AUD/USD posted losses for a third straight week, closing just above the 0.75 line. This week’s key event is the Retail Sales. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, the Fed left rates unchanged and sounded optimistic about the economy, helping boost the greenback against the Aussie. In Australia, the RBA quarterly statement said that wage growth is expected to remain low.

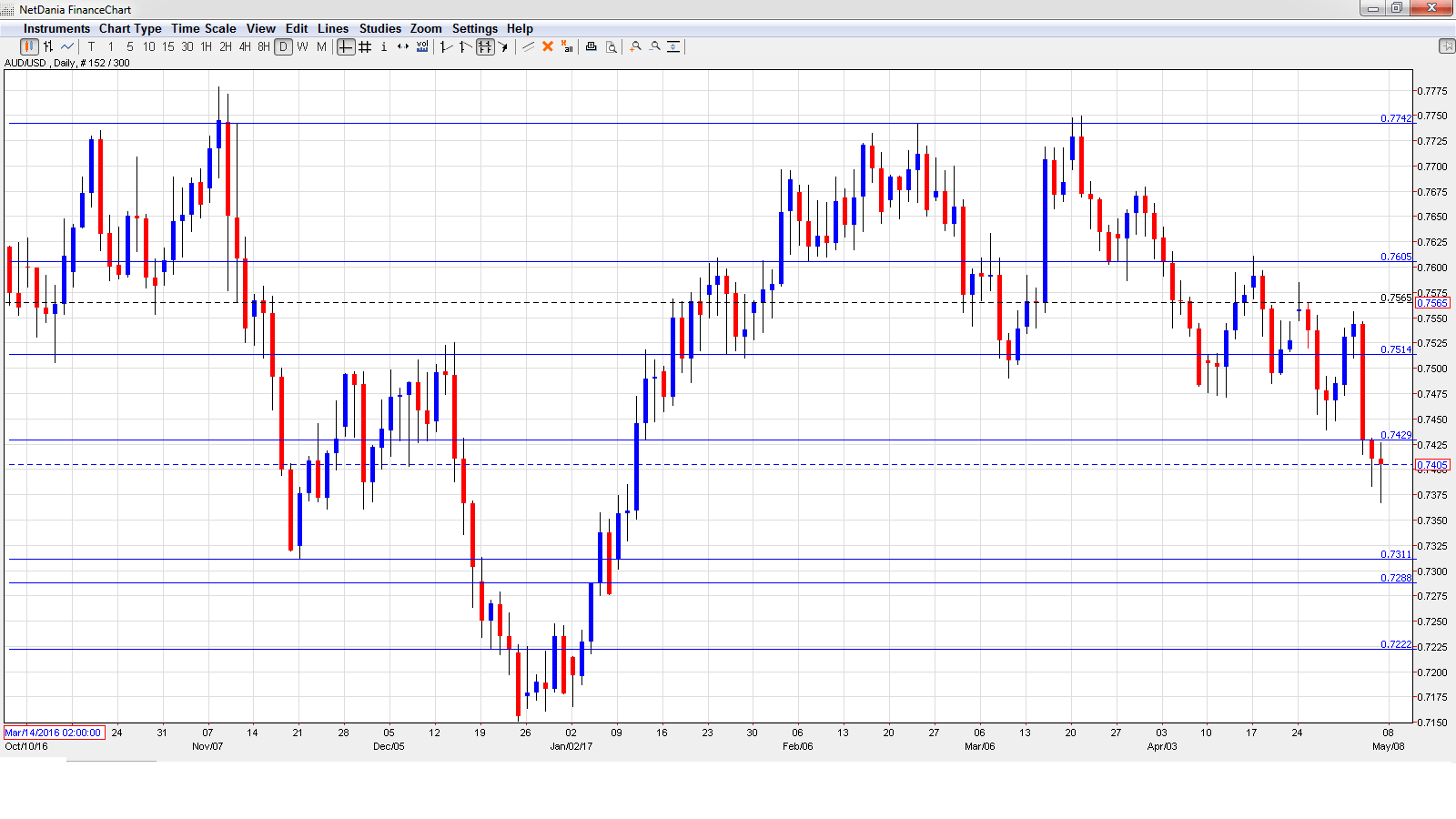

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Building Approvals: Monday, 1:30. This indicator tend to show strong fluctuation from month to month. In February, the indicator jumped 8.3%, compared to a forecast of -1.4%. For March, the markets are braced for a decline 3.9%

- NAB Business Confidence: Monday, 1:30. This indicator has been softening, as the March reading of +6 marked the weakest gain in 3 months. Will we see a rebound in the April report?

- Chinese Trade Balance: Monday, Tentative. China’s trade balance bounced back in March with a surplus of $164 billion, well above the forecast of $76 billion. The upward trend is expected to continue in April, with an estimate of $197 billion.

- Retail Sales: Tuesday, 1:30. The indicator declined 0.1% in February, short of the forecast of 0.3%. The markets are expecting better news in March, with an estimate of 0.3%.

- Annual Budget Release: Tuesday, 9:30. The budget outlines the government’s forecast for spending and revenue, and should be treated as a market-mover.

- MI Inflation Expectations: Thursday, 1:00. This indicator is useful for predicting actual inflation numbers. In March, the indicator edged up to 4.1%.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7483 and climbed to a high of 0.7556 early in the week. The pair then reversed directions and dropped to a low of 0.7367, as support held at 0.7311 (discussed last week). The pair closed the week at 0.7408.

0.7835 was the high point in April 2016.

0.7741 was a cap in February.

0.7605 has strengthened in resistance as AUD/USD lost ground last week.

0.7513 is the next resistance line.

0.7429 is has switched to a resistance role. It is a weak line.

0.7311 marked a low point in November.

0.7223 is the next support line.

0.7105 has held since March 2016. It is the final support level for now.

I am bearish on AUD/USD

The Fed statement was more hawkish than expected, increasing the likelihood of a June rate hike. The US economy hit some turbulence in Q1, but the economy remains strong, as does sentiment in favor of the US dollar.

Our latest podcast is titled US economic unease and slippery oil

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.