In the US, consumer confidence reports were better than expected, but durable goods orders were quite mixed. There were no major Australian releases last week, which was an important factor in the Aussie showing modest movement last week.

AUD/USD posted slight gains last week, as the pair closed the week at 0.7650. This week’s highlights are the Cash Rate and Retail Sales. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

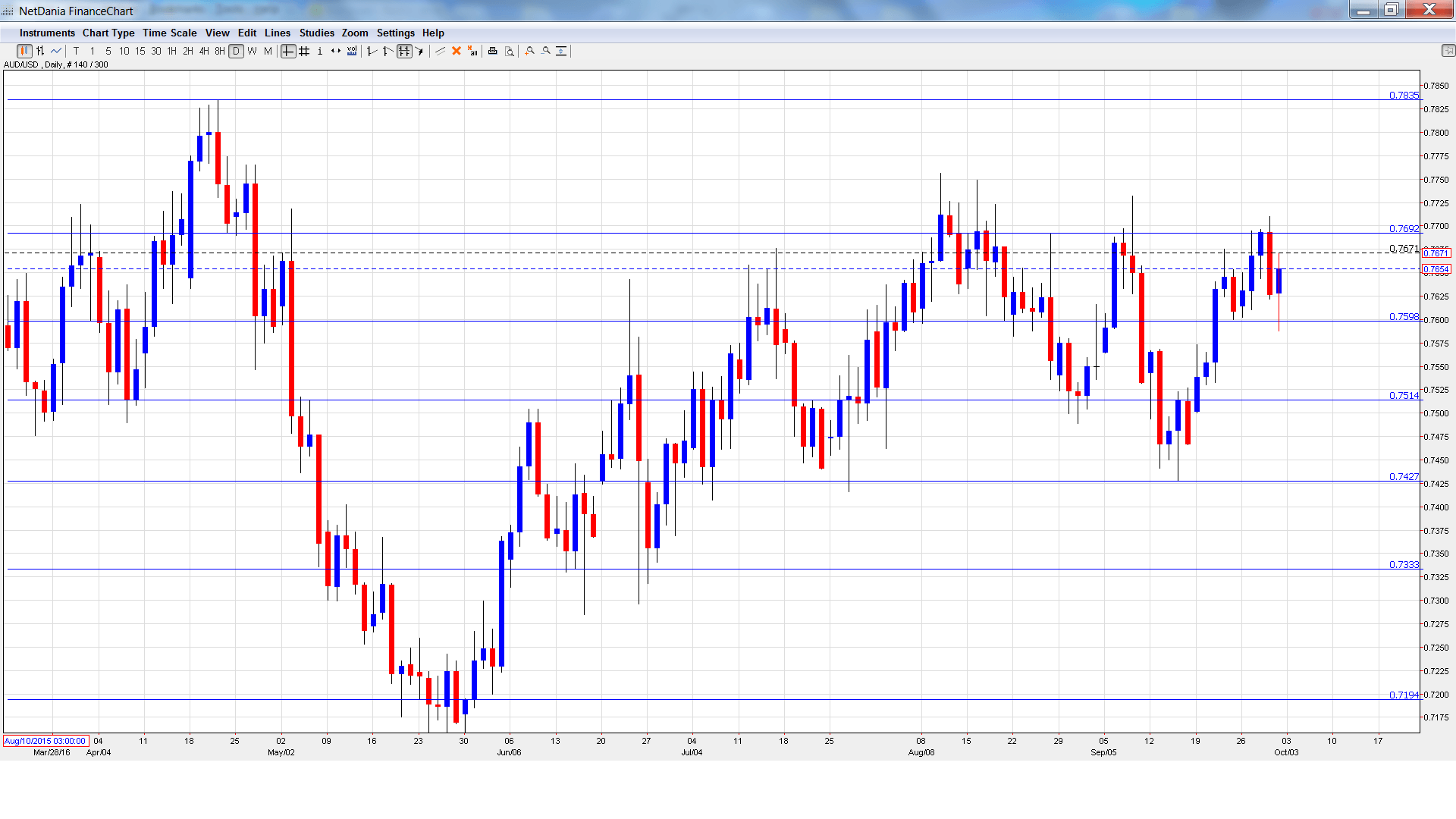

AUD/USD graph with support and resistance lines on it. Click to enlarge:

- AIG Manufacturing Index: Sunday, 22:30. The indicator has pointed to expansion throughout 2016, with readings above the 50-level, which separates contraction from expansion. However, in August, the indicator dropped to 46.9, its lowest level since May 2015.

- MI Inflation Gauge: Monday, 00:00. This monthly indicator helps track CPI, which is only released each quarter. In August, the indicator gained 0.2%, rebounding from a decline of 0.3% a month earlier. Will the indicator remain in positive territory in September?

- Building Approvals: Tuesday, 00:30. Building Approvals tends to show strong volatility, making accurate forecasts a tricky task. In July, the indicator rebounded with a sharp gain of 11.3%, crushing the estimate of 0.0%. The markets are braced for a sharp turnaround in August, with the estimate standing at -5.8%.

- RBA Cash Rate: Tuesday, 3:30. The RBA last lowered rates in May, in a widely-expected move. The bank is not expected to make any changes to the benchmark rate.

- Commodity Prices: Tuesday, 5:30. Commodity Prices posted as rare gain in August, with a small gain of 0.8%. Will the positive trend continue in September?

- AIG Services Index: Tuesday, 22:30. This services indicator slid to 45.0 points in August, following three straight readings above the 50-level.

- Retail Sales: Wednesday, 00:30. This key indicator should be treated as a market-mover. In July, the indicator dipped to 0.0%, short of the forecast of 0.3%. This was the weakest reading since February. The estimate for the August reading stands at 0.2%.

- RBA Assistant Governor Christopher Kent Speaks: Wednesday, 5:30. Kent will deliver remarks at an economic conference in Melbourne. The markets will be looking for hints regarding future monetary policy.

- Trade Balance: Thursday, 00:30. Australia’s trade deficit narrowed substantially in July, dropping to A$2.42 billion, beating the forecast. The deficit is expected to continue to drop in August, with an estimate of A$2.32 billion.

- AIG Construction Index: Thursday, 22:30. The index slipped to 46.6 in August, pointing to contraction in the construction sector. Will we see an improvement in the September release?

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7614. The pair touched a high of 0.7710 late in the week and then reversed directions, dropping to a low of 0.7588, testing support at 0.7597 (discussed last week). AUD/USD closed the week at 0.7650.

Live chart of AUD/USD:

Technical lines from top to bottom:

We start with resistance at 0.8019, which has held firm since May 2015.

0.7938 is next.

0.7835 has been a cap since April.

0.7692 was tested in resistance last week.

0.7597 is an immediate support level.

0.7513 is next.

0.7427 marked the low point for the month of September.

0.7334 was a cap in December 2015.

0.7194 is the final support level for now.

I remain bearish on AUD/USD

The Fed didn’t raise rates in September but its stance is hawkish regarding a rate hike in December, and the markets have currently priced in a December hike at about 50/50. The RBA has downplayed any expectations of a rate hike, so monetary divergence will continue to favor the greenback.

Our latest podcast is titled Bold BOJ vs. Fearful Fed

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.