The Australian dollar was on the back foot, partly due to the “risk off” sentiment. Is the battle for 0.80 over? The rate decision is the big event for the week, but certainly not the only one. Here are the highlights of the week and an updated technical analysis for AUD/USD.

North Korea’s statement that the “US has declared war” weighed on sentiment and sent risk currencies such as the Aussie lower. The RBA is not that keen on raising rates. Later on, the US dollar surged on optimism, mostly stemming from hopes for a massive tax reform in the US.

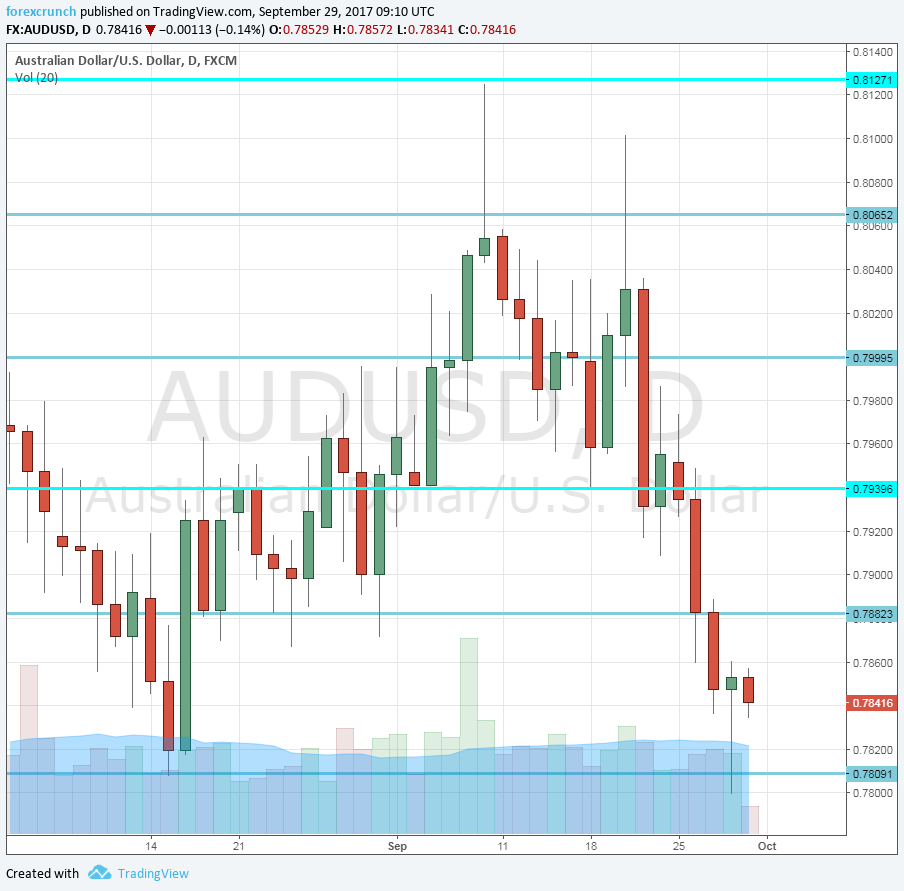

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- AIG Manufacturing Index: Sunday, 22:30. The Australian Industry Group has shown very robust growth in the manufacturing sector: a score of 59.8 points in August, well above the 50-point threshold that separates contraction and expansion.

- MI Inflation Gauge: Monday, 00:00. The Melbourne Institute’s inflation gauge fills a gap: Australia publishes its inflation figures only once per quarter. Prices rose by 0.1% in August, the same as in July and in June. A similar figure is likely.

- HIA New Home Sales: Tuesday, 00:00. The Housing Industry Association has reported two months of drops in sales of new homes. After a slide of 3.7% in July, we could see a bounce in the report for August.

- Building Approvals: Tuesday, 00:30. Permits for building new homes dropped by 1.7% in July, but that came after a surge of 11.7% in June. Volatility is expected to continue in August.

- Rate decision: Tuesday, 3:30. The Reserve Bank of Australia is firmly in “neutral”. In a recent public appearance by RBA Governor Phillip Lowe, he reiterated that interest rates are set to remain stable for the time being. The language about the Australian dollar will be interesting to watch in the statement. The RBA has complained about the exchange rate but not in an aggressive manner. Will it change now?

- Commodity Prices: Tuesday, 5:30. Prices of commodities have risen by a whopping 20.1% y/y in August and this is positive for the Australian economy. Another yearly rise is on the cards now. Goldman Sachs recently said that iron prices are set to continue rising.

- AIG Services Index: Tuesday, 22:30. The services sector is not doing as well as the manufacturing one, with the PMI slipping to 53 points in August.

- Retail Sales: Thursday, 00:30. The volume of sales disappointed in July by remaining flat. Consumers did not spend as expected. Will it rise now?

- Trade Balance: Thursday, 00:30. Australia had a trade surplus in June, but it came out below expectations for the second month in a row. After 0.46 billion in June, we could see a wider surplus now for July.

- AIG Construction Index: Thursday, 22:30. The last PMI-like figure from AIG has fallen quite a bit in August: from 60.5 to 55.3. However, this is still a positive number.

AUD/USD Technical Analysis

The Australian was struggling early in the week, unable to hold onto support at 0.7920 (mentioned last week).

Technical lines from top to bottom:

0.83 was a swing high seen in early 2015 and is our top line. 0.8165 was another swing high, back in May 2015. The new high of 2017 at 0.8125 is becoming interesting as well.

0.8065 is the previous 2017 high. It is followed by the psychological round level of 0.80.

0.7920 was the low point the pair reached after the pair moved to the highs. The round number of 0.7810 provided support in August and replaces the veteran 0.7835 level.

Below, we find 0.7740, that was a high point in June 2017 and also beforehand. 0.7635 was a stepping-stone on the way up, also in June.

Even lower, we find 0.7565 was a low point before the pair shot higher in July. The last line, for now, is 0.7515.

I am bearish on AUD/USD

The RBA could take advantage of the recent weakness in the exchange rate and hit the Aussie when it is down.

Our latest podcast is titled Euro troubles and golden opportunities

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!