- Bitcoin may be vulnerable to massive losses if $7,400 is sustainably broken.

- Crypto whales positioning may be responsible for the sell-off.

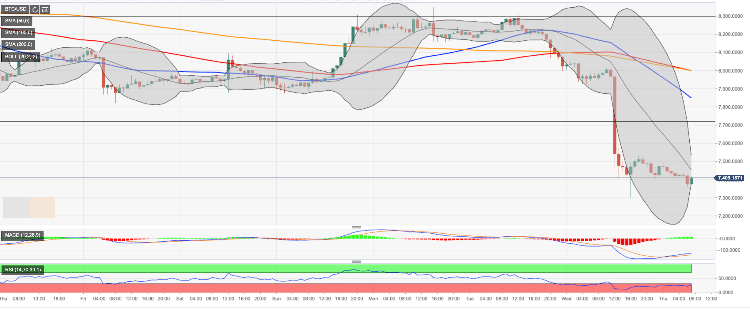

Bitcoin (BTC) resumed the decline and moved below $7,400 handle. At the time of writing, BTC/USD is changing hands at $7,370, down 1% since the beginning of the day and losing over 7% on a day-to-day basis. Wednesday’s collapse took thee price below SMA100 (Simple Moving Average) on a weekly chart for the first time since the beginning of May, which spells gloom and doom for the Bitcoin forecasts.

Whales behind the sell-off?

While the true reasons of the crash remain unknown, there is a theory that the sell-off might have been triggered by bitcoin whales positioning.

According to Larry Chermak from The Block, someone liquidated bitcoin longs on BitMEX to the tune of $200 million within an hour.

“Bitcoin slid by more than 6% in the last 20 minutes. Massive long squeeze – more than $205M in liquidations on BitMEX in the last hour,” he wrote on Twitter.

This move might have triggered a sharp sell-off that took the price below critical levels.

Bitcoin’s technical picture

Looking technically, the initial support is created by $7,300 (the lower line of the Bollinger Band on a weekly chart). It is followed by psychological $7,000.

On the upside, we will need to see a recovery above $7,530 ( the middle boundary of one-hour Bollinger Band) to mitigate an initial pressure and allow for an extended recovery towards $7,800 and $7,850 (SMA50 one-hour), which now serves as a pivotal resistance.