- BTC/USD fades bounce off $36,192 while teasing the confirmation of a bullish chart pattern.

- RBA official said Bitcoin not a payment instrument, it’s not money.

- Weekly support line, 100-bar SMA add to the downside filters.

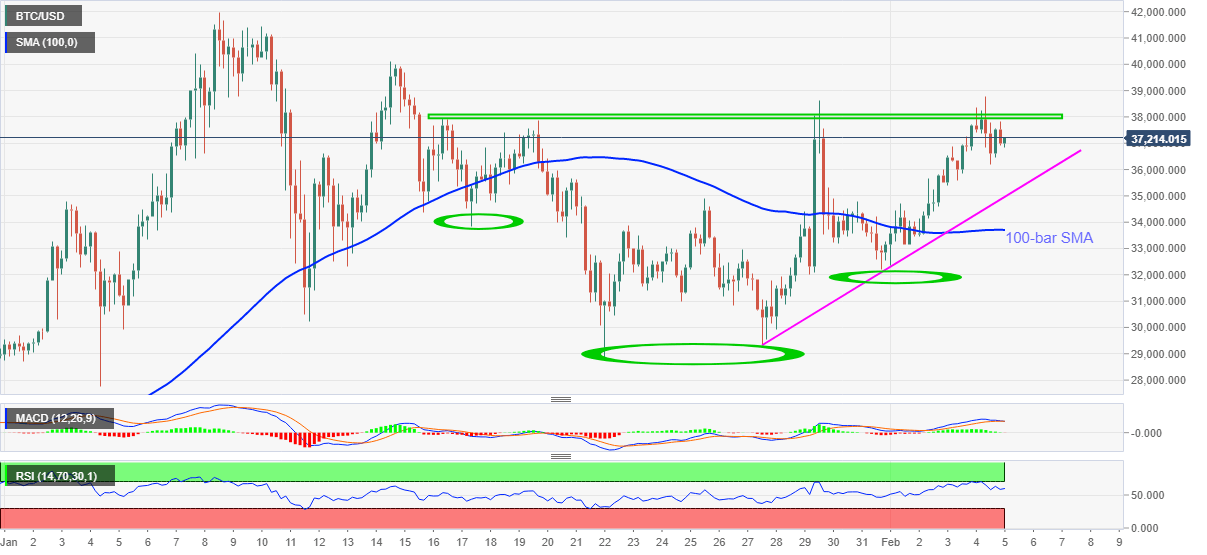

BTC/USD eases to $37,100 during early Friday. Even so, the crypto major portrays a bullish chart formation on the four-hour (4H) play and is well keeping the uptrend, as per the MACD and RSI conditions.

The latest pullback could be traced from the downbeat comments from the Reserve Bank of Australia (RBA) official. The RBA assistant governor for financial systems, Michelle Bullock crossed wires recently while saying, “I think there is a lot of fuss over bitcoin and it’s not a payment instrument and it’s not even real money.”

Also challenging the Bitcoin bulls could be the Australian Financial Review (AFR) piece quoting RBA Governor Philip Lowe. Reserve Bank governor Philip Lowe said, “It’s a risk to investors but it’s not a financial stability risk”, per the news.

However, the quote’s sustained trading beyond a short-term support line, at $34,970, followed by 100-bar SMA near 33,700 keeps the BTC/USD bulls hopeful towards breaking the $38,000 hurdle and confirms the inverse head-and-shoulders bullish chart pattern.

Following that the theoretical rally towards the $48,000 level may catch a breather around the latest all-time high of $41,987.

Meanwhile, a downside break of 100-bar SMA will trigger a notable change in the current bull-run while also directing short-term bears toward the $30,000 threshold and then to January’s low around $27,780.

BTC/USD daily chart

Trend: Bullish