- The cryptocurrency market is strongly bearish, Bitcoin Cash price test support at $830.

- Bitcoin Cash price must overcome the resistance at $870, but the key resistance rests at $900.

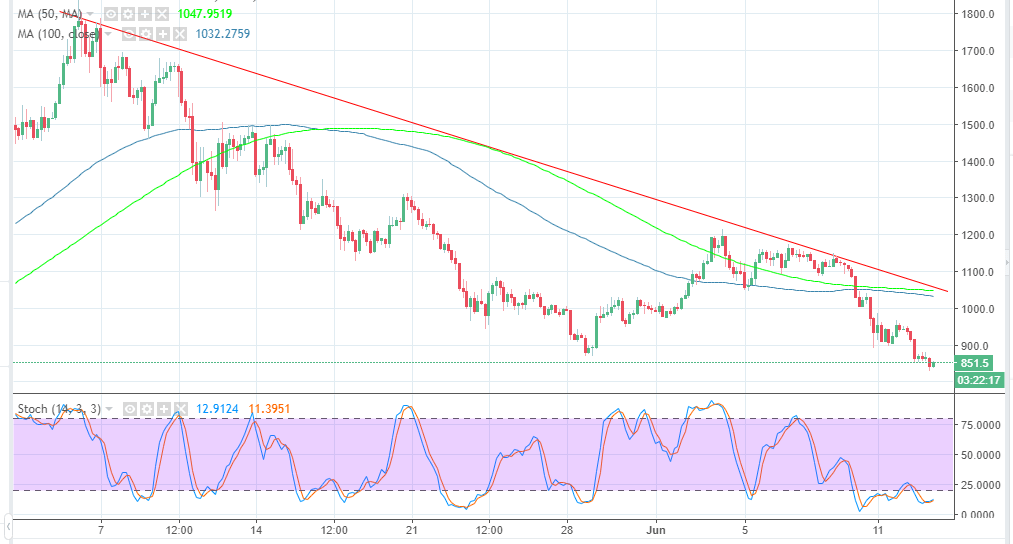

The market is strongly bearish on Wednesday and Bitcoin Cash price has not been spared. The crypto is trading marginally above $850 after a slight recovery from testing the support at $830. BCH/USD embarked on a sole recovery journey breaking barriers from mid-April this and even exchanged hands above $1,800.

It has, however, succumbed to selling pressure wiping off most of the gains and the downside seems highly unstoppable. Regulatory pressure is still a major concern in the cryptocurrency industry. The decline initiated in the last weekend has not found a support after the CFTC in the US began an investigation into several exchanges.

Bitcoin Cash bulls lack fresh catalyst and support to reverse the bear trend. The bears, on the other hand, are not done yet despite the crypto being in the oversold region. At the moment, a weak bullish momentum is forming on the chart which can be confirmed by the narrowing gap of the moving averages. Significantly, the stochastic oscillator is still in the oversold levels but is slowly moving upwards.

On the upside, Bitcoin Cash price must overcome the resistance at $870, but the key resistance rests at $900. Further up, $1,000 is a breakout towards $1,100 and higher levels. The immediate support is seen at $830, although the bear trend makes $800 and other lower levels within reach.

BCH/USD 4-hour chart