- Indicator signals are bearish; Bitcoin Cash threatens to break key range support.

- Sellers’ dominance in the market to continue in the short-term.

The consolidation in the market is a good thing for the crypto market. The volatility is the reason why institutional investors have been watching from afar. However, the entrance of financial investment giants like Goldman Sachs and JP Morgan Chase is clear indication that the market is rewriting its history. Bitcoin Cash and other altcoin’s prices are greatly correlated to Bitcoin (BTC). Therefore, if Wall Street Embraces Bitcoin, the entire market benefits mutually.

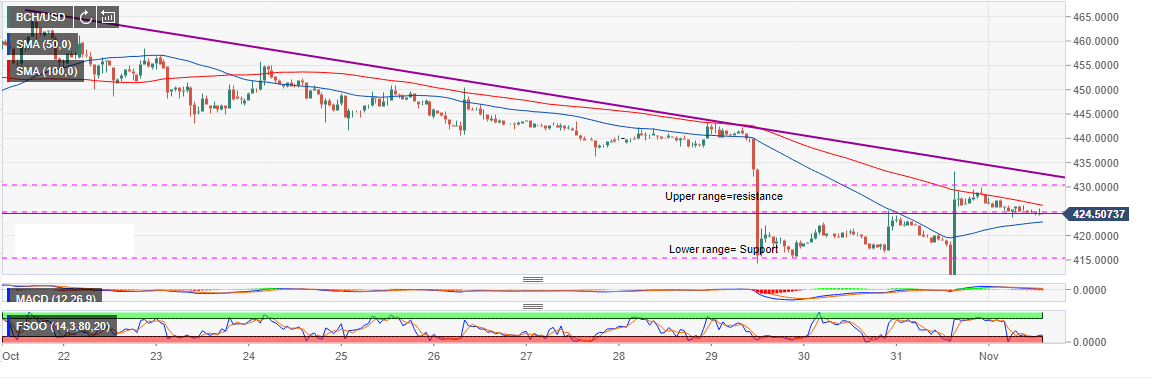

Bitcoin Cash retested the support at $410 on Monday this week. The sudden declines affected most digital assets leading to a drop in the market cap from $208 billion (Sunday) to $203 billion (Monday). The market cap recovered slightly during the faint recovery on Wednesday 31 and currently stands at $205 billion.

Bitcoin Cash, on the other hand, recovered in a bullish spike from the support escaping the bear range a limit at $424 (resistance). However, the move failed to break above the upper resistance range with a limit at $430. BCH/USD is currently dancing with $424.51 between the moving averages. The 100 SMA is limiting gains immediately to the upside while the shorter term 50 SMA is offering support at 422.79.

The bears have increase their presence in the market even before indicators like the RSI hit the overbought levels. The MACD is hanging on to the mean level while the 100 SMA is above the 50 SMA to signal that the sellers will continue to dominate in the near-term.

BCH/USD 1-hour chart