AUD/USD showed strong volatility late last week, but ended the week almost unchanged, at 0.7448. There are six events this week. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In a vote that has sent shock waves in the UK and across Europe, Brits decided to leave the EU in a decisive 52% to 48% vote. After the vote, the pound plummeted while the Aussie showed strong volatility but ended the week almost unchanged. The Brexit has implications not only on the economies of Europe, but across the globe. In the US, Yellen sounded quite dovish and a rate hike is unlikely before September at the earliest.

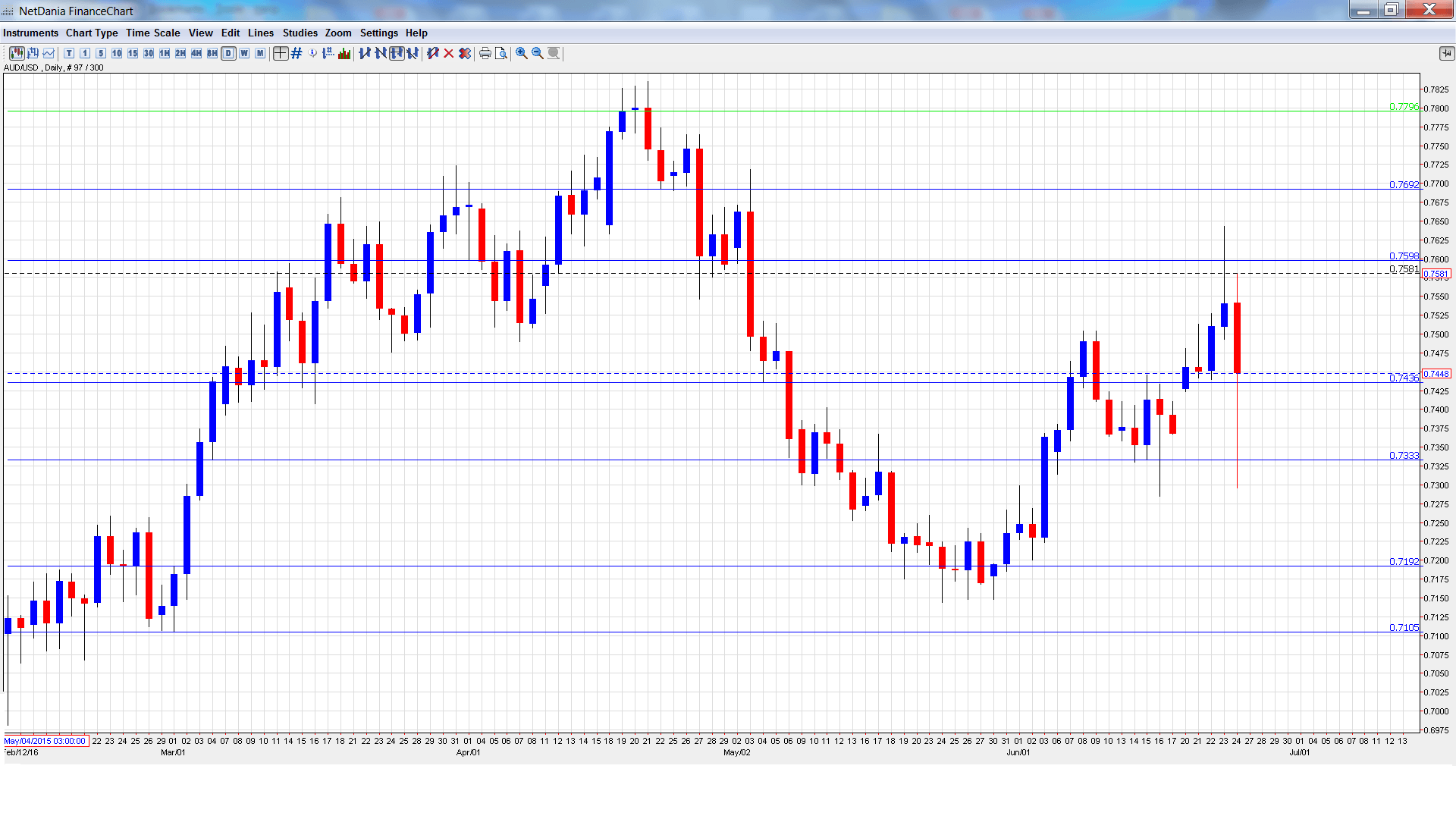

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- HIA New Home Sales: Wednesday, 1:00. The indicator provides a snapshot of the level of activity in the housing sector. In April, the indicator reversed directions and declined 4.7%. Will we see a gain in the May report?

- Private Sector Credit: Thursday, 1:30. Higher borrowing levels often translate into increased spending by consumers and businesses. The indicator posted a gain of 0.5% in the previous reading, matching the forecast. Another gain of 0.5% is expected in the upcoming release.

- AIG Manufacturing Index: Thursday, 23:30. The index has been losing ground in recent releases, although it is still pointing to expansion in the manufacturing sector. The indicator came in at 51.0 points in April.

- Chinese Manufacturing PMI: Friday, 1:00. The Chinese manufacturing sector has been stagnant, posting two straight readings of 50.1. More of the same is expected in the May report.

- Chinese Caixin Manufacturing PMI: Friday, 1:45. This PMI has been pointing to contraction in the manufacturing sector in 2016, with readings below the 50-point level. The index came in at 49.2 points in April, and the forecast for the May release stands at 49.1 points.

- Commodity Prices: Friday, 6:30. The indicator continues to post sharp declines, as global demand for Australian exports remains weak. The April release came in at -10.0%.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7427 and touched a high of 0.7643 late in the week, as resistance held firm at 0.7692 (discussed last week). The pair then changed directions and dropped to a low of 0.7296, before recovering and closing the week at 0.7448.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

0.7798 was an important resistance line for much of June 2015.

0.7692 is protecting the 0.77 line.

0.7597 is the next line of resistance.

0.7438 was tested in support as AUD/USD dropped sharply before recovering.

0.7334 was a cap in December 2015.

0.7192 is providing strong support.

0.7105 has been a cushion since the end of February. It is the final support level for now.

I am bearish on AUD/USD

The stunning vote in the UK has caused plenty of turmoil in the markets, and the aftershocks could lessen the appetite for risk and hurt risky commodities like the Aussie.

Our latest podcast is titled Brexit Boiling Point

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.