AUD/USD posted small losses last week, closing just below the 0.74 line. This week’s key events are the RBA’s policy minutes and Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, President Trump’s firing of FBI Director James Comey set off a political firestorm. The controversial move has markets worried that the Administration may have to delay plans for fiscal spending and tax reform. The US dollar lost ground on the news but recovered quickly. On the fundamental side, US CPI and retail sales disappointed and missed the forecasts. In Australia, building approvals and retail sales disappointed with declines and missed their estimates.

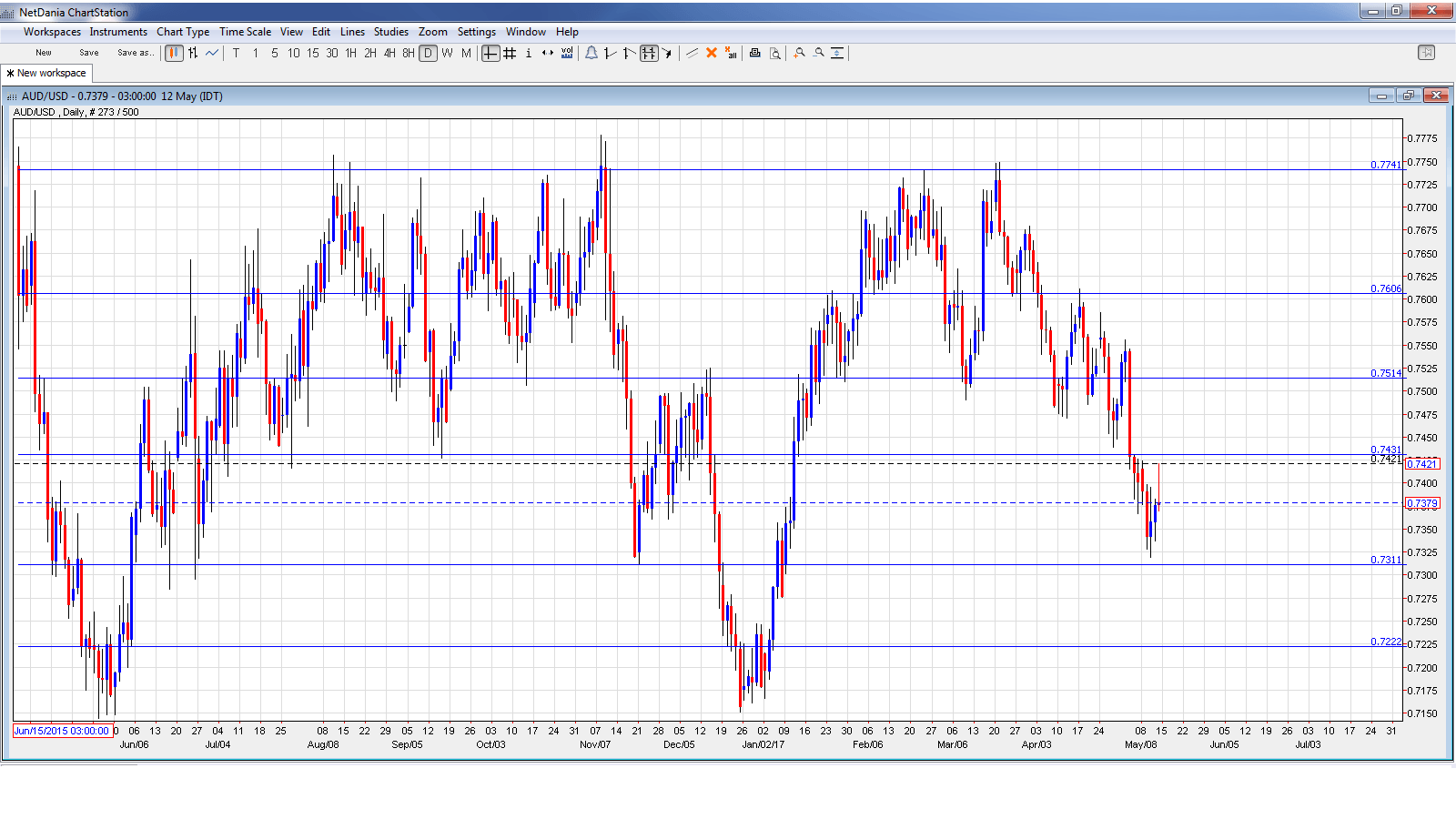

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Home Loans: Monday, 1:30. This indicator provides a snapshot of the level of activity in the housing sector. In February, the indicator declined 0.5%, short of the estimate of +0.1%. The forecast for March remains unchanged at +0.1%.

- Chinese Industrial Production: Monday, 2:00. Chinese key releases can have a significant impact on the Australian dollar, as China is Australia’s number one trading partner. The indicator jumped 7.6% in March, its sharpest gain since December 2014. The estimate for the April release stands at 7.0%.

- RBA Monetary Policy Meeting Minutes: Tuesday, 1:30. The minutes will provide details of the May policy meeting, at which time the RBA held rates at 1.50%. Analysts will be looking for clues as to the central bank’s future monetary stance.

- New Motor Vehicle Sales: Tuesday, 1:30. This important consumer spending indicator rebounded in March with a strong gain of 1.9%, after a decline of 2.7% a month earlier.

- Westpac Consumer Sentiment: Wednesday, 00:30. Consumer confidence often translates into consumer spending, a key driver of economic growth. In April, the indicator declined 0.7%, a disappointing reading after three straight gains. Will we see a gain in the May report?

- Wage Price Index: Wednesday, 1:30. Wage growth is released on a quarterly basis, magnifying the impact of each release. In Q4 of 2016, the indicator posted a gain of 0.5%, matching the forecast. The estimate for Q1 remains at 0.5%.

- MI Inflation Expectations: Thursday, 1:00. This indicator is carefully monitored by analysts, as inflation expectations can translate into actual inflation figures.

- Employment Change: Thursday, 1:30. Employment change is one of the most important indicators and should be treated as a market-mover. In March, the indicator soared to 60.9 thousand, crushing the estimate of 20.3 thousand. A modest gain of 5.2 thousand is expected in the April release. The unemployment rate is expected to remain at 5.9%.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7410 and quickly climbed to a high of 0.7424 early in the week. The pair then reversed directions and dropped to a low of 0.7329, testing support held at 0.7311 (discussed last week). The pair closed the week at 0.7385.

Technical lines from top to bottom

0.7835 was the high point in April 2016.

0.7741 was a cap in February.

0.7605 is next.

0.7513 has held in resistance since early May.

0.7429 is a weak resistance line.

0.7311 is an immediate support line.

0.7223 is the next support line.

0.7105 has held since March 2016.

0.6998 is the final support level for now.

I am neutral on AUD/USD

US numbers have softened, as underscored by March’s disappointing CPI and retail sales reports. Still, the Fed is expected to raise rates two more times in 2017, although there is some doubt about a June hike.

Our latest podcast is titled Brexit bites the BOE, volatility evaporates

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.