The Australian dollar managed to bounce from the lows after a barrage of data from Australia and China. However, the pair never went too far. Here is some fresh analysis from NAB:

Here is their view, courtesy of eFXnews:

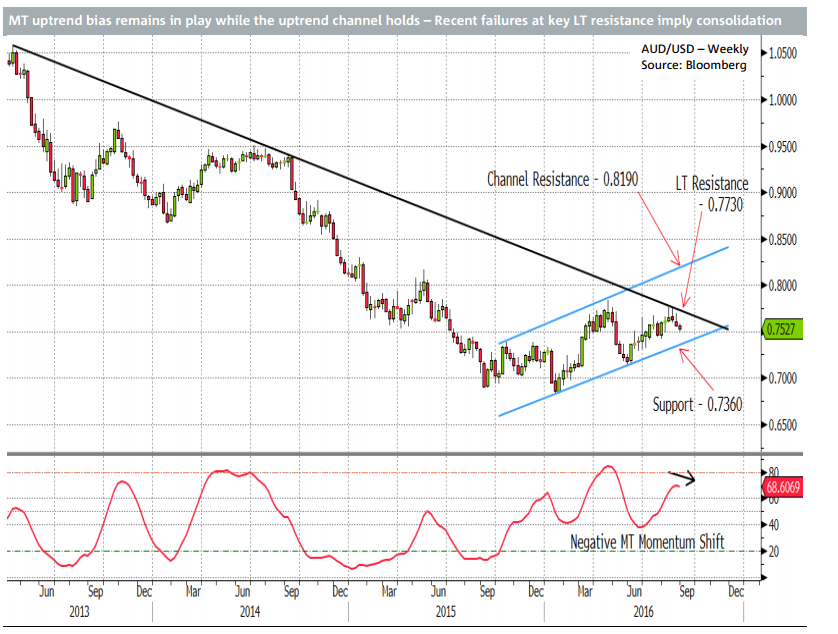

Trend: Price has been captured in a parallel uptrend channel since bottoming in January 2016. More recently a series of higher lows/higher highs since the interim low in late May has re-established an interim uptrend. Price has tested towards LT trend resistance (now around 0.7730) in the recent weeks, and the sharp rejections imply that the pattern is not ready to extend beyond 0.7730/0.7835. At this stage, we don’t consider this to be a threat to the MT uptrend, but most likely an indication that upward progress may remain slow and a period of consolidation / correction will stay in play in the coming days to weeks. The base of the uptrend channel around 0.7360 is unlikely to be breached on a multi-month basis.

Momentum: LT momentum continues to confirm an uptrend bias, and the July close in the monthly RSI (not shown here) highlights the fact that this uptrend was accelerating. This close completed a break above a five-year downtrend channel in the RSI and thus highlighted the strongest LT momentum upswing in five years into the July end. ST/MT momentum bias is negative highlighting the current period of consolidation/correction.

Outlook: Recent failures around key resistance levels now at 0.7730/0.7835 have placed the interim uptrend on hold. The negative shift in MT momentum is further confirmation. ST risk remains negative, and we see this period of ST consolidation/correction continuing in the coming days to weeks. We expect to see strong support towards 0.7360 but need to assess the price response if this level is challenged.

And here is another opinion from BNP Paribas:

AUD/USD: Latest Data Consistent With Our Bearish View Targeting 0.70 – BNPP

The AUD faces twin challenges today from the Chinese PMI reports (both Caixin and official surveys were better than H1) suggesting the state of the industrial sector has somewhat improved. In contrast, Australian Q2 capex and August retail sales underscored expectations.

The data is consistent with our bearish AUD view targeting 0.70 in coming months but we continue to stress that global equities are the current key driver of AUDUSD so a fall in equities is likely necessary for AUDUSD to reach our target.

The real risks to the commodity bloc currencies now are external in our view, and continued sub- 50 readings on the official China manufacturing PMI should be a reminder of this.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.