- Bitcoin Cash is primed for gains but first, the trendline and the resistance at $420 must be broken.

- The support at $410 has come to the rescue of the bulls twice in the same month.

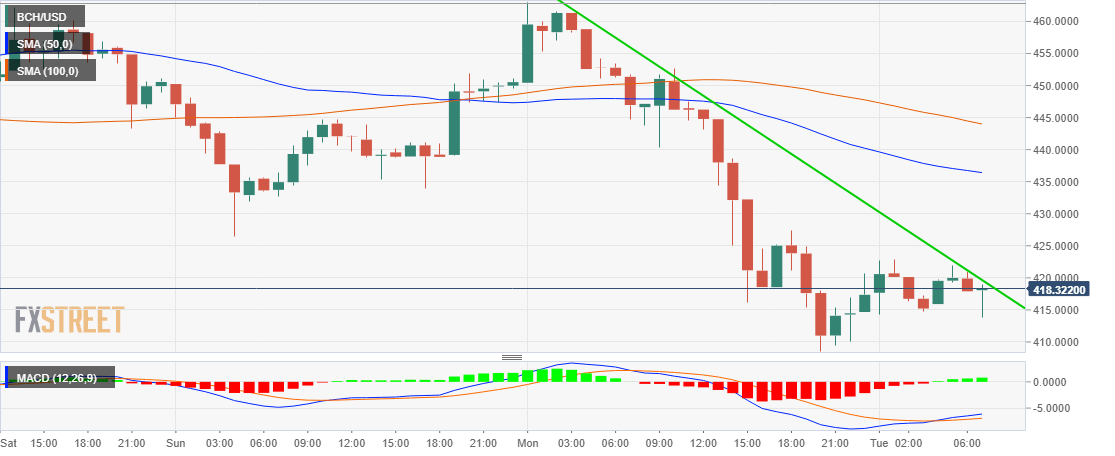

Bitcoin Cash tumbled yesterday just like most the digital assets in the market. The king of the cryptocurrencies, Bitcoin (BTC) shattered the support at $6,400 and broke down further below $6,300. Over the last weekend, Bitcoin Cash witnessed a slight lower correction which found a significant support at the $430. The bulls regain composure and the price bounced back stepping above $460 on Monday morning.

However, the bearish wave in the market yesterday saw selling activities increase as BCH/USD trimmed the accrued gains. The wild tailspin could not calm down at $445, not event at the previous support ($430) but the bulls sought refuge at $410 (major support). Bitcoin Cash upside is currently limited at $420 although it has touched $423 on Tuesday.

The bearish trendline is also limiting the gains on the hourly timeframe chart. A break above $420 will give the buyers the momentum to attack $430 and plan another trip to $460. Before that, the resistance at the 50SMA and the 100SMA will have to be overcome. On the flipside $415 is a short-term support while the primary support at $410 will prevent breakdown towards the $400 level.

Looking at the 1-hour chart, Bitcoin Cash trend is positive and could correct higher in the short-term. The MACD is advancing to the mean line (0.0) confirming that the buyers have the control.