AUD/USD had an outstanding week, gaining 300 points. The pair closed at 0.7437. The upcoming week has 10 events on the schedule. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Australian dollar was boosted by GDP and retail sales, both of which improved over the previous readings. In the US, the worrying services sector report weighed on the greenback and an excellent Non-Farm Payrolls report failed to stem the Aussie’s rally. Wage growth in the US fell by 0.1%, well below predictions.

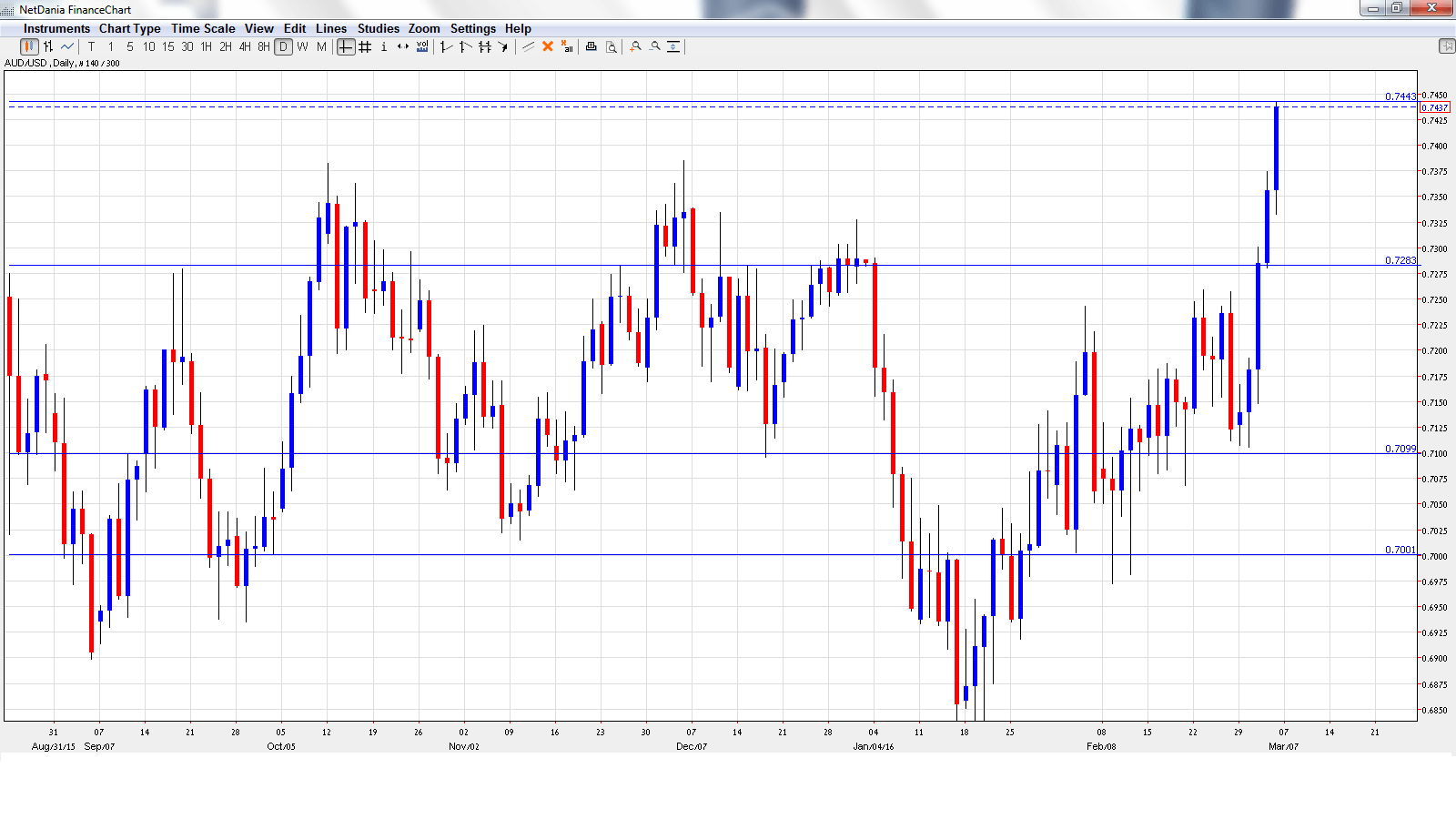

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- AIG Construction Index: Sunday, 22:30. The index has slipped below the 50-point index, pointing to contraction. The January release dipped to 46.3 points. Will we see a reversal in February?

- ANZ Job Advertisements: Monday, 00:30. The indicator provides a snapshot of the strength of the employment market. In January, the indicator rebounded with a strong gain of 1.0%.

- RBA Deputy Governor Philip Lowe Speaks: Monday, 23:20. Lowe will speak at an event in Adelaide. The markets will be looking for hints regarding the RBA’s future monetary policy.

- NAB Business Confidence: Tuesday, 00:30. This is the first key event this week. The indicator has been losing ground and fell to 2 points in January.

- Chinese Trade Balance: Tuesday, Tentative. The Australian dollar is sensitive to key Chinese data, as the Asian giant is Australia’s number one trading partner. The indicator surged to $406 billion in January, well above the forecast of $389 billion. However, the markets are expecting a reversal in the February report, with the estimate standing at $329 billion.

- Westpac Consumer Sentiment: Tuesday, 23:30. Analysts carefully monitor this event, as stronger consumer sentiment usually translates into consumer spending, a critical engine of economic growth.

- Home Loans: Wednesday, 00:30. Home Loans posted an excellent gain of 2.6% in December, but this was shy of the forecast of 2.9%. The markets are braced for a sharp turnaround, with an estimate of -2.7%.

- MI Inflation Expectations: Thursday, 00:00. Expectations of inflation often translate into actual inflation figures. The indicator has been very steady, posting two straight gains of 3.6%.

- Chinese CPI: Tuesday, 1:30. CPI has been steadily moving higher in recent weeks, and improved to 1.8% in January, within expectations. No change is expected in the February report.

- Chinese Industrial Production: Saturday, 5:30. Softer Chinese demand has caused ripples across the globe, and a further decline could be bad news for the Aussie. The indicator dropped to 5.9% in January, compared to 6.2% a month earlier. The estimate stood at 6.0%. Will the indicator improve in February?

* All times are GMT

AUD/USD Technical Analysis

It was all uphill for AUD/USD last week. The pair opened the week at 0.7127 and touched a low of 0.7105 before surging higher. AUD/USD climbed to a high of 0.7443, breaking above resistance at 0.7440 (discussed last week. AUD/USD closed the week at 0.7447.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

With AUD/USD posting sharp gains last week, we begin at higher levels:

0.7886 was last breached in late May.

0.7798 was an important resistance level for much of June.

0.7692 is next.

0.7597 is protecting the 0.76 line.

0.7438 has switched to support following sharp gains by the Aussie. It is a weak line and could see further action early in the week.

0.7284 is providing support.

0.7100 has strengthened in support.

The round number of 0.70 worked as a cushion in August. It is the final support line for now.

I am bearish on AUD/USD

It was an off-week for the US dollar, and we could see some profit taking which would lead to a downward correction this week. In the US, a March hike is unlikely, even with a strong NFP report, but the bias remains towards tightening. This monetary divergence favors the US dollar.

Our latest podcast is titled Drum roll for Draghi

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast