AUD/USD had a good week, climbing close to 100 points. This week’s highlight is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The RBA didn’t make a move, leaving the benchmark rate at 1.75%. In the US, the Fed minutes were cautious and a rate hike remains unlikely. US employment numbers were strong at the end of the week, but the US dollar didn’t get a lift.

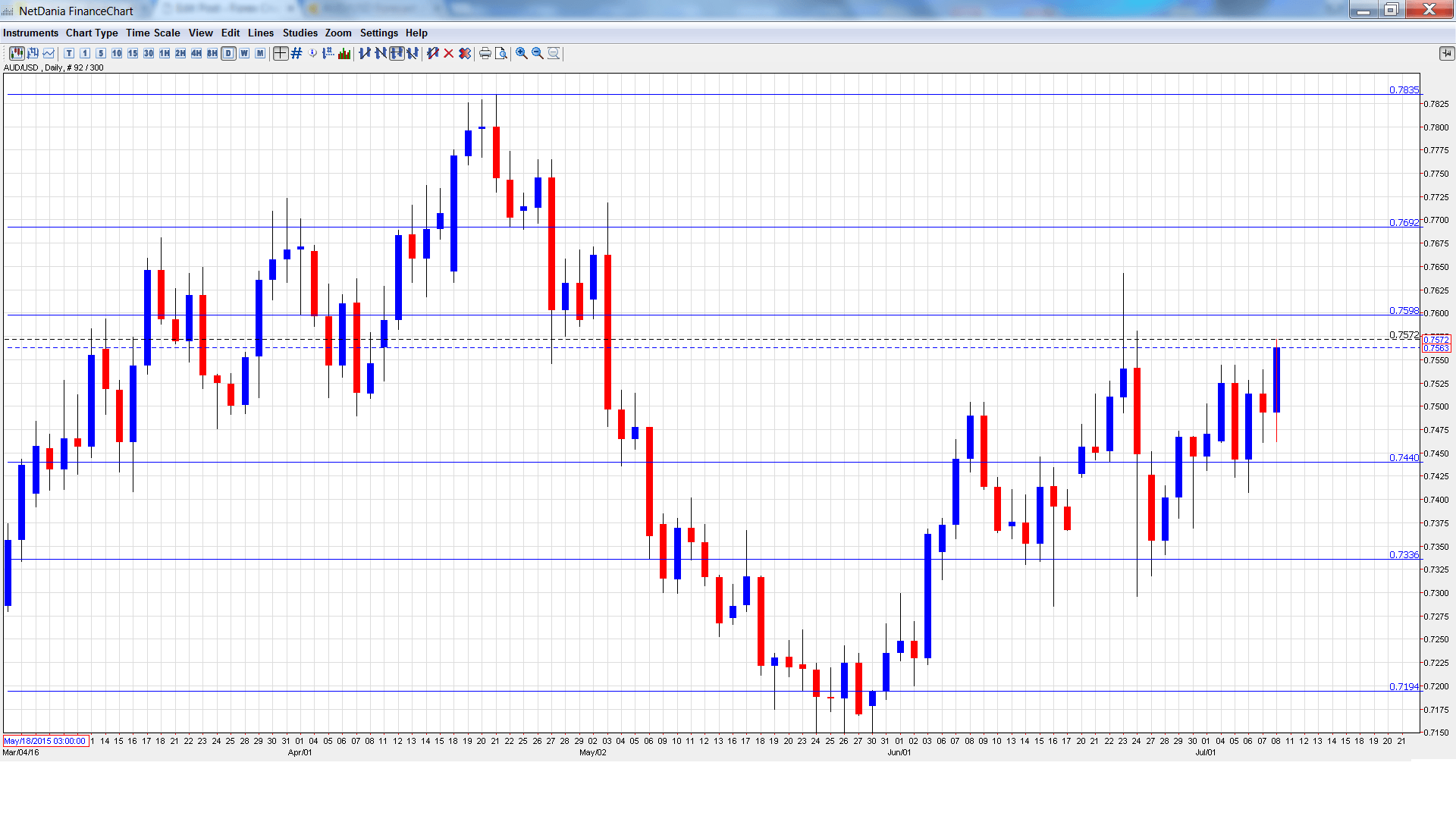

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- Home Loans: Monday, 1:30. Home Loans provides a snapshot of the strength of the housing sector. The indicator continues to alternate between gains and declines. In April, the indicator climbed 1.7%, short of the estimate of 2.6%. The May estimate stands at -1.9%.

- NAB Business Confidence: Tuesday, 1:30. NAB Business Confidence dipped to 3 points in May, marking a 3-month low. Will the indicator rebound in the upcoming release?

- Westpac Consumer Sentiment: Wednesday, 00:30. Stronger consumer sentiment is correlated to consumer spending, a key driver of economic growth. The indicator has struggled, posted three declines in the past four months.

- MI Inflation Expectations: Thursday, 1:00. The indicator helps analysts track actual inflation levels. In May, the indicator improved by 3.5%, up from 3.2% in the previous reading.

- Employment Change: Thursday, 1:30. Employment Change is one of the most important economic indicators and an unexpected reading can have a significant impact on the movement of AUD/USD. In May, the indicator impressed with a strong gain of 17.9 thousand, beating the estimate of 14.9 thousand. The forecast for the June reading stands at 10.1 thousand. The unemployment rate is expected to edge higher to 5.8%, up from the current 5.7%.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7462 and touched a low of 0.7407, testing support at 0.7334 for a second straight week (discussed last week). The pair then changed directions and climbed to a high of 0.7572 and closed the week at 0.7556.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 0.7930.

0.7835 has provided resistance since April.

0.7692 is protecting the 0.77 line.

0.7597 is a weak line of resistance.

0.7438 is next.

0.7334 was a cap in December 2015. This line was tested in support last week.

0.7192 is providing strong support.

0.7105 has been a cushion since the end of February. It is the final support level for now.

I am neutral on AUD/USD

In the US, monetary policy is not expected to be hawkish and a rate hike appears doubtful. The markets will have to deal with the new Brexit reality, and continuing instability in the markets could weigh on the Aussie.

Our latest podcast is titled 3 markets – 3 totally different Brexit reactions

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.