AUD/USD had another bad week, dropping 130 points. The pair closed at 0.7160, its lowest level since January. This week’s sole event is Private Sector Credit. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, GDP third quarter growth beat expectations with an excellent reading of 3.5% but durable goods orders were mixed. Consumer confidence also looked sharp, rising for a second straight month. In Australia, the mid-year fiscal and economic outlook pointed to larger deficits than presented in the budget, which could spell trouble for the economy.

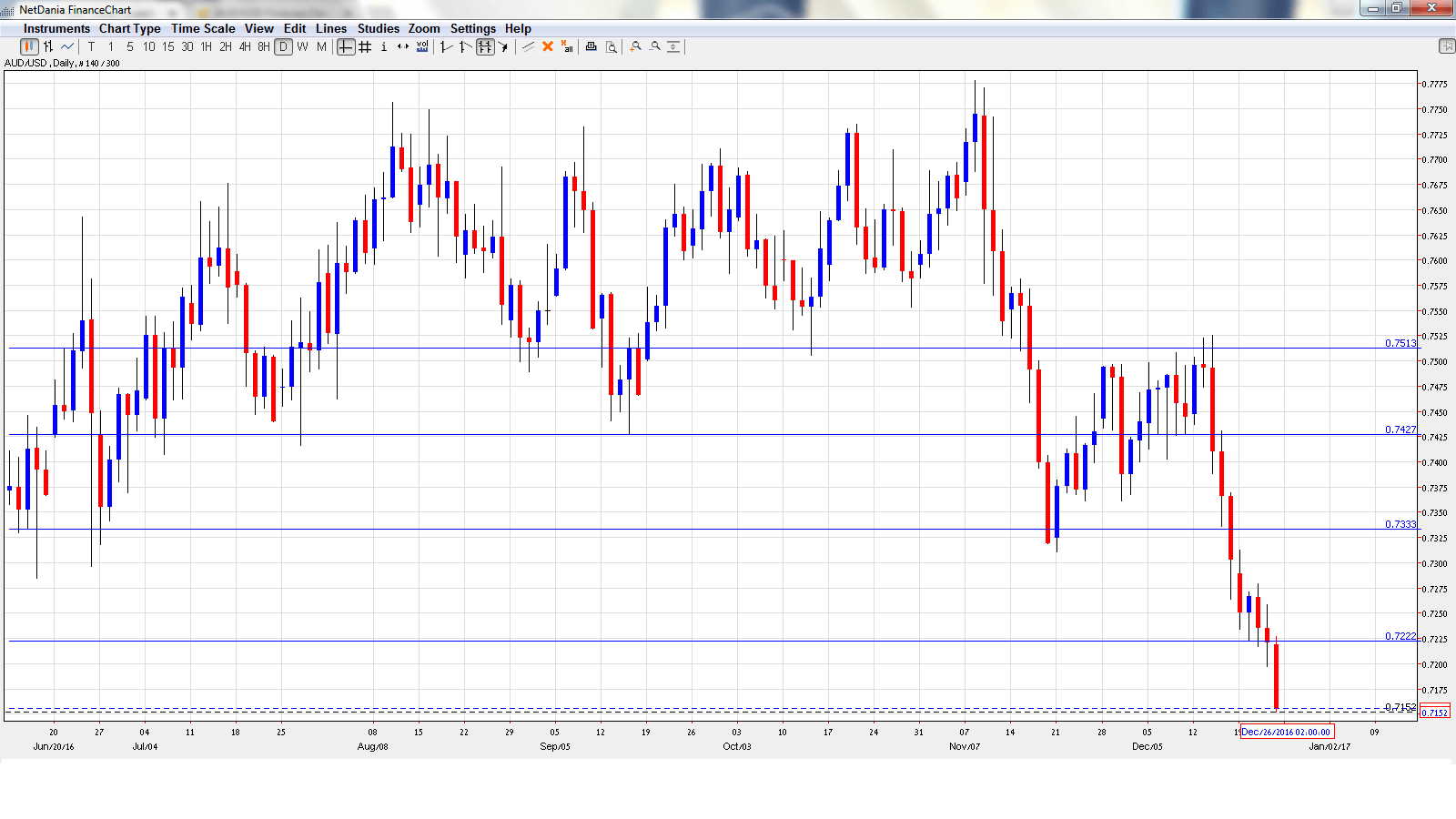

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

Private Sector Credit: Friday, 00:30. The indicator came in at 0.5% in October, edging above the estimate of 0.4%. This marked the strongest gain since April. Another gain of 0.5% is expected in the November report.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7289 and quickly climbed to a high of 0.7313. The pair then reversed directions and dropped to a low of 0.7152, as support held firm at 0.72148 (discussed last week). AUD/USD closed the week at 0.7156.

Live chart of AUD/USD:

Technical lines from top to bottom:

With AUD/USD continuing to head lower, we start at weaker levels:

0.7513 was a cushion in April 2015.

0.7427 has strengthened in resistance.

0.7333 held early in the week as the pair moved higher before retracting sharply.

0.7223 is an immediate resistance line.

0.7148 is under pressure in support. It could see action early in the week.

0.7015 is protecting the symbolic 0.70 level.

0.6918 was last tested in late January.

0.6827 is the final support line for now.

I am neutral on AUD/USD

Trading volumes are usually light the week of Christmas and there are only a handful of major events on the calendar. So, we’re unlikely to see any significant move from the pair.

Our latest podcast is titled What will move markets in 2017

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.