AUD/USD was almost unchanged for a third straight week, as the pair closed at 0.7623. This upcoming week has just two events. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, the Fed’s minutes showed that only a small minority favors a rate hike, while the vast majority wants to continue to wait, notably because of low inflation levels. Australian July employment numbers were sharp, as Employment Change and the unemployment rate beat expectations.

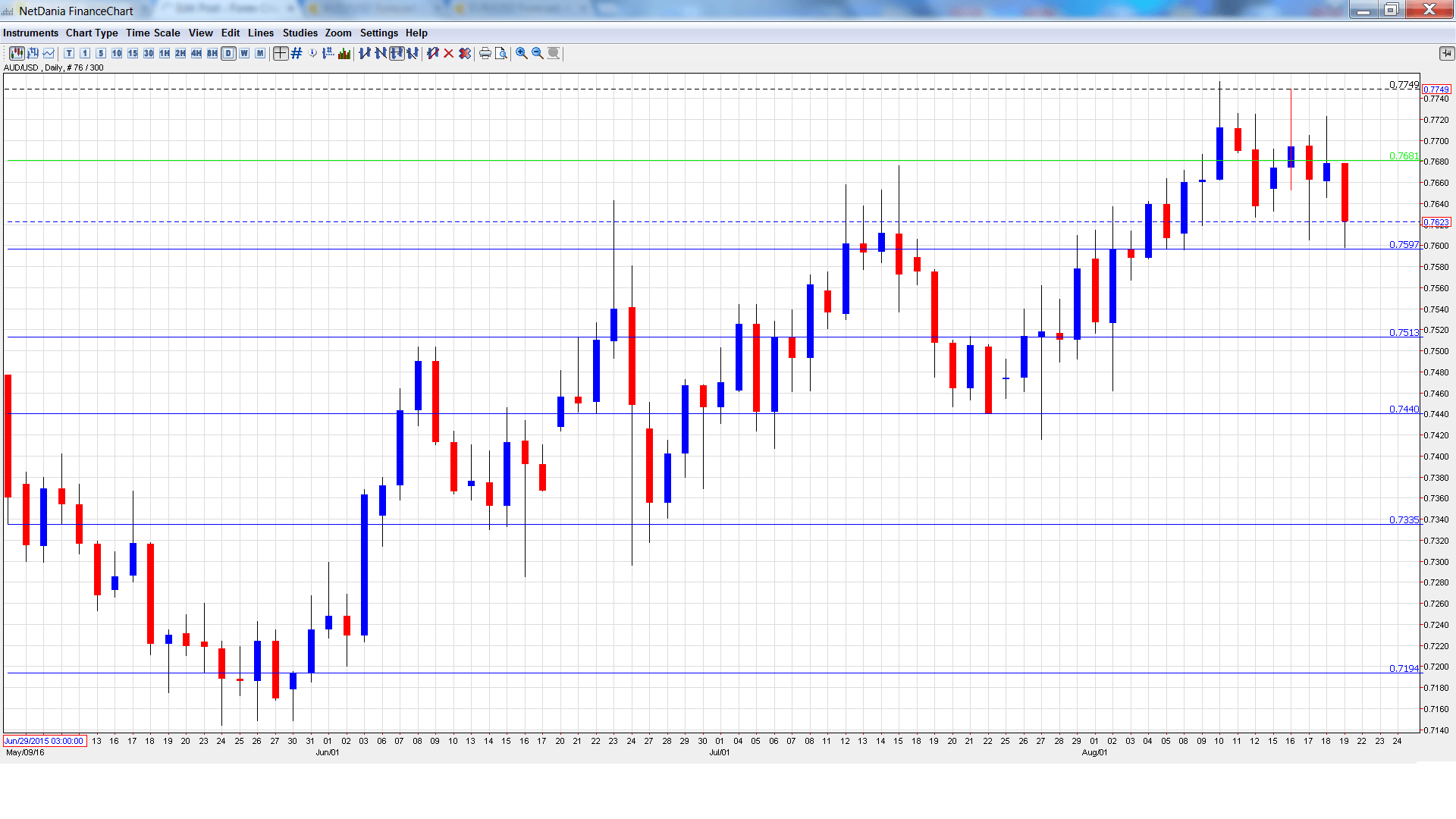

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- CB Leading Index: Monday, 14:30. This indicator is based on 7 economic indicators, but is considered a minor event since most of the data was previously released. The index posted a small gain of 0.1% in May, much weaker than the previous reading of 0.5%.

- Construction Work Done: Wednesday, 1:30. This important indicator has been struggling, posting just one in gain in the past 8 quarters. Another decline is expected in Q2, with an estimate of -1.9%.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7654 and quickly climbed to a high of 0.7749. The pair then reversed directions and dropped to a low of 0.7598 late in the week, as support held firm at 0.7797 (discussed last week). AUD/USD closed the week at 0.7623.

Live chart of AUD/USD:

Technical lines from top to bottom:

We begin with resistance at 0.8025.

0.7938 is next.

0.7835 has provided resistance since April.

0.7682 remains an immediate resistance line.

0.7597 held firm last week as AUD/USD lost ground late in the week. It is a weak support line.

0.7513 was a cap in May and June.

0.7438 is a strong support line.

0.7334 was a cap in December 2015.

0.7192 is the final support level for now.

I am neutral on AUD/USD

The Fed is unlikely to raise rates before December at the earliest, given recent weak inflation numbers. The RBA has been hinting that it could lower rates again, but last week’s strong employment numbers could give the bank some breathing room.

Our latest podcast is all about the Fed’s forecast failures.

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.