AUD/USD reversed directions last week and jumped over 200 points. The pair closed at 0.7817, its highest weekly close since April 2016. The major event this week is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In Australia, NAB Business Confidence improved to 9 points in June. In the US, the latest political scandal involving Donald Trump Jr. hurt the dollar, and Yellen’s concern about low inflation also weighed on the greenback.

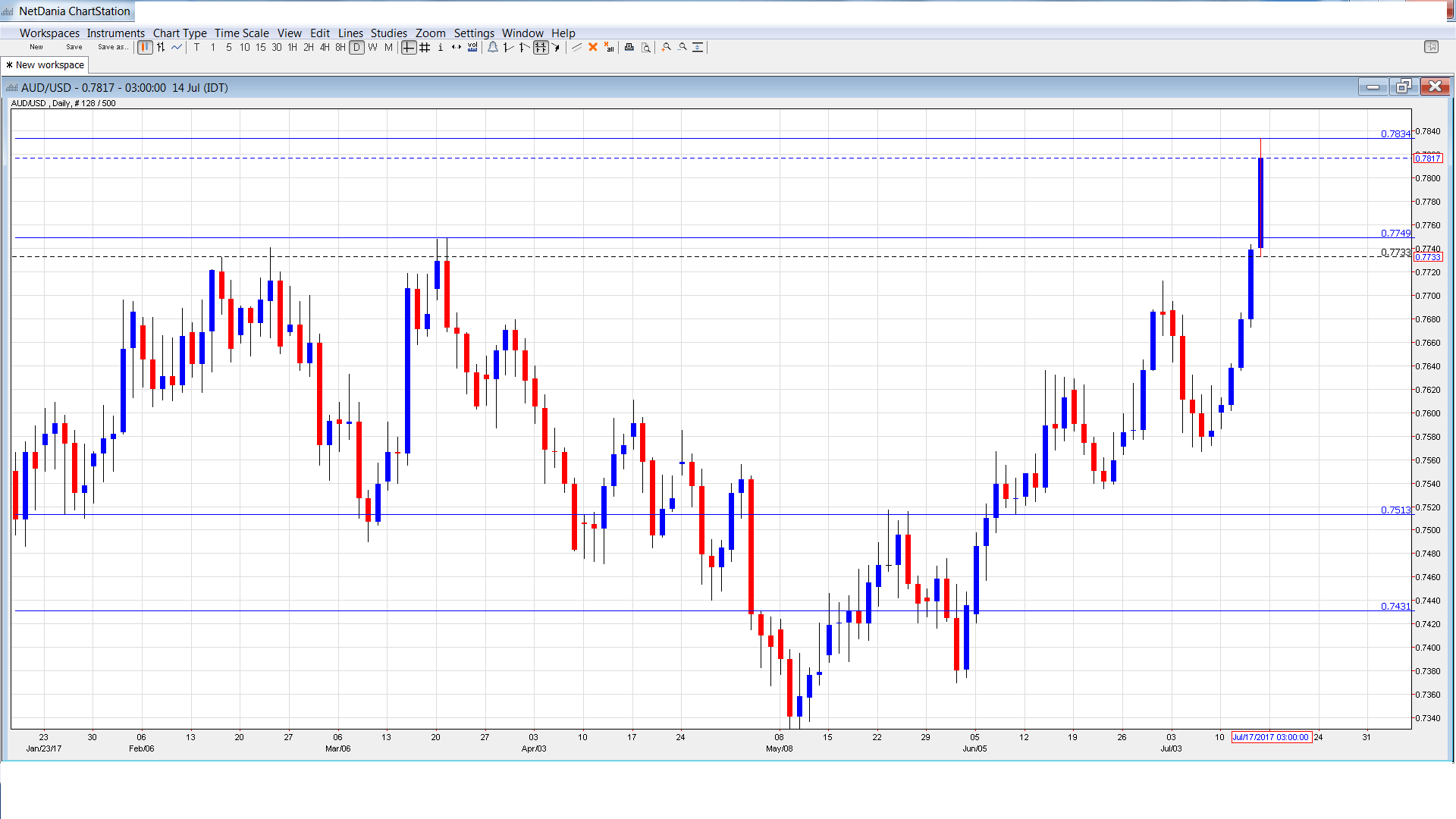

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Chinese GDP: Sunday, 22:00. Chinese key indicators can have a strong impact on the Australian dollar, as China is Australia’s number one trading partner. Chinese GDP has been moving higher and climbed to 6.9% in Q4, edging above the estimate of 6.8%. The forecast for Q1 stands at 6.8%.

- Chinese Industrial Production: Sunday, 22:00. The indicator has posted two straight readings of 6.5%, and this is the forecast for Q1.

- Monetary Policy Meeting Minutes: Monday, 21:30. The RBA maintained the benchmark rate at 1.50%, where it has been pegged since August 2016. The minutes will provide details of the views of policymakers regarding the health of the economy and could provide clues of future monetary policy.

- MI Leading Index: Tuesday, 20:30. The index remains weak, having posted just one gain in 2017. In May, the indicator posted a flat reading of 0.0%.

- CB Leading Index: Wednesday, 10:30. The indicator has posted two consecutive gains of 0.5%. Will we see another gain in the May report?

- Employment Change: Wednesday, 21:30. This is the key event of the week. The indicator continues to post strong gains, and the economy added 42.0 thousand jobs in May, crushing the estimate of 9.7 thousand. The forecast for June is 15.3 thousand.

- NAB Quarterly Business Confidence: Wednesday, 21:30. The quarterly indicator continues to show expansion, and edged up to 6 points in Q4. Will the upward trend continue in Q1?

- RBA Assistant Governor Guy Debelle Speaks: Thursday, 23:40. Debelle will speak at an event in Adelaide. The markets will be listening closely for any hints regarding future monetary policy.

- RBA Assistant Governor Michele Bullock Speaks: Friday, 00:15. Bullock will speak at an event in Melbourne. A speech that is more hawkish than expected is more bullish for the Canadian dollar.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7600 and quickly touched a high of 0.7586. It was all uphill from there, as the pair reversed directions and climbed to a high of 0.7834, as support managed to hold at 0.7835 (discussed last week). The pair closed the week at 0.7817.

Technical lines from top to bottom:

With the Australian dollar posting strong gains last week, we start at higher levels:

0.8163 has held in resistance since May 2015.

0.8031 is protecting the symbolic 0.80 level.

0.7938 is next.

0.7835 was the high point in April 2016.

0.7749 has switched to a support role following strong gains by AUD/USD last week.

0.7611 is the next support level.

0.7513 has provided support since early June.

0.7429 is the final support level for now.

I am bullish on AUD/USD

The Fed is on record that it will raise interest rates a third time in 2017, but the markets are skeptical, as the odds of a December rate is below 50%. US economic numbers have mixed in Q2, which could weigh on the US dollar.

Our latest podcast is titledYellen is not loving it, markets do

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.