The first day of September is quite busy regarding economic releases from both Australia and its No. 1 trade partner, China. The data somewhat mixed, but it was good enough for the Aussie to lift itself from the lows of 0.75 and moved to the somewhat higher ground, around 0.7540.

In Australia, retail sales remained flat in July, below expectations for a rise of 0.3%. Capital Expenditure also disappointed on the headline number: a drop of 5.4% against a slide of 4% expected. However, some internal figures were more promising. The third estimate for 2016 and 2017 is now higher than earlier: it is up to 105.2 billion from 97 billion, serving as a silver lining.

In China, things were somewhat mixed as well. The official manufacturing PMI rose from 49.9 to 50.4 points, beating projections for no-change and advancing into growth territory, above 50 points. On the other hand, the unofficial Caixin manufacturing PMI dropped to exactly 50 points. While this was not a surprise, a fall is not good.

The last figure to be released was commodity prices: these rose by 0.8%, an improvement from a drop of 2.7% last time.

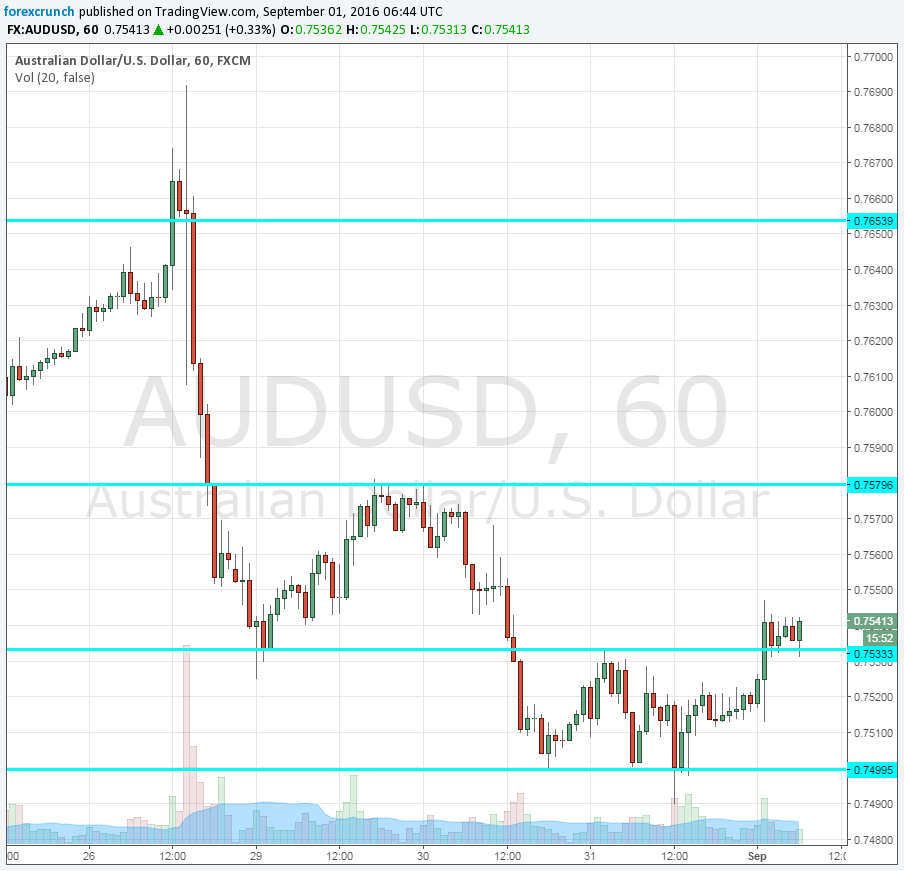

AUD/USD currently trades at 0.7542, after struggling with 0.75 yesterday. The pair climbed above the 0.7530 resistance line. The next cap is 0.7580, followed by 0.7640.

Here is our video about AUD/USD: