AUD/USD posted strong gains for a second straight week, gaining 150 points. The pair closed at 0.7555. This week’s highlights are RBA minutes and Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The shining Aussie shrugged off soft employment and consumer confidence numbers. In the US, Unemployment Claims looked sharp, dropping to 259 thousand.

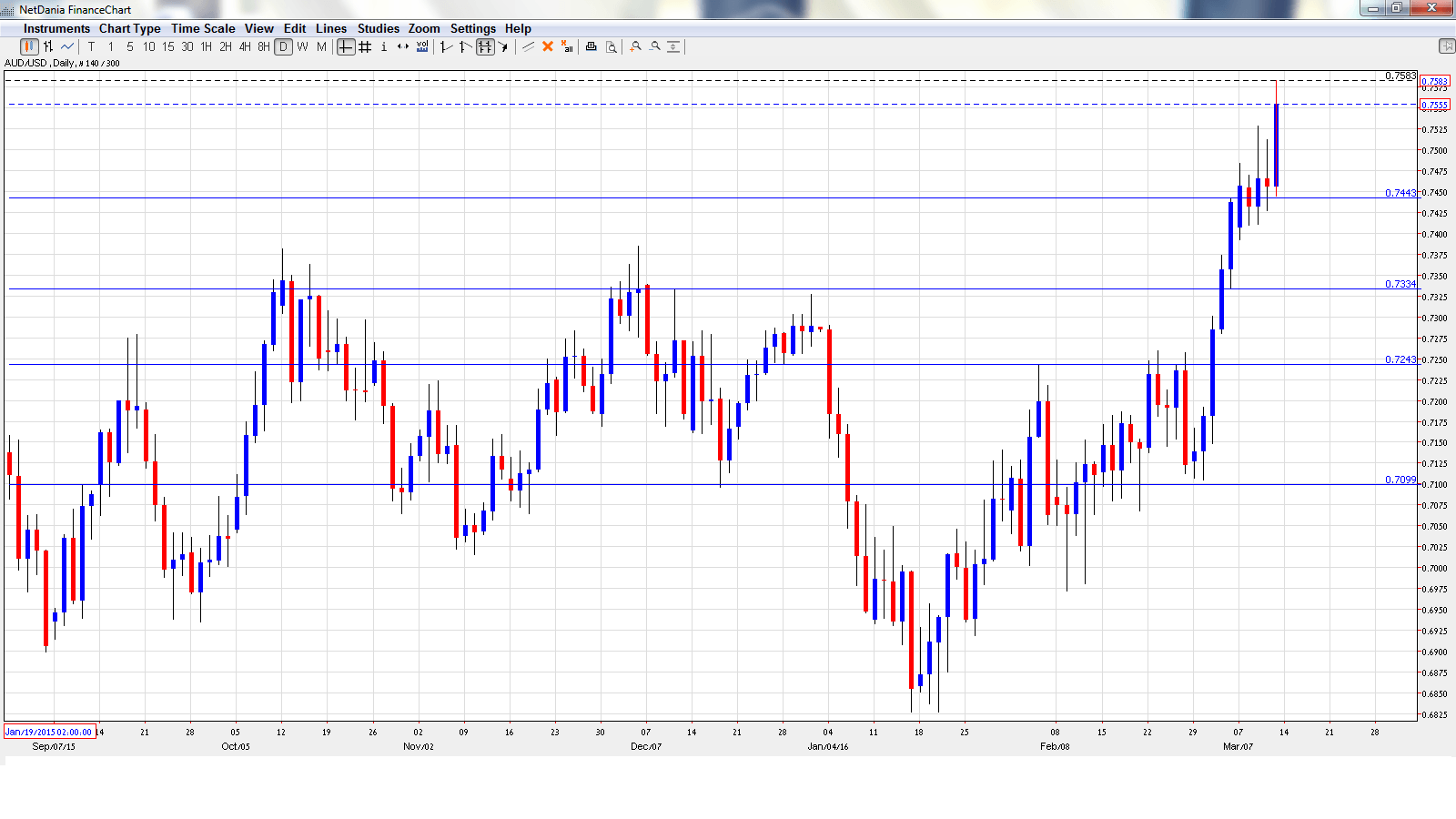

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- RBA Monetary Policy Meeting Minutes: Tuesday, 00:30. The RBA will release the minutes of its policy meeting from early March. At the meeting the RBA kept the benchmark rate at 2.00%, but said it was maintaining its easing bias.

- MI Leading Index: Tuesday, 23:30. This indicator is based on 9 economic indicators. The index improved to 0.0% in January after posting two declines.

- RBA Assistant Governor Guy Debelle Speaks: Wednesday, 22:05. Debelle will speak at a conference in Sydney. The markets will be looking for hints regarding the RBA’s future monetary policy.

- Employment Change: Thursday, 00:30. Employment Change is a key event and should be treated as a market-mover. The indicator has struggled of late, posting two straight declines. The markets are expecting better news in the February report, with an estimate of 12.3 thousand. The unemployment rate rose to 6.0% in January, above the estimate of 5.8%. No change is expected in February.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD started the week at 0.7406 and quickly dropped to a low of 0.7392. AUD/USD posted sharp gains late in the week and climbed to a high of 0.7583, as resistance held at 0.7597 (discussed last week). The pair closed the week at 0.7555.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 0.8025, which is protecting the symbolic 0.80 level.

0.7886 was last breached in late May.

0.7798 was an important resistance level for much of June.

0.7692 is next.

0.7597 held firm as AUD/USD posted strong gains, but is currently a weak line.

0.7438 has strengthened in support.

0.7334 was a cap in mid-December.

0.7243 is next.

The round number of 0.71 is the final support level for now.

I am bearish on AUD/USD

The Aussie continues to push higher and has racked up 400 points in March. Will we see some profit taking this week? The RBA minutes will likely show a bias towards easing, although for now the RBA sees enough domestic growth to avoid any moves. In the US, a March hike is unlikely, but the bias remains towards tightening. This monetary divergence favors the US dollar.

Our latest podcast is titled Digesting Draghi & Fired for the Fed

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast