The Australian dollar was on the back foot despite some positive Australian data. It was overwhelmed by the force of the recovering US dollar. The release of the meeting minutes is the big event of the week. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australia posted an excellent jobs report: 54.2K jobs were gained and most of them were full-time positions. However, the US dollar had an even better week: the political landscape has improved and data is seen as supporting a rate hike. The slower growth in Chinese industrial output: 6%, did not help the Aussie either.

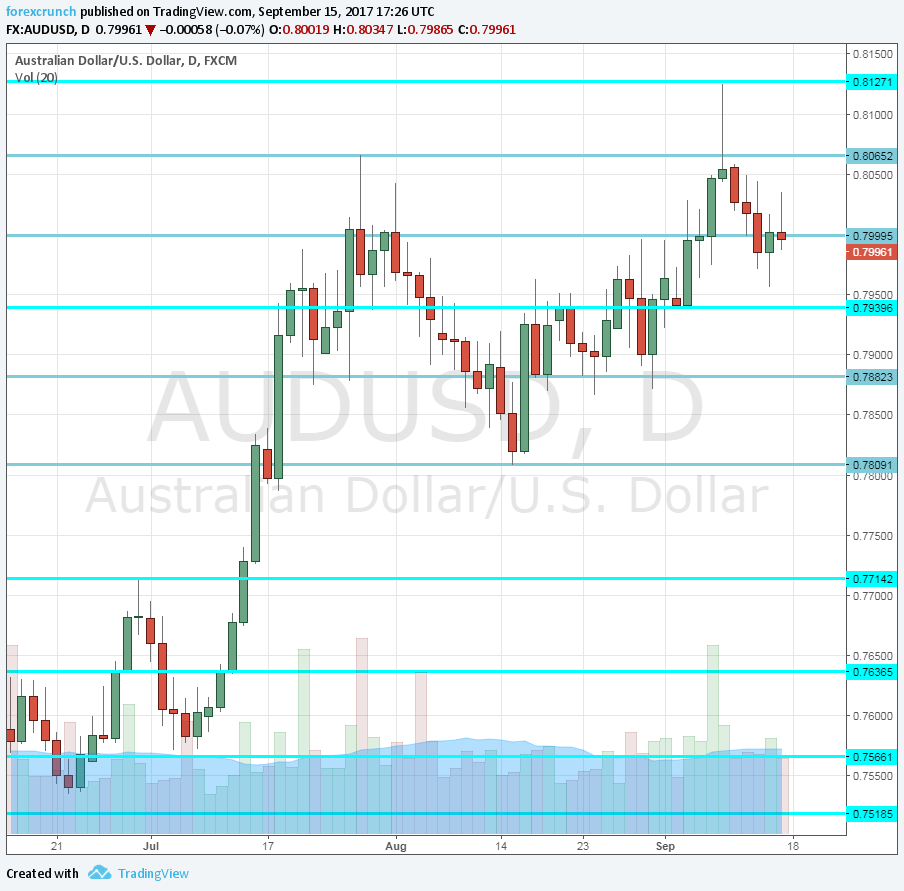

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- New Motor Vehicle Sales: Monday, 1:30. The volume of vehicle sales serves as an indicator for the wider economy. Sales dropped by 2% in July, ending four months of consecutive rises. We now get the data for August.

- CB Leading Index: Monday, 14:30. The Conference Board’s Leading Index uses 7 economic indicators for its wide gauge of the economy. The index increased by 0.5% in June.

- Monetary Policy Meeting Minutes: Tuesday, 1:30. These are the minutes from the September decision. While the RBA did not alter the interest rates, the statement certainly moved the Aussie. In the past few months, minutes from the rate decision have had their own significant market effect. Will it happen again? Given past experience, it could be more hawkish than the statement.

- HPI: Tuesday, 1:30. House prices are rising at a robust rate, with some worries about a bubble emerging in the major cities. In the first quarter of 2017, the House Price Index increased by 2.2%. Another rise is likely for Q2: 1.3% is predicted.

- MI Leading Index: Wednesday, 00:30. The Melbourne Institute uses nine indicators for its composite indicator. It slipped by 0.1% in July, a second consecutive drop. A bounce could be seen now.

- RBA Bulletin: Thursday, 1:30. The quarterly report by the Reserve Bank of Australia could provide more data after the RBA’s meeting minutes. It consists of further economic data, as seen by the central bank.

AUD/USD Technical Analysis

The Australian dollar slipped under the 0.80 level (mentioned last week) and struggled to hold onto it.

Technical lines from top to bottom:

0.83 was a swing high seen in early 2015 and is our top line. 0.8165 was another swing high, back in May 2015. The new high of 2017 at 0.8125 is becoming interesting as well.

0.8065 is the previous 2017 high. It is followed by the psychological round level of 0.80.

0.7920 was the low point the pair reached after the pair moved to the highs. The round number of 0.7810 provided support in August and replaces the veteran 0.7835 level.

Below, we find 0.7740, that was a high point in June 2017 and also beforehand. 0.7635 was a stepping-stone on the way up, also in June.

Even lower, we find 0.7565 was a low point before the pair shot higher in July. The last line, for now, is 0.7515.

I am neutral on AUD/USD

The dovishness of the RBA could further weigh on the Aussie dollar, balancing out the upbeat economic data. The US dollar rally could reach a halt, but that may not be enough for the pair to advance.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!