AUD/USD closed the week almost unchanged. This week’s highlight is the RBA Monetary Minutes. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

Australian business confidence data jumped, but consumer confidence numbers dipped. Employment data was lukewarm, as Employment Change missed expectations and the unemployment rate rose. In the US, retail sales looked good, but inflation levels remained low and consumer confidence slipped.

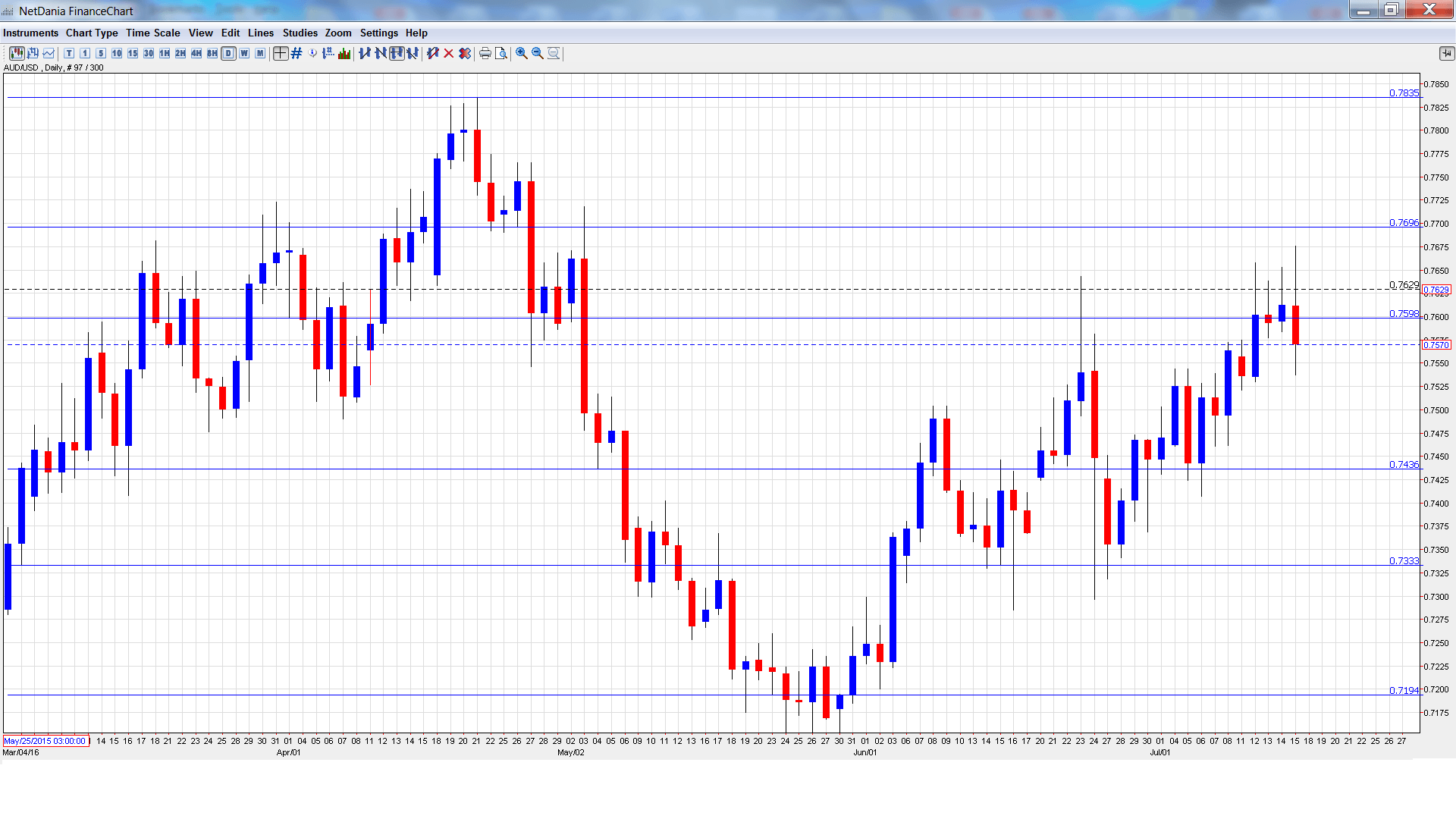

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- CB Leading Index: Monday, 14:30. This indicator is based on based on 7 economic indicators but is a minor event, as most of the data has already been released. In May, the index gained 0.5%, its strongest gain since February 2015.

- RBA Monetary Policy Meeting Minutes: Tuesday, 1:30. This is the key event of the week. The minutes provide details of last week’s policy meeting, where the RBA held the benchmark rate at 1.75%.

- MI Leading Index: Wednesday, 00:30. The index has been steady, posting two straight gains of 0.2%.

- NAB Quarterly Business Confidence: Thursday, 1:30. The indicator is based each quarter, magnifying the impact of each release. The indicator has recorded to consecutive gains of plus-4, which points to improving conditions. The markets will be hoping for another strong reading in Q2.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7557 and quickly touched a low of 0.7521. The pair then reversed directions and climbed to 0.7667, as resistance held firm at 0.7692 (discussed last week). AUD/USD then retracted and closed at 0.7570.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We begin with resistance at 0.7930.

0.7835 has provided resistance since April.

0.7692 is protecting the 0.77 line.

0.7597 remains a weak line of resistance. It could see action early in the week.

0.7438 is a strong support level.

0.7334 was a cap in December 2015.

0.7192 is providing strong support.

0.7105 has been a cushion since the end of February. It is the final support level for now.

I am neutral on AUD/USD

In the US, monetary policy is not expected to be hawkish and a rate hike appears doubtful. The markets will have to deal with the new Brexit reality, and continuing instability in the markets could weigh on the Aussie.

In our latest podcast we explain helicopter money and discuss how Carney Marked up the pound.

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.