AUD/USD posted slight gains last week, closing at 0.7455. There are five events this week. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The US dollar was broadly lower as the Trump administration was racked by more scandals. Trump has been accused of interfering in an investigation by FBI director James Comey, raising suspicion of obstruction of justice by Trump. The US dollar fell on market concerns that growth-friendly policies such as tax reform and increased fiscal spending could be stalled. As well, US construction numbers were soft. In Australia, employment data sparkled, as employment change jumped and the unemployment rate dipped.

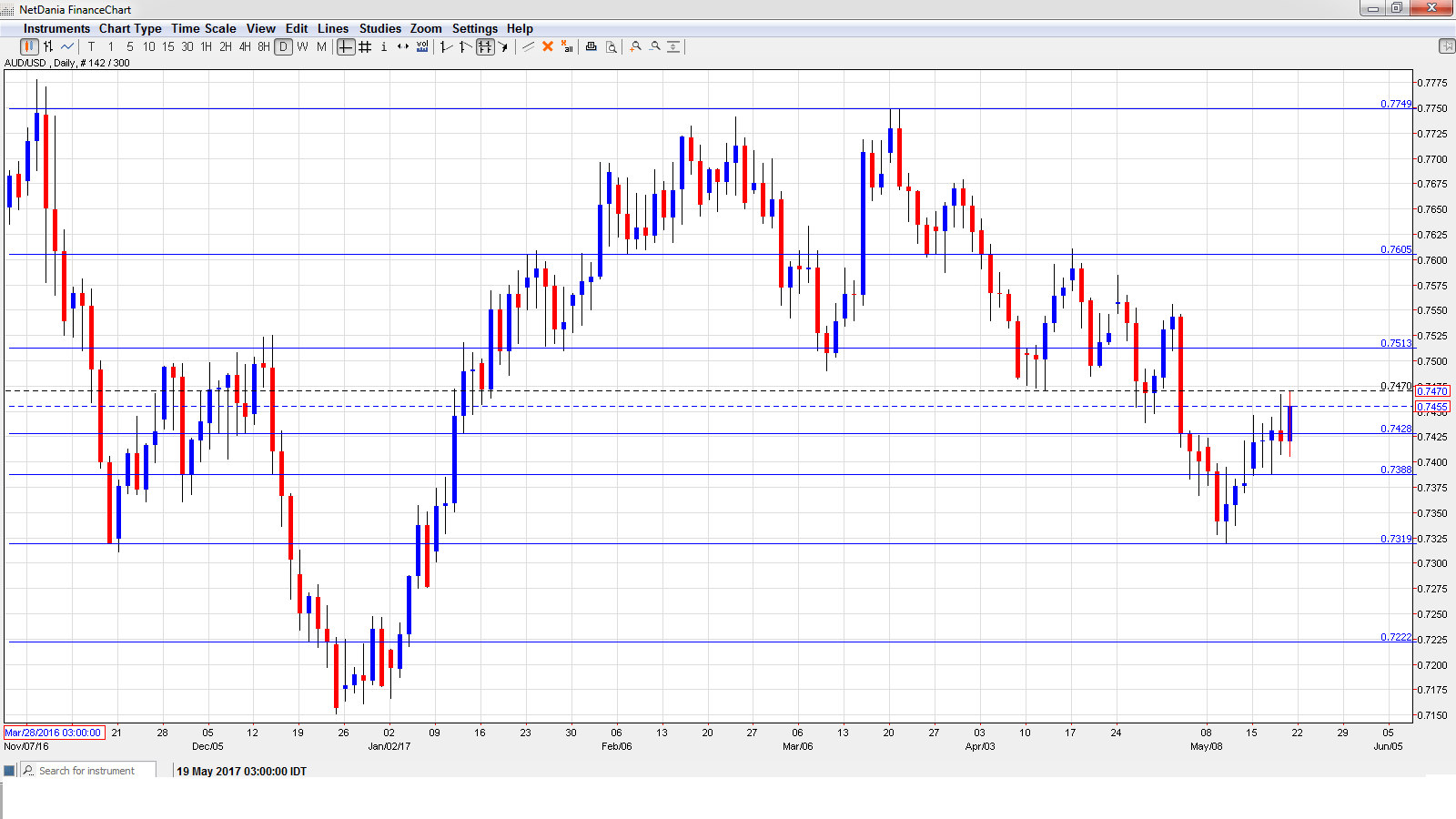

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- CB Leading Index: Monday, 14:30. This minor indicator is based on 7 economic indicators. The index has been steady, with two straight gains of 0.4%.

- RBA Assistant Guy Debelle Speaks: Monday, 17:30. Debelle will deliver remarks at an event in Basel. The markets will be listening closely for any clues regarding future monetary policy.

- MI Leading Index: Wednesday, 00:30. This minor index has been subdued in recent months, with a small gain of 0.1% in March. Will we see another gain in the April release?

- Construction Work Done: Wednesday, 1:30. The indicator continues to post declines, pointing to contraction in the construction sector. However, the decline in Q4 was just 0.2%, much better than the Q3 reading of -4.9%.

- RBA Assistant Governor Guy Debelle Speaks: Thursday, 8:00. Debelle will speak at an event in London. A speech which is more hawkish than expected is bullish for the Australian dollar.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7393 and quickly climbed to a low of 0.7455. The pair then reversed directions and climbed to a high of 0.7470, breaking above resistance at 0.7429 (discussed last week). The pair closed the week at 0.7455.

Technical lines from top to bottom

0.7835 was the high point in April 2016.

0.7749 was a cap in March.

0.7605 is next.

0.7513 has held in resistance since early May.

0.7429 has switched to a support role following gains by AUD/USD last week. It is a weak line.

0.7319 is the low point in May.

0.7223 is the next support line.

0.7105 has held since March 2016.

0.6998 is the final support level for now.

I am neutral on AUD/USD

The political turmoil in Washington has soured investors on the dollar, but minor currencies like the Aussie are unlikely to gain ground as investors have less appetite for risk.

Our latest podcast is titled Brexit bites the BOE, volatility evaporates

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.