AUD/USD had an uneventful week and posted modest gains. This week’s highlights are Retail Sales and the Cash Rate. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

There were no major Australian releases last week. The Aussie steadied last week, as global markets digested the stunning Brexit vote. In the US, GDP posted came in at 1.1%, beating the estimate of 1.0%. The week wrapped up on a positive week, as ISM Manufacturing PMI beat expectations.

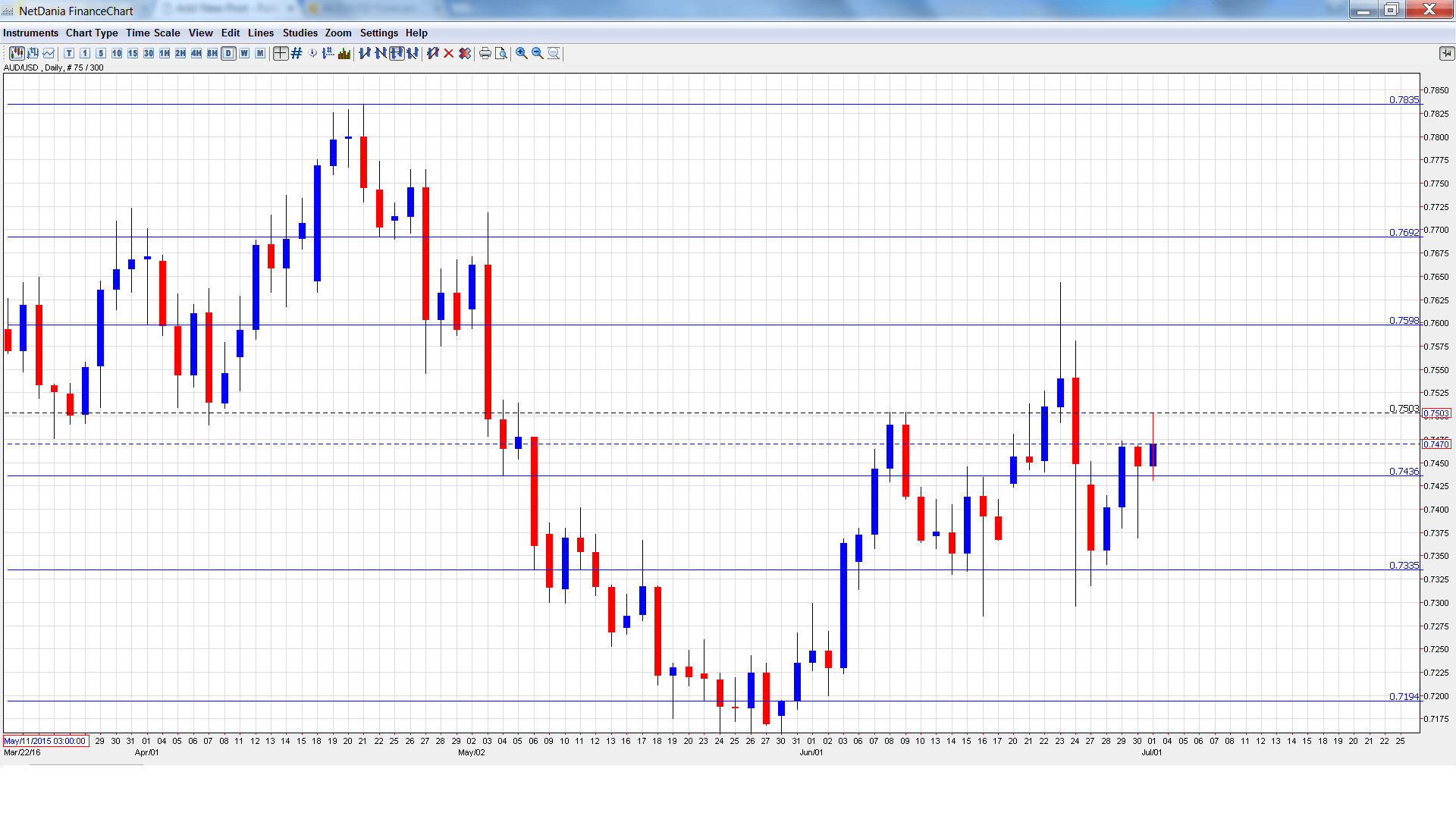

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- MI Inflation Gauge: Monday, 1:00. This monthly indicator helps analysts track CPI, which is released every quarter. In June, the indicator posted a decline of 0.2%, marking a 3-month low.

- Building Approvals: Monday, 1:30. This key indicator has posted three straight gains, beating the estimate each time. The markets are expecting a strong turnaround in the May release, with an estimate of -3.6%.

- AIG Services Index: Monday, 23:30. The index improved to 51.5 points in June, pointing to slight expansion in the services sector. This was only the second reading pointing to expansion since October 2015.

- Retail Sales: Tuesday, 1:30. Retail Sales is the primary gauge of consumer spending and can have a strong effect on the movement of AUD/USD. The April reading posted a gain of 0.2%, shy of the forecast of 0.3%. The estimate for the May release stands at 0.3%.

- Trade Balance: Tuesday, 1:30. Australia’s trade deficit narrowed to A$1.58 billion, lower than the estimate of A$2.11 billion. The deficit is expected to rise to A$1.72 billion in the May report.

- Cash Rate: Tuesday, 4:30. The RBA is not expected to change the benchmark rate, with the national election last week. Currently the rate stands at 1.75%. The RBA will publish its decision with a rate statement.

- RBA Assistant Governor Guy Debelle Speaks: Wednesday, 7:30. Debelle will deliver remarks at an event in Sydney. The markets will be looking for clues regarding the RBA’s future monetary policy.

- AIG Construction Index: Wednesday, 23:30. The index continues to register readings below the 50-point level, pointing to contraction in the construction sector. The index dipped to 46.7 points in the May release.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7426 and touched a low of 0.7318, testing support at 0.7334 (discussed last week). The pair then changed directions and climbed to a high of 0.7503 and closed the week at 0.7470.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

0.7835 has provided resistance since April.

0.7692 is protecting the 0.77 line.

0.7597 is the next line of resistance.

0.7438 has switched to support role following gains by AUD/USD.

0.7334 was a cap in December 2015. This line was tested in support last week.

0.7192 is providing strong support.

0.7105 has been a cushion since the end of February. It is the final support level for now.

I am bearish on AUD/USD

In the US, monetary policy is not expected to be hawkish and a rate hike appears doubtful. The markets will have to deal with the new Brexit reality, and continuing instability in the markets could weigh on the Aussie.

Our latest podcast is titled Brexit Boiling Point

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.