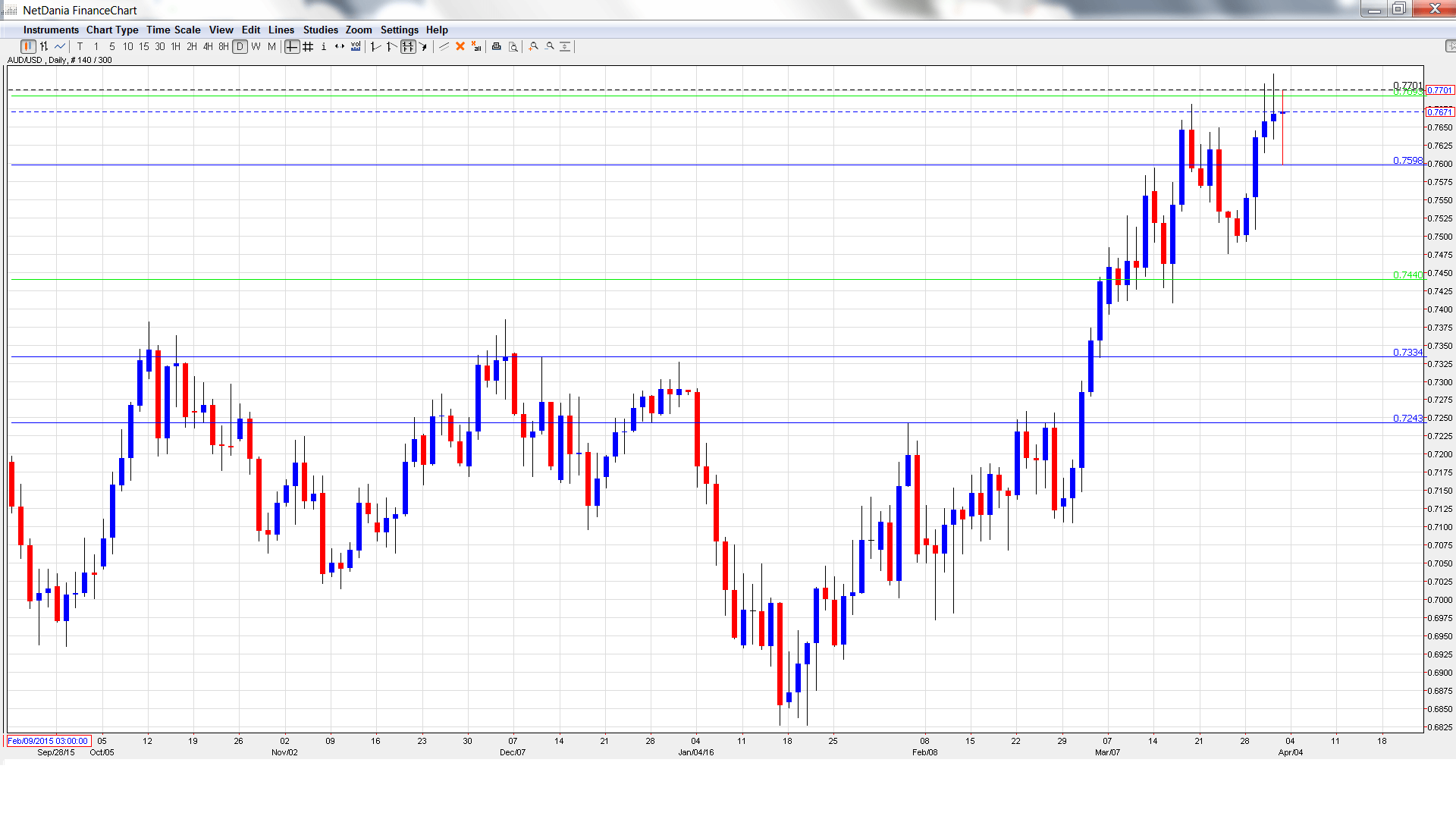

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- MI Inflation Gauge: Monday, 1:00. This monthly index helps analysts track CPI, which is released each quarter. The indicator posted a decline of 0.2% in February, its first decline since November 2012. Will the indicator rebound to positive territory in the March report?

- Building Approvals: Monday, 1:30. Building Approvals tends to show strong fluctuation, and posted a sharp decline of 7.5% in January, well short of the estimate of a 2.9% drop. The markets are expecting a rebound in February, with an estimate of 2.1%.

- Retail Sales: Monday, 1:30. Retail Sales is the primary gauge of consumer spending, a key driver of economic activity. The indicator improved to 0.3% in January, and is expected to edge up to 0.4% in February.

- AIG Services Index: Monday, 23:30. The indicator improved to 51.8 points in February, the first reading pointing to expansion after four straight readings below the 50-level, which indicate contraction.

- Trade Balance: Tuesday, 1:30. Australia’s trade deficit narrowed to A$2.94 billion in January, beating the forecast of A$3.22 billion. The deficit is expected to further contract in February, with an estimate of A$2.55 billion.

- Cash Rate: Tuesday, 4:30. The RBA’s benchmark rate has been pegged at 2.00% for almost a year and no change is expected in the April decision, which will be announced through a rate statement.

- RBA Assistant Governor Christopher Kent Speaks: Wednesday, 7:00. Kent will deliver remarks at an event in Hobart. A speech which is more hawkish than expected is bullish for the Australian dollar.

- AIG Construction Index: Wednesday, 23:30. The index has posted three straight readings below the 50-line, pointing to ongoing contraction in the construction sector. The index dipped to 46.1 points in February, marking a 12-month low. Will the indicator improve in the March report?

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7501 and quickly dropped to a low of 0.7492. The pair then reversed sharply and climbed sharply, hitting a high of 0.7723, testing resistance at 0.7692 (discussed last week). AUD/USD closed the week at 0.7671.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 0.8163.

0.8025 has held firm since May 2015.

0.7886 is next.

0.7798 was an important resistance line for much of June 2015.

0.7692 is an immediate support level.

0.7597 has switched to a support role following strong gains by AUD/USD.

0.7438 is the next support level.

0.7334 was a cap December 2015.

0.7243 is the final support level for now.

I am neutral on AUD/USD

The Fed has poured cold water on speculation of an imminent rate hike, while in Australia the RBA keeps talking about low inflation but is unlikely to make a rate move. At the same time, US fundamentals are certainly stronger than those of Australia, and many investors are still playing it safe in the current global environment and avoiding risk currencies like the Aussie.

In our latest podcast we explain why the doves do NOT cry.

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast